The equity markets experienced the largest weekly decline of the year last week after the Federal Reserve reduced the fed funds rate target by 25-basis points and the Administration announced a 10% tariff on an additional $300 billion of Chinese goods effective September 1.

This set in motion a plunge in stocks – the S&P 500 NYSEARCA: SPY – long-term bond yields and Oil prices NYSEARCA: USO, while Gold prices NYSEARCA: GLD soared to new cycle highs on prospects of a prolonged trade fight and concerns of the impact on consumer spending.

It is apparent that China needs a trade deal. While the U.S. consumer may experience modest increases in costs, China is currently experiencing a food shortage and the slowest economic growth in 27-years.

At this juncture, the U.S. has withstood the challenges of a slowdown in the global economy primarily on the strength in consumer spending.

We believe a strong labor market and the high level of consumer confidence will continue to support the U.S. economy. However, given the uncertainty on rates and trade and the impact that could have on second half of the year earnings, there is a high probability that the market has entered a consolidation or correction phase.

Additionally, the market is faced with a more challenging seasonal backdrop with stocks entering the often-volatile August-October time frame.

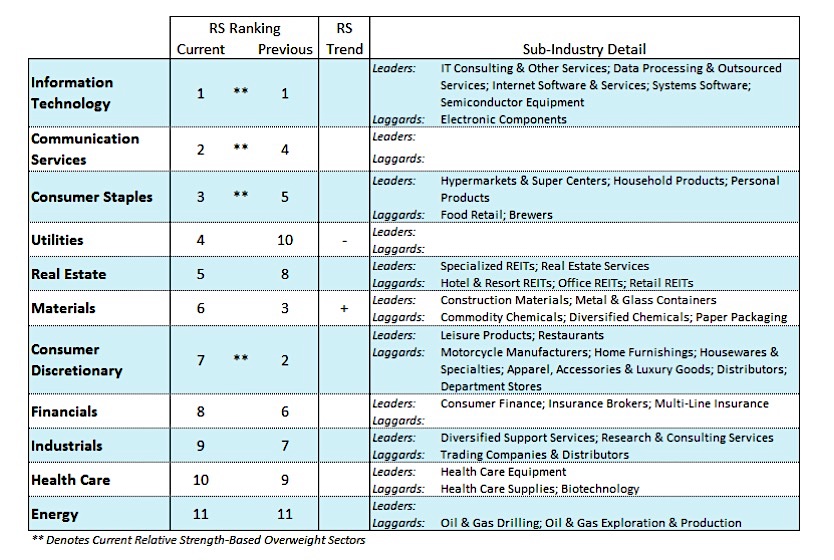

Currently the strongest sectors of the market are the consumer staples, consumer discretionary, information technology and utilities groups.

In spite of worries about slowing growth and trade concerns, the consumer stocks are among the best performers. The consumer staples sector, which includes companies that manufacture products essential for living, tends to do well during periods of investor uncertainty.

Although capital spending for both large and small companies has slowed, businesses are upgrading their technology and consumers are still spending on technology which bodes well for the information technology sector. Dividend-paying utility stocks tend to do well in slow growth, low interest rate environments. Investors may want to balance portfolios with three- to five-year quality corporate bonds and gold or gold mining stocks.

The broad market continues to improve, particularly when viewing the international markets. The percentage of global markets trading above their 200-day moving average has risen above the 50% threshold for the first time since the first quarter of 2018. This holds longer-term bullish ramifications.

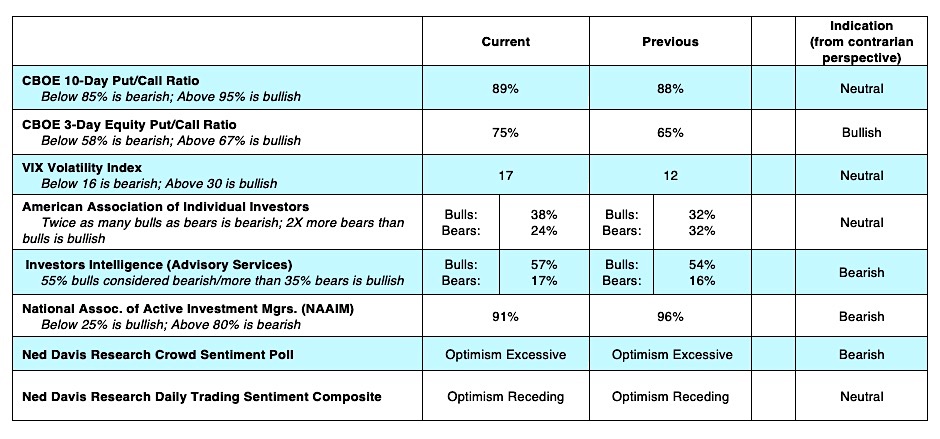

Our concern is that the stock market has lost a great deal of momentum at a time when investor sentiment indicators are pointing towards excessive optimism, and the market is entering a traditional seasonally weak period. Evidence of optimism is seen in the latest data from Investors Intelligence (II) that shows three times as many bulls than bears.

Last week’s survey by the American Association of Individual Investors (AAII) showed a drop in the percentage of bears to 24%, down from 32% the prior week. The most recent data from the National Association of Active Investment Managers show a near fully allocated position toward equities of 92%, a level often seen at short-term peaks in the stock market. A contrarian’s perspective suggests the leap toward optimism in recent weeks is problematic.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.