Last week the S&P 500 Index (INDEXSP: .INX) declined for the fourth week in a row and the Dow Jones Industrial Average registered a sixth consecutive weekly decline.

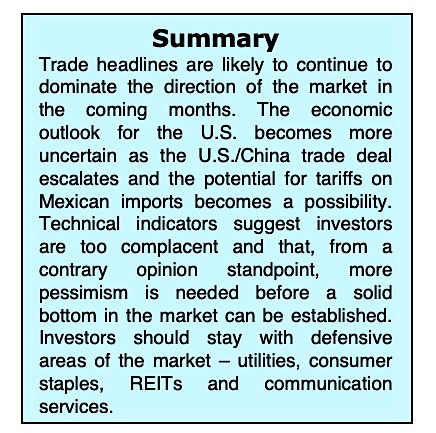

Trade tensions between the U.S. and China and Mexico continue to escalate as the Trump Administration is threatening to impose tariffs on all $371 billion of imports from Mexico beginning June 10 unless they take steps to stop the flow of illegal immigrants coming through their southern border.

The idea of tariffs is adding to the cloud of uncertainty for American business, but it’s worth noting that they may never come to pass as the U.S. and Mexican officials will meet this week.

All three major indexes – the S&P 500, Dow Industrials and the NASDAQ Composite are still up for the year, although gains have been reduced.

There are pockets of the economy where we are seeing weakness – disappointing retail earnings, factory output down, existing home sales down 14 months in a row. We still have strong job growth, wages rising at the fastest level in 10 years, and low interest rates which should keep the U.S. economy growing. However, the economic outlook becomes more uncertain if the U.S./China trade talks do not show signs of a resolution as business and consumer sentiment will erode.

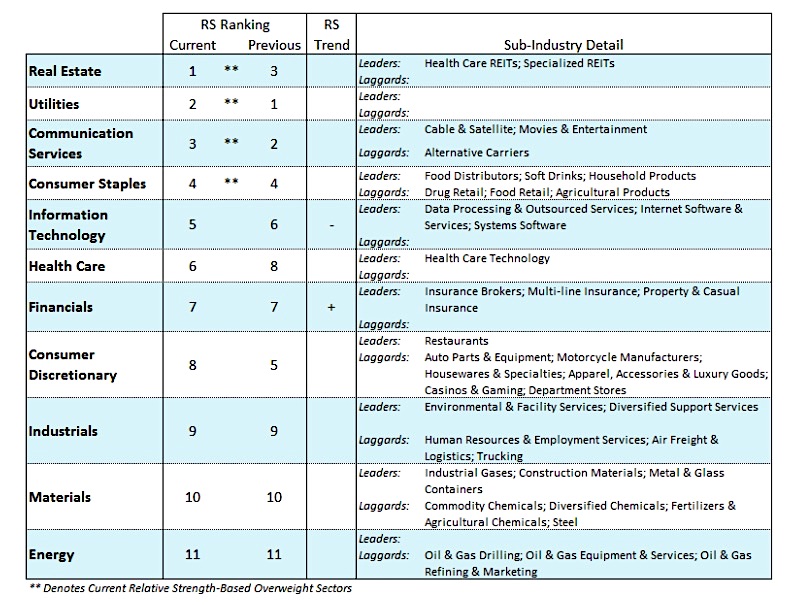

Both sides have strong incentives to reach a deal for their own economies and for the world economy more broadly. In spite of inflammatory rhetoric targeted at the United States trade practices by leaders in the Chinese Communist Party last week, Sunday morning China’s Commerce Secretary told reporters that they are still open to negotiations. We suggest investors stay with the defensive sectors of the market including utilities, consumer staples, REITs, and communication services. We have also been suggesting that with the probability of volatility continuing, investors look at bonds to help reduce the swings in their stock portfolios.

The technical indicators for the stock market began flashing a yellow light in early April as measures of broad market performance failed to confirm the new highs by the S&P 500 and NASDAQ Composite.

Entering the new week, weakness in the broad market shows no sign of abating. The equity markets are also suffering from a reversal of momentum, which turned negative in early May when stocks suffered a session where downside volume exceeded upside volume by a ratio of 9-to-1. Before a solid bottom is seen, we expect to see this reversed where upside volume exceeds downside volume by a ratio of 9-to-1 or more.

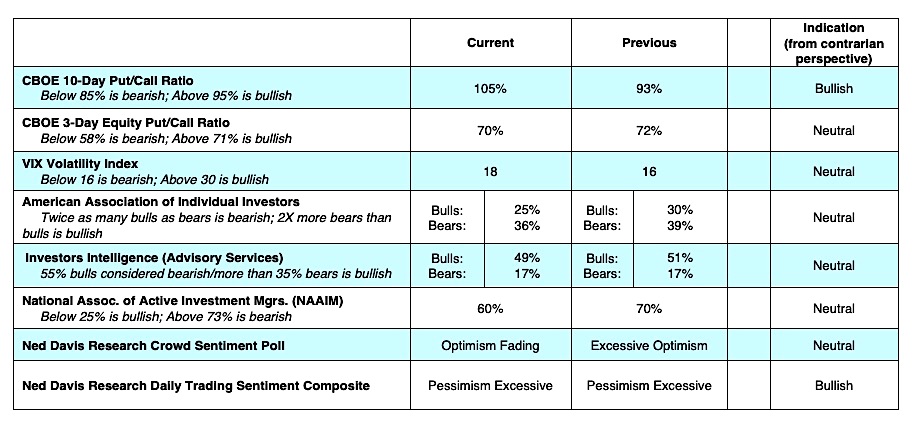

Measures of investor psychology that historically have been very reliable in identifying a market low offer little evidence that a solid bottom is close. At the important lows in 2011, 2015 and 2018 the survey by Investors Intelligence (II) showed more than 30% bears, the CBOE Volatility Index soared above 35 and the Ned Davis Crowd Sentiment Poll showed excessive pessimism. In the present example, the II data shows only 17% bears, the VIX closed Friday at 18 and the Ned Davis Crowd Sentiment Poll just recently dropped out the excessive optimism zone to neutral.

The bottom line is that deteriorating trends in the broad market and the failure of the current weakness to generate widespread and deeply seated pessimism argues the decline has not fully run its course.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.