It’s time to review several stocks that had unusual options activity over the last week. Although traders can never be sure why these trades take place (and who’s making them), I believe it’s important to be aware of notable options activity as an indicator for directional bias.

Here’s a weekly recap of 10 stocks that had unusual options activity and what, if any, significance these trades may have.

Unusual Options Activity: 10 Stocks With Notable Trades

Monday

TTM Technologies (NASDAQ:TTMI): 5,000 June 2017 $17.50 calls were bought for $0.65. There was follow through on Tuesday and Wednesday with open interest now at 8,151 contracts. On average, 65 calls traded per day prior to this action.

Salesforce.com (NYSE:CRM): There was a rollout from 5,000 Dec 16 $68.50 puts (credit $0.34-$0.40 credit) into 5,000 Jan 20 2017 $67.50 puts ($1.49-$1.55 debit) in Salesforce stock options. On the bullish side, on December 14th, the Feb 2017 $65/$75/$87.50 bull call spread risk reversal was put on 5,000 times for a $0.59 debit.

Lowe’s (NYSE:LOW): There was a rollout from 4,000 Dec 16 2016 $70 calls ($4.62-$4.66 credit) into 4,000 Jan 20 2017 $75 calls ($1.79-$1.86 debit). On December 7th, the company said they see FY sales up 9-10%; comps +3-4%. RBC Capital Markets upped their price target to $83 from $75 the next day.

Tuesday

Fairmount Santrol (NYSE:FMSA): Call activity was 8 times the average daily volume on Tuesday, led by sizable buying in the Jan 2017 $10 calls (600+ contracts traded) and Mar 2017 $10 calls (2,200+ traded). Traders continued to bid up the March $10 calls towards the end of week, the largest block of 1,990 going for $1.25 on Friday. The $2B sand-based proppant solutions provider is projected to return to profitability in 2017.

Thursday

Union Pacific (NYSE:UNP)- There was a rollout from 10,855 Jan 20 2017 $100 calls ($6.15 credit) into 17,555 Jan 20 2017 $105 calls ($3.05 debit). On November 21st, the Jan 20 2017 $100 calls were bought for $3.95 as part of a rollout from Dec 16 2016 $95 calls ($4.05 credit). On November 14th, Deutsche bank reiterated their $110 price target (as Union Pacific remains a top pick by the investment firm).

SAGE Therapeutics (NASDAQ:SAGE)- More than 3,000 Feb 2017 $40 puts were bought for $2.25-$2.50. On average, just 106 puts trade per day. Top-line results from the Part A open-label study in Parkinson’s disease are expected in the first half of 2017 and the essential tremor study is anticipated to report results in the second half of 2017.

Friday

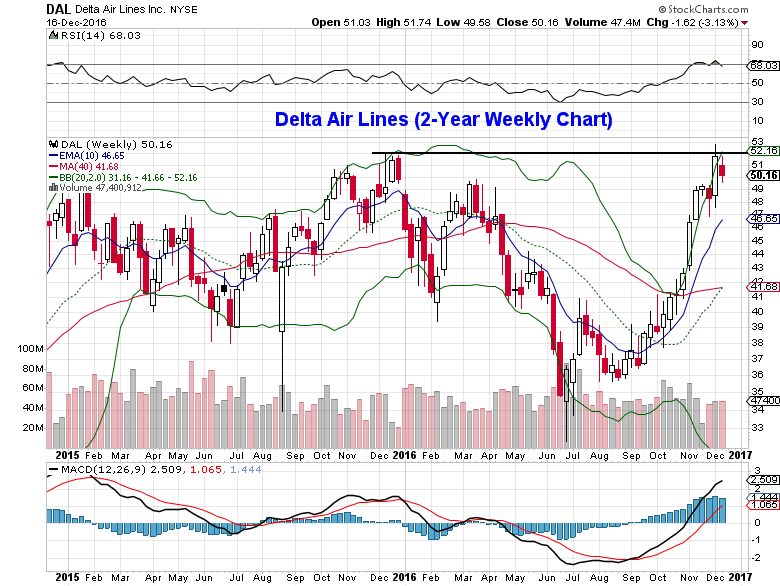

Delta Air Lines (NYSE:DAL)- There was a rollout from 4,000 Dec 16 2016 $49.50 calls ($0.65 credit) into 9,741 Jan 13 2017 $51 calls ($1.22 debit). Delta’s CEO, Ed Bastian, noted at the recent investor day that operating margins won’t be as strong in 2017 (16.5% this year), but sees long-term potential between 17 and 19%. Shares have been trending higher after recent better than expected quarterly results, but trade at a P/E ratio of 9.76x 2017 estimates.

The chart above shows the recent rally from the summer lows all the way back to the late 2015 highs near $52. Given the breakeven even of the large call buyer ($52.22), he/she likely sees the stock hitting new all-time highs within the next month.

Constellation Brands (NYSE:STZ): Roughly 3,300 Jan 2017 $150 puts were sold for $1.95-$2.10. Earnings are due out on January 5th (shares have opened higher on 7 straight reports).

Community Health Systems (NYSE:CYH): There was a rollout from 43,000 Dec 16 2016 $5 puts ($0.05 debit) into 43,000 Jan 20 2017 $5 puts ($0.28 credit). On November 22nd, the December puts were initially sold to open for $0.10. This trader remains confident that shares of the hospital operator will stay above $5 through January options expiration (breakeven is $4.72 on the latest put sale).

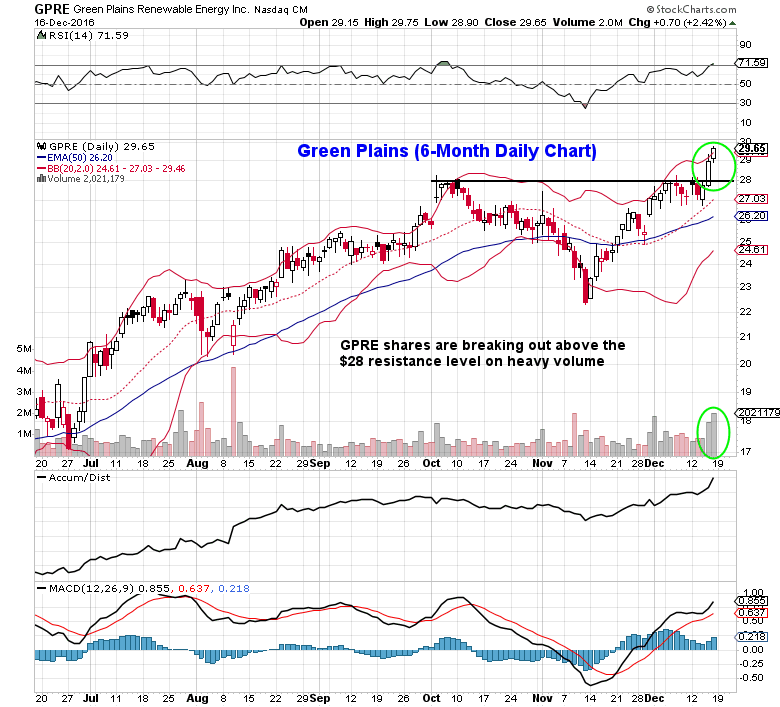

Green Plains (NASDAQ:GPRE): The Mar 17 2017 $31/$36 bull call spread was put on 1,500 times for a $1.25 debit. Also, there was sizable buying in the Jan 17 2017 $30 calls for $0.95-$1.05 (2,100+ traded). Green Plains call activity was 17x the average daily volume. Shares of Green Plains stock trade at a P/E ratio of 15.77x (2017 estimates), 0.35x sales, and 1.35x book value.

Thanks for reading and have a great week!

Twitter: @MitchellKWarren

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.