Investing is discussed in terms of “either or”—buy or sell, bull or bear, large or small.

But a look at an important chart shared in today’s article highlights the opportunities that exist in occasionally replacing “or” with “and” for small and mid-cap stocks.

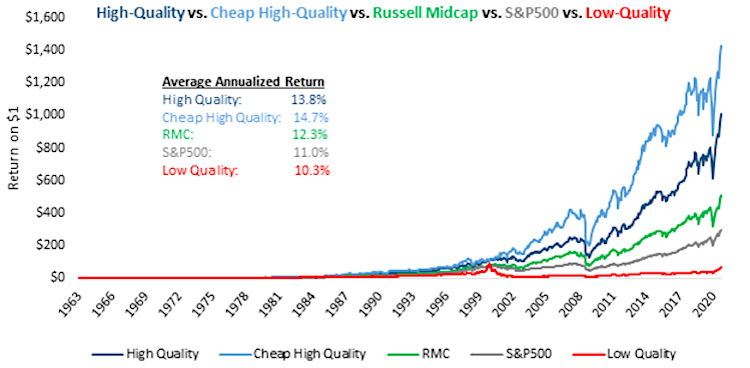

As the graph below shows, investors who put their money in a portfolio of mid-cap stocks that were inexpensive and high-quality, have enjoyed an advantage over a strategy that holds high-quality names regardless of valuation.

In fact, the combination meaningfully outpaces the returns of the mega-cap dominated S&P 500 and adds to the long history of mid-caps outperforming large-cap stocks as a group.

Source: Kailash Concepts. Monthly, 4/30/1963 to 12/31/2020. All indices are unmanaged. It is not possible to invest directly in an index. Past Performance does not guarantee future results.

Intuitively the performance gap makes sense. Investors are buying more of a good thing (quality as measured by earnings before interest and taxes/total assets) at a lower price as measured by price/earnings. The challenge comes from uncovering quality names that are overlooked by the broader market and still trading at a discount.

Heartland’s adherence to our time-tested 10 Principles of Value Investing™ has made the task manageable, in our view, as it is designed to identify quality companies and seeks out names that may be facing temporary setbacks that have had an outsized impact on valuations.

This post was written by Colin McWey, CFA at Heartland Advisors.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in this article are those of the presenter(s). Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

CFA is a trademark owned by the CFA Institute.

Separately managed accounts and related investment advisory services are provided by Heartland Advisors, Inc., a federally registered investment advisor. ALPS Distributors, Inc. is not affiliated with Heartland Advisors, Inc.

Definitions: Earnings Before Interest and Tax (EBIT) is an indicator of a company’s profitability, calculated as revenue minus expenses, excluding tax and interest to eliminate the effect of different capital structures and tax rates used by different companies. Normalized Price/Earnings Ratio (P/E) of a stock is calculated by dividing the current price of the stock by its trailing or its forward 12 months’ earnings per share. Earnings are adjusted for cyclical ups and downs in the economy. Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index. All indices are unmanaged. It is not possible to invest directly in an index. S&P 500 Index is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index. 10 Principles of Value Investing™ consist of the following criteria for selecting securities: (1) catalyst for recognition; (2) low price in relation to earnings; (3) low price in relation to cash flow; (4) low price in relation to book value; (5) financial soundness; (6) positive earnings dynamics; (7) sound business strategy; (8) capable management and insider ownership; (9) value of company; and (10) positive technical analysis.