This article is the first of two research pieces that will provide an updated outlook for the U.S. stock market. This research piece look at the market from a fundamental perspective, while the next will examine the market from a technical perspective.

In either case, the variables are broken out and weighed separately. The tailwinds include a favorable Central Banks theme, while the headwinds include historically high market valuations. While I am expecting near-term volatility, it appears that this cyclical rally has not yet run its course.

Let’s review the fundamentals…

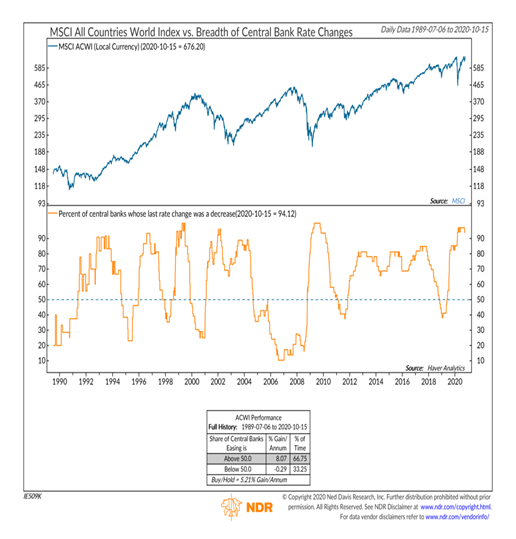

Federal Reserve Policy: BULLISH

The tools in the Federal Reserve’s toolbox are not ideal for dealing with the challenges facing the U.S. economy. But from providing liquidity, offering assurances that rates will stay low for an extended period of time, and trying to jawbone fiscal authorities into action, the Fed is doing what it can to provide economic support. While having a limited impact on the economy at this point, Fed actions have been overwhelmingly positive for equity markets. We might want to argue with the economic wisdom of Central Banks actions, but the equity market track record speaks for itself: Over the past 30+ years, all of the net gains in global equities have come when more than half of the world’s central banks have been lowering interest rates.

Economic Fundamentals: NEUTRAL

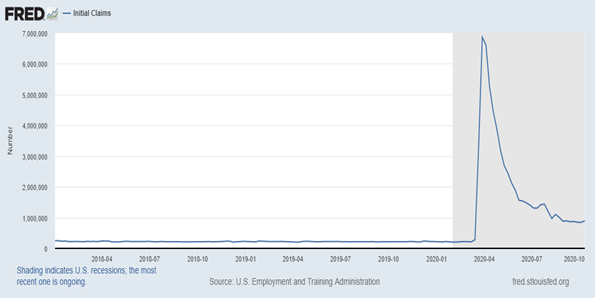

While upgrading the economy from bearish to neutral, I also what to acknowledge an exceedingly uncertain path forward for the economy recovery. While the economy was sitting on top of a decade’s worth of expansion coming into 2020, there were fissures in the foundation that were present even prior to COVID (remember, the Fed began cutting rates in the second half of 2019). This year’s recession has exacerbated the imbalances in the economy and the recovery looks to be shaped like a “K” – those doing well prior to COVID continue to do well, while those who were struggling have seen those struggles amplified. The acute, shut down-related weakness of earlier this year has passed, but overall economic activity remains below its early year level and the path for growth going forward (at least in the near-term) is likely to be rocky and dependent on further fiscal stimulus.

On the subject of stimulus, three parties need to agree for a deal to come together (White House, Senate Republicans, House Democrats). While in the past the White House has been able to bring along Senate Republicans on whatever deal it would agree to, that does not currently seem to be the case. In the eyes of most senators, they are permanent fixtures, while White House occupants come and go. Additional stimulus (of the size being discussed) is not a easy sell for many Republican Senators. Only if and until Senate Republicans are active & engaged participants in stimulus-related negotiations should any conversations be seen as more than just pre-election posturing with little hope of consummation.

This year has been a challenging one for the economy and for economic indicators – they are not equipped to deal with the disruption that we have experienced. There is plenty of noise in the data right now, but I continue to keep a close on initial jobless claims data – elevated claims do not seem consistent with an economy that is experiencing a robust and lasting recovery.

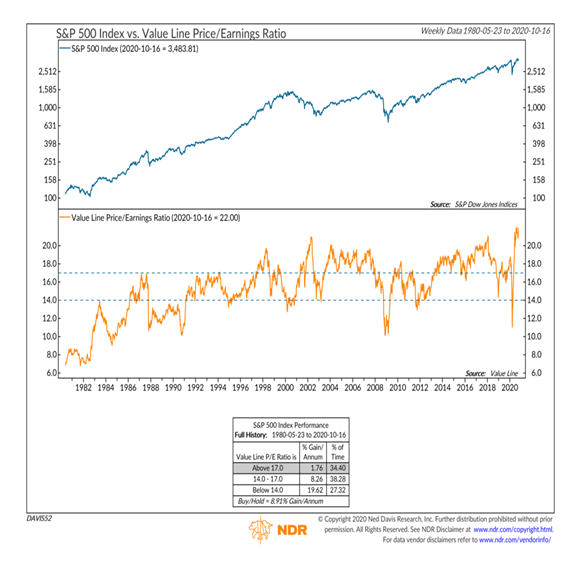

Stock Market Valuations: BEARISH

As I mentioned last week: All of the net gains in U.S. stocks over the past 55 years have come when the median P/E ratio for the S&P 500 has been 21x or below. Currently it is at 28x. The ValueLine P/E ratio (which uses as an earnings number the last 6 months of actual earnings and the next 6 months of estimates) is back to a record high. There is a desire by some to compare stock market valuations to bond yields. At the margin declining bond yields may increase the relative attractiveness of stock market valuations, but from a longer-term perspective, both stocks and bonds are currently priced at levels consistent with well-below average returns. Investors who have added (or maintained) equity market exposure (and thus support current valuation levels) under the view that there is no alternative may be in for a bumpier roller coaster ride than they have bargained for.

The weight of the fundamental evidence is ‘neutral’ for stocks over the near-term.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.