The U.S. equity markets have regained some of the ground they lost last week, with the S&P 500 Index (INDEXSP:.INX) and Dow Jones Industrial Average (INDEXDJX:.DJI) moving higher on Monday.

The pervasive lack of volatility in the stock market, though, has not afforded the necessary footing or springboard that a meaningful correction typically provides to spark a momentum surge that carries stocks to new highs.

Instead, the markets are locked in a period of extreme low volatility that can only be found in a handful of cases over the history of the stock market and one of the longest periods without the S&P 500 Index experiencing a 5.0% correction. This suggests that more time is likely to be spent consolidating the strong gains that led to the March 1 peak.

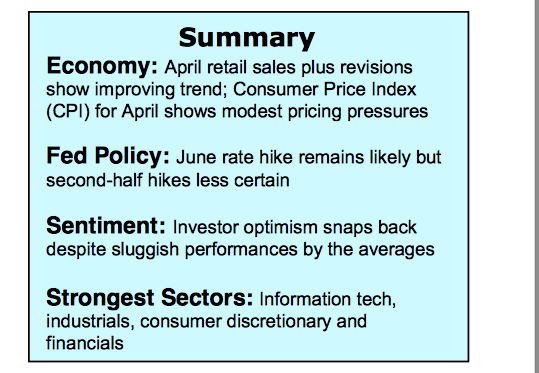

Perhaps the most important support for the stock market over the past week has been the benign Consumer Price Index (CPI) Report that showed inflation pressures easing. Considering that an acceleration of Fed tightening is the most serious risk to the equity markets, the inflation news reduces the likelihood that the Fed will become too aggressive in the effort to normalize interest rates.

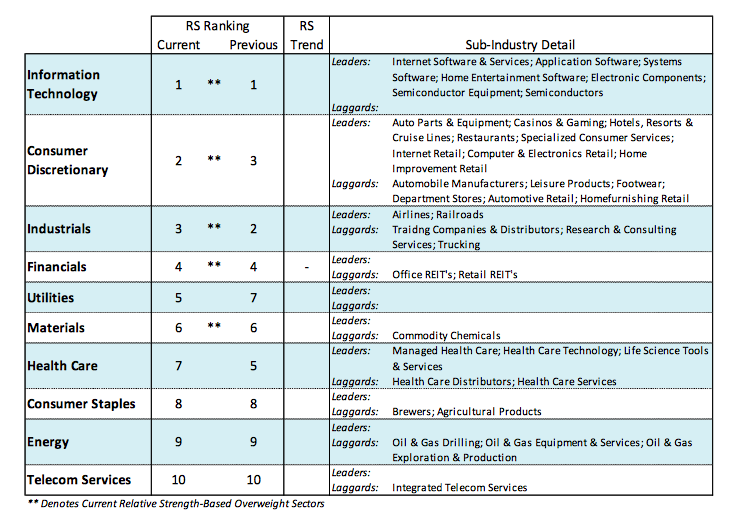

Additional support is also found in the earnings rebound that appears to be gaining steam. The 14% gain in overall S&P 500 earnings in the first quarter and the likelihood that corporate profits could further improve in the second quarter is a significant offset to a market where valuations are in the excessive zone. The best-performing sectors continue to be those tied closely to the economy including information tech, consumer discretionary and industrials.

The technical condition of the stock market deteriorated for the second week in a row suggesting lower before higher by the popular averages. Most concerning is market breadth as only a select few stocks are leading the averages higher. This is best exemplified by the fact that only 54% of S&P 500 issues are trading above their 50-day moving averages even though the Index is close to a record high. Despite reaching a new high mid-week, a declining number of issues within the S&P 500 Index are hitting new-52-week highs.

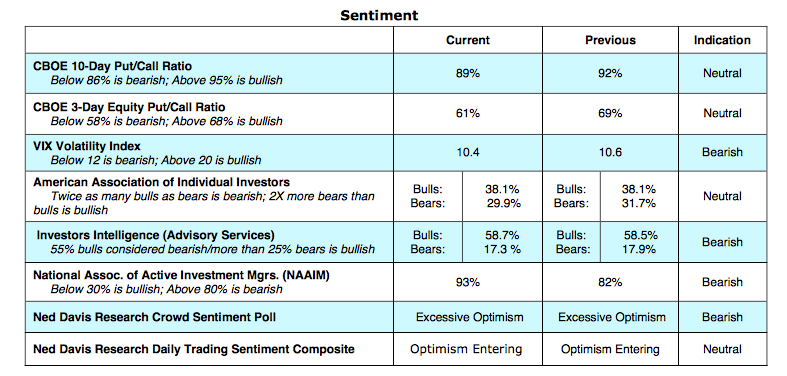

Investor psychology is also a concern as optimism has returned in a meaningful fashion even though most of the averages are below the March 1 peak. This suggests that near-term liquidity being reduced is more important in the current cycle with investor funds now moving to overseas markets for the first time in several years. Investors poured $6 billion into European stock funds over the past week, the most since 2000. To gain confidence that the consolidation/correction phase has run its course we would need to see a surge in market breadth and or a return to broad-based skepticism/caution among investors.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.