The Dow Jones Industrial Average (INDEXDJX:.DJI) and S&P 500 Index (INDEXCBOE:.INX) hit new record highs early last week as investors celebrated the revised NAFTA deal.

The new trade agreement with Mexico and Canada, called the U.S. Mexico Canada Agreement (USMCA), will govern nearly $1.2 trillion in trade which makes it the largest trade deal in U.S. history.

The rally in stocks, however, was capped by a sudden rise in interest rates sending the broad market lower. Although the damage was minimal for the Dow Industrials and the S&P 500 Index which fell less than 1.0%, the NASDAQ and Russell 2000 Indices dropped nearly 4.00%.

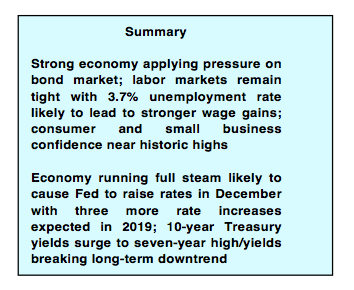

The rise in interest rates was sparked by signs that the economy is beginning to run hot. The September Employment Report showed the unemployment rate plunging to 3.7%, the lowest in 50 years, while the latest ISM Non-Manufacturing Index jumped to its highest level since 1997 and the second highest on record.

Federal Reserve Chairman Jerome Powell reiterated last week that his goal is to set policy to support job growth and low steady inflation. As the economy has gained strength the Fed has been gradually raising interest rates closer to levels that are normal in a healthy economy. The Fed is widely anticipated to raise rates 25 basis points in December and three more times in 2019. As long as inflation remains low and unemployment remains low, we believe the Fed can continue on its path to slowly raise rates and that economic growth will continue.

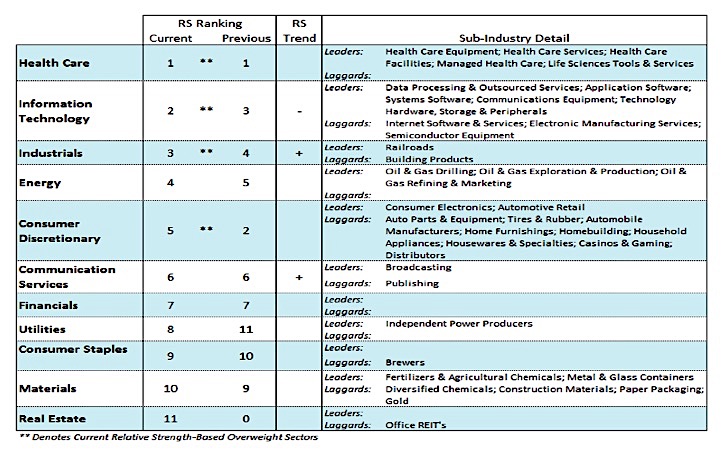

Third-quarter earnings reports will begin to flow this week with consensus estimates that S&P 500 earnings grew by 17%. Looking forward, profit margins could come under stress due to rising interest rates, rising wages, four-year highs in energy costs and a strong dollar. We recommend investors concentrate on the strongest sectors including health care and industrials.

The technical underpinnings of the equity markets argue on the side of caution. Despite new highs by the S&P 500 and Dow Industrials just a few days ago, the broad market continues to deteriorate. Less than 50% of S&P 500 and NASDAQ stocks are trading above their 50-day moving averages. Although the popular averages remain in close proximity to record highs, the number of NYSE issues hitting new 52-week lows doubled from the previous week.

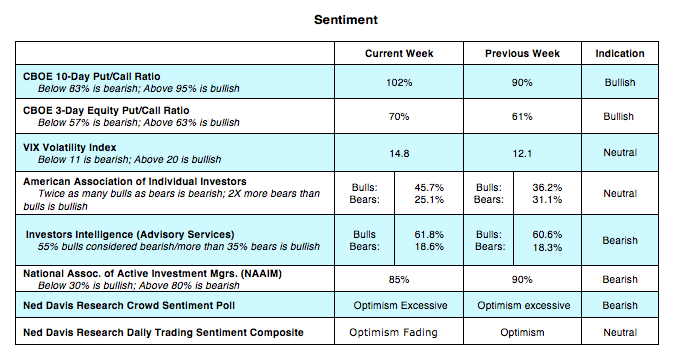

Additionally, the percentage of industry groups within the S&P 500 in defined uptrends fell for the second week in a row to 66% from 80% early in the year. The healthiest markets are found when most areas are in harmony with the primary trend. This is not the case in the present example where only a few stocks, groups and sectors have provided virtually all of the gains in 2018. Measures of investor psychology are mixed. A surge in the demand for put options late last week is short-term bullish. This is offset, however, by the latest reports from Investors Intelligence (II) and the American Association of Individual Investors (AAII) that show a surge in optimism.

The bottom line is that until such time that market breadth improves and investor pessimism becomes widespread, a cautious approach to the stock market is warranted.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.