The decline in stock prices in the fourth quarter was largely due to concerns that the U.S. economy was headed toward recession triggered by an overly aggressive Federal Reserve monetary policy.

This notion was quickly set aside by a remarkably strong December jobs report on Friday accompanied by comments from Fed Chief Powell stating that the labor market strength in December as well as upward revisions in the October and November hiring and steady wage growth should calm fears regarding an economic slowdown.

That helped the S&P 500 rebound sharply (and likely investor sentiment too).

The Fed chief signaled that he would be more “patient” with monetary policy suggesting the Fed may pause its rate hike campaign, which is likely to provide additional room on the upside for stocks. This also set in motion a rally in bond yields and oil prices that had investors worried about a business slowdown as oil prices fell 41% since October.

Nevertheless, it would be premature based on a single month’s data, to consider that the volatility in the stock market will disappear and that a sustained new uptrend has begun.

Fourth-quarter earnings reports will soon be forthcoming accompanied by important guidance figures for 2019. In December, analysts reduced their profit estimates on more than half the companies in the S&P 500. According to FactSet, expectations are that earnings will grow 7.8% in 2019, down from forecasts made in September of 10.1%.

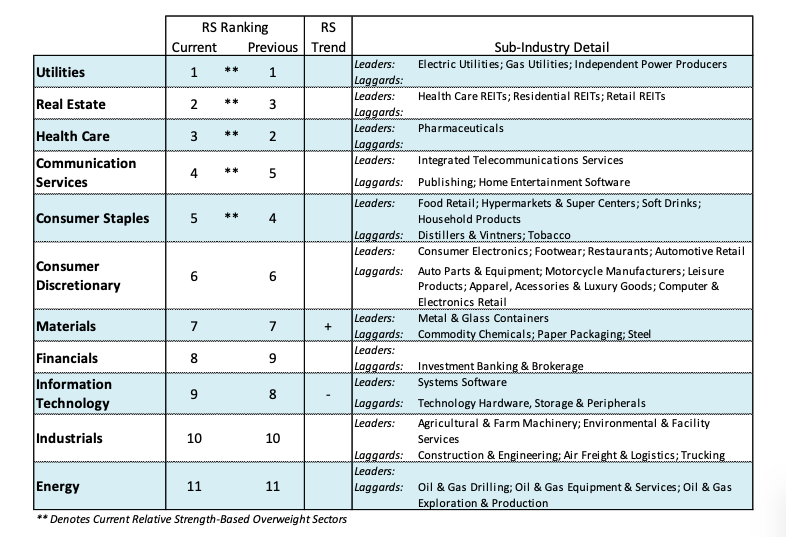

Additionally, uncertainty lingers over trade talks with China as does the impact of the slowdown in global growth on the domestic economy. We recommend focusing on the strongest sectors within the S&P 500, all of which have defensive characteristics. The top five sectors in relative strength include utilities, REITs, consumer staples, health care and communication services.

The technical condition of the stock market has improved significantly suggesting further upside progress is likely. The strong downside momentum that plagued the stock market since October has been broken.

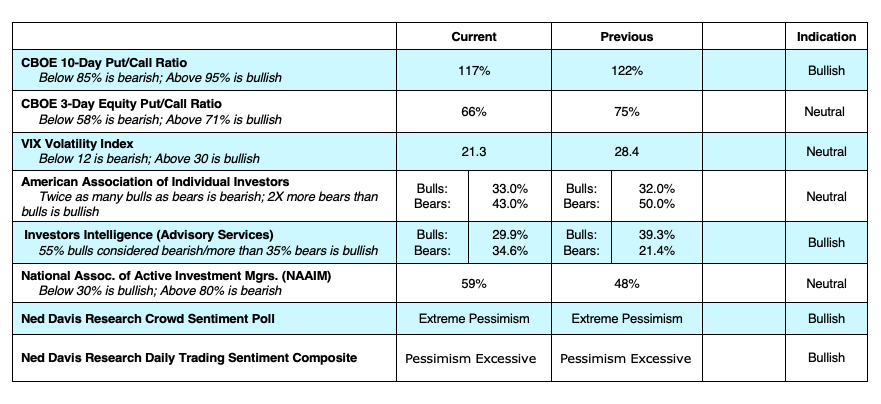

We now have had two sessions (December 26 and January 4) where upside volume has overwhelmed downside momentum by a ratio of 10 to 1 or more. Investor sentiment indicators show a significant level of pessimism for stocks that from a contrary opinion standpoint suggests further gains in stock prices are likely.

The latest report from Investors Intelligence, which tracks the opinion of Wall Street letter writers, showed a significant drop in bulls last week and the highest level of bears since the end of the market correction in February 2016.

Additionally, the Ned Davis Daily Trading Sentiment Composite recently showed the most pessimism since the 2011 bear market bottom. Further evidence of excess pessimism is the fact that individual investors pulled a record $75.5 billion from equity mutual funds and ETFs in December.

Using contrary opinion, we anticipate a counter-trend rally in the first quarter, the strength and potential of the rally dependent on a significant expansion of stock market breadth. On this front, we are encouraged last week by the fact that the Russell 2000 and the NYSE Composite Index, that includes more than 2000 issues, outperformed the S&P 500 and Dow Industrials by advancing 3.20% and 4.23% respectively versus 1.60% for the Dow Industrials and 1.88% for the S&P 500 Index. Expansion in stock market breadth will be a function of how well small- and mid-cap stocks rebound.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.