The U.S. equity markets fell sharply last week, erasing most of the gains since early June.

Much of the damage was related to a deterioration in U.S./China trade relations as well as the rise in bond yields as the 10-year Treasury note hit the highest level since 2011.

Investors are concerned that the Federal Reserve may raise rates too quickly and choke off the U.S. economy by impacting borrowing costs and eroding corporate profits.

We do not see any evidence of this as the Fed has responded to a strong labor market and a record performance by the U.S. service sector by raising rates gradually against a backdrop of low inflation pressures. This was seen in the latest Consumer Price Index Report that showed inflation pressures weaker than expected in September which relieves the pressure on the Fed to raise rates.

The strength in the U.S. economy is real, with a great job market and companies that are expanding, supported by tax cuts and deregulation and not based upon quantitative easing as in the past. About 75% of S&P companies will announce third-quarter earnings over the next month and analysts are expecting earnings to be up almost 20%.

The technical underpinnings of the stock market continue to argue for a cautious approach. Given that stocks enter the week deeply oversold, a short-term counter-trend rally appears likely. From a longer-term perspective, however, there is insufficient evidence to expect a sustainable rally back to the September highs.

The broad market, that typically leads the popular averages by 3-6 months, weakened further last week. This is seen by the fact that the number of NYSE stocks hitting new 52-week lows ballooned to 870 from 649 the previous week.

Before issuing a bullish signal, we would need to see the popular indexes trend lower accompanied by a reduction in the number of issues making new lows. There should also be a reversal in the downside momentum that currently plagues the markets to signal the downtrend has been broken.

Last Thursday marked the seventh time this year where downside momentum has overwhelmed upside momentum by a ratio of 10-to-1 or more without a single session where upside volume exceeded downside volume by a ratio of 10-to-1 or more. Before signaling a bottom is in place, we would need to see at least one day (and probably multiple days) where upside volume outpaces downside volume by better than 10-to-1.

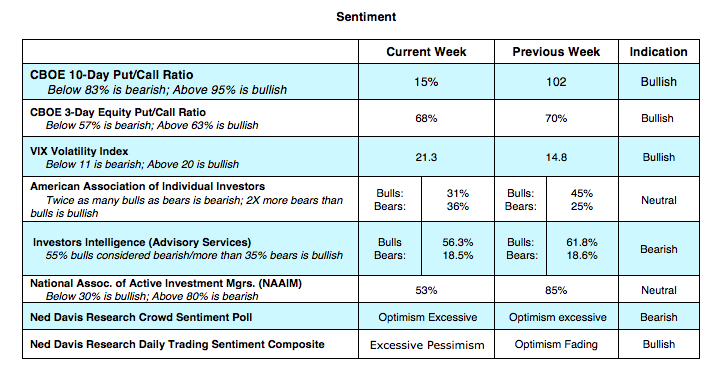

Virtually all sustainable rallies the past few years have been preceded by investors turning excessively pessimistic. Sentiment indicators are very telling because of the inverse relationship that exists between sentiment and liquidity. When pessimism becomes excessive it argues that liquidity has accumulated on the sidelines to a sufficient degree to support the next important rally. In the present example, investor psychology has moved from optimism to caution and skepticism with little evidence of broad-based pessimism. To issue an all-clear signal, we would like to see pessimism reach excessive or extreme levels to feel confident that a low is in place.

The Bottom Line: For confirmation that a year-end rally is underway we would expect to see a contraction in the number of stocks hitting new 52-week lows accompanied by extreme levels of pessimism and at least one session where upside volume blows out downside volume.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.