S&P 500 Trading Outlook (2-3 Days): Fading The Move Higher

One final push higher on the S&P 500 (INDEXSP:.INX) may develop into early next week. However I’m looking to sell into this move.

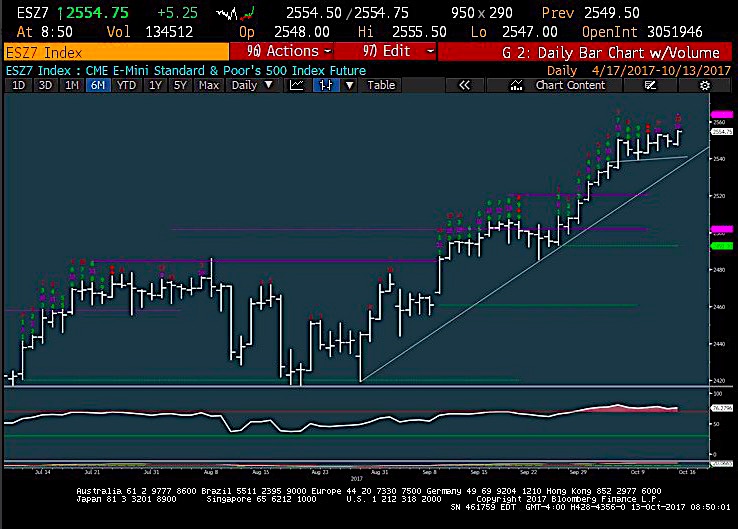

The upside technical price target for the S&P 500 lies at 2562-67. However, any sign at all into next week of the S&P 500 reversing course is reason for caution. A move back down under the 10/9 lows at 2539 would likely begin the larger correction.

S&P 500 Futures Chart

TECHNICAL THOUGHTS

Most of what was written recently needs to be re-emphasized as many of these developments played out further on Thursday.

6 Bearish Signs For Traders:

1) Treasury yields and Financials fell, with the Financials Sector ETF (NYSEARCA:XLF) moving to new four day closing lows.

2) Defensive groups gained further ground with both Utilities and Consumer Staples higher by 0.45%+ or more.

3) Implied volatility is higher than it was back on 10/5.

4) Europe has stalled out.

5) Market Breadth still hasn’t exceeded highs from 10/5.

6) Investor sentiment heating up – bull/bear spread high

Looking back, Thursday yet again showed more volume in “down” stocks than “up” , we saw just scant progress in Industrials, fueled by a meek Transport comeback. Furthermore, evidence of Media stocks falling down to new multi-month lows hurt the Discretionary sector and doesn’t appear to be over. Also, Telecom stocks were also very hard hit, with T and VZ both pulling back hard (T down over 6%) So a very difficult day for the market that wasn’t reflected, yet again, by just minimal price action in the S&P 500, a very tight trading range yet again.

One interesting new development concerns Sentiment – it has now risen to one of the highest levels since 2009 with over a 45% spread between Bulls and Bears (45% Net spread with Bulls at 60% and Bears down to 15%) Historically when valuation has risen to the 90+ percentile while sentiment gets overly complacent, it’s been very difficult for equities to make headway. Only Financials are showing real signs of weakness of late, but one should watch Technology carefully in the trading days ahead. While the cyclical window for when this correction “should have occurred is past its main window, there are other minor cycles which intersect at 10/17 and then 10/26 which could equally be important.

Bottom line, the net Non-movement in equities is reason for concern at a time when sentiment is so complacent, and investors have clearly set their sights on tax reform and no obstacles in the way. Trends need to be watched very carefully for evidence of giving way in the week ahead. For S&P, the area near last week’s 2517 low stands out as initially having importance.

The theory laid out yesterday about bond yields , Financials, USDJPY all turning down to lead the broader equity market lower remains on the Front burner in terms of how any decline could get underway, as the trend remains quite resilient. Overall, not much looks to happen Friday for the NASDAQ Composite and/or DJIA, but SPX requires one further push up to register its counter-trend sell, so this might happen either Friday, or early next week.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.