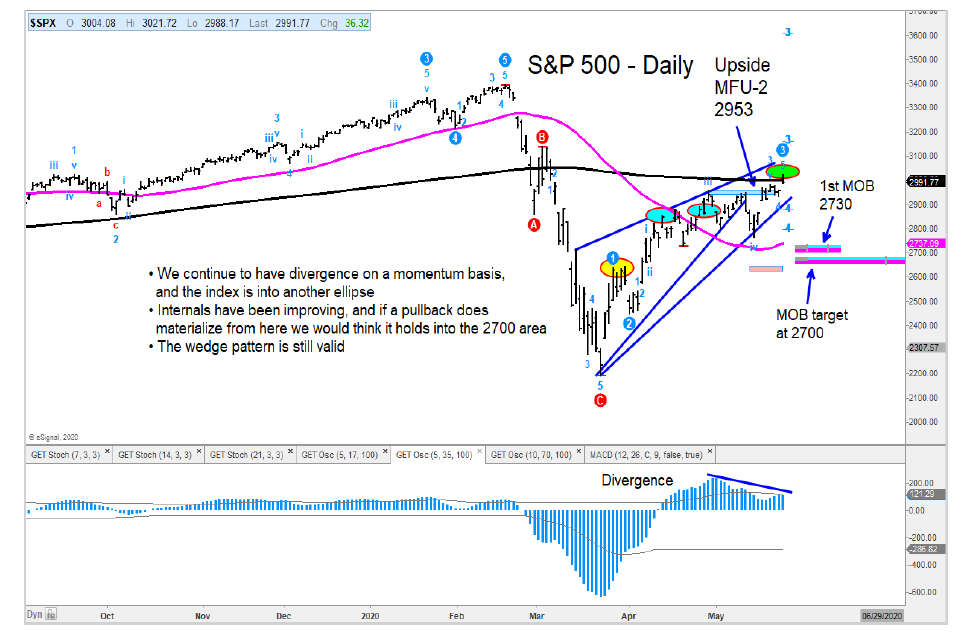

I am not a chaser of momentum as I continue to see the stock market indices in areas that we don’t want to be chasing.

Two important observations from Tuesday’s price action:

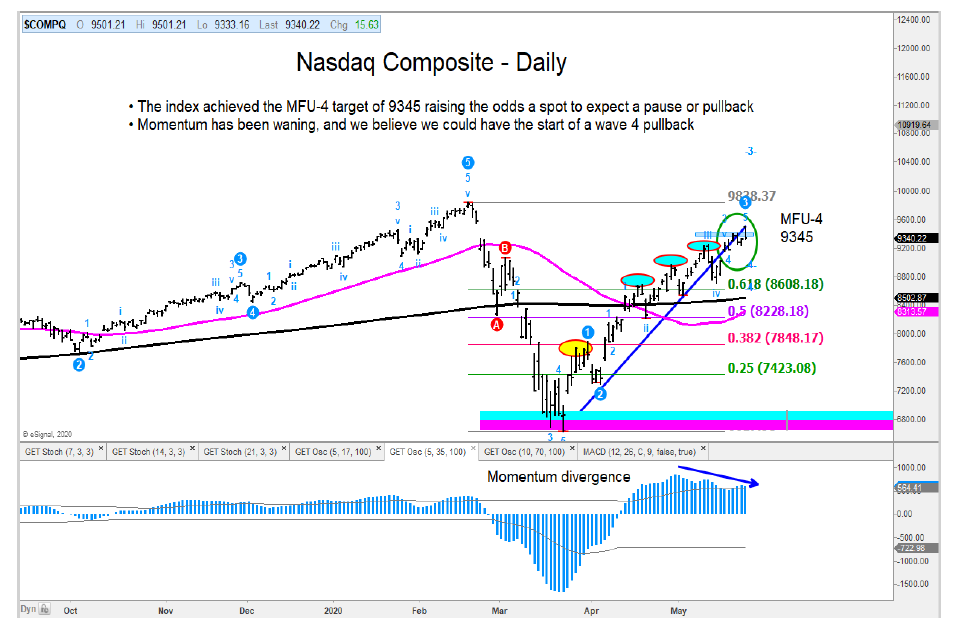

1). The Nasdaq Composite has achieved its MFU-4 target at 9345 which we have been highlighting for some time.

2). I see a shift starting in Momentum (MTUM) vs. Value (SPLV).

This looks like the start of a pullback in MTUM.

The S&P 500 Index had a gap higher on Tuesday and stopped at its 200-day moving average and ellipse area.

The Nasdaq Composite also had a strong rally and achieved its MFU-4 target at 9345. This would be a good area to look for a pause/pullback.

Both the Russell 2000 (IWM) and Mid-Cap (MDY), which have lagged, had a strong move up with the MDY gapping to its 61.8% Fibonacci retracement level.

The author may have position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.