The corn market was essentially stuck in neutral this week with values showing little desire of breaking out of what has been a very narrow trading range since the beginning of October. So what’s going on with December Corn futures?

The reasons for the lack of trader enthusiasm and overall disinterest in corn futures are many at the moment. Here are two reasons that specifically stick out to me:

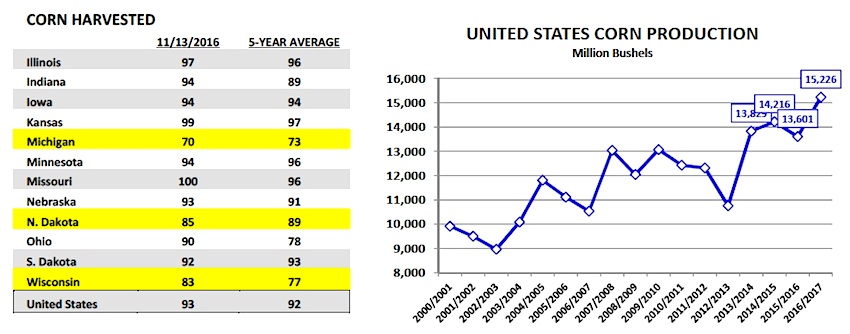

1). Monday’s Crop Progress report showed the U.S. corn harvest improving to 93%. Of the top 12-corn producing states in the country only Michigan, North Dakota, and Wisconsin have 15% or more of their state corn harvests remaining. Doesn’t this mean there should be less commercial hedge (sell) paper to constrain future corn rallies? In theory yes, however I believe the ultimate hope for Corn Bulls, concerning finding a legitimate justification for sustainable post-harvest corn rallies of at least 30 to 40-cents per bushel, was primarily centered on the USDA finding a U.S. corn yield closer to 168 bpa versus the USDA’s current November forecast of 175.3 bpa. Since harvest began the U.S. corn yield estimate has gotten larger, not smaller…

2). Secondarily, the USDA’s latest 2016/17 U.S. corn production forecast of 15,226 million bushels would suggest that the selling will likely return in mass on even small rallies throughout the next 90 to 120-days given the sheer size of this year’s crop. I can’t overstate how much unpriced corn there is right now in the countryside in both producer and commercial hands. 5-cent rallies will be seen by some as an opportunity to price some corn. Invariably this leads to layers and layers of topside resistance, which in turn dissuades money-flow investors from chasing corn longs. There’s no reason to fear the corn market getting away to the upside. This equates to patient buyers and sideways markets.

BRAZIL Corn Back Under The Microscope

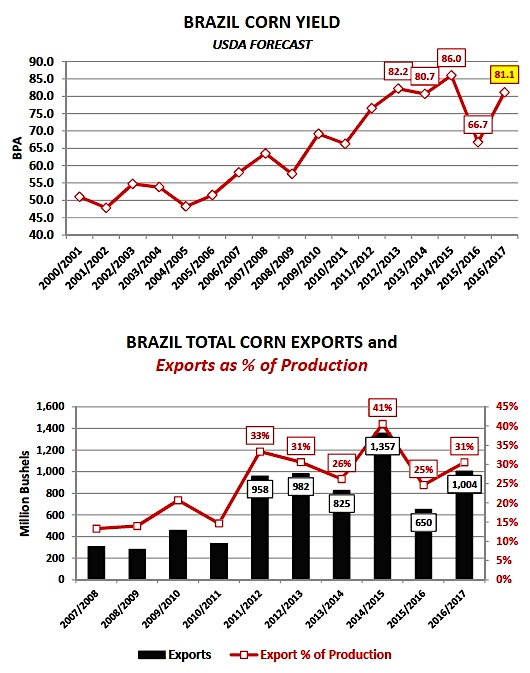

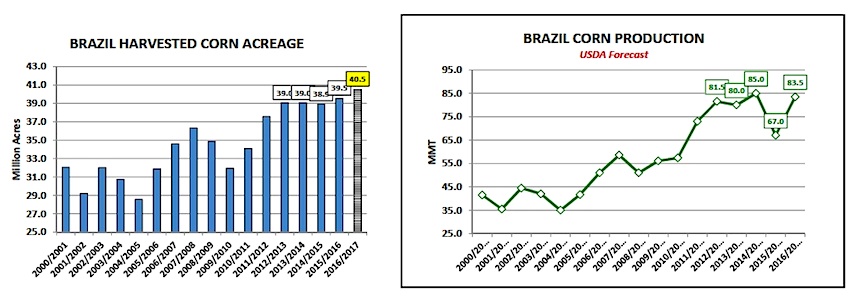

Following what was a very challenging 2015/16 corn growing season in Brazil (which culminated in total corn production being down 21% from the prior crop year); the market has been keenly focused on production prospects for 2016/17. Recently Conab (Brazil’s “National Supply Agency” similar to our USDA) estimated Brazil 2016/17 corn production at a midpoint of 83.8 MMT versus the USDA’s November forecast of 83.5 MMT and 2015/16 production of 67.0 MMT. That said the majority of the year-on-year production increase is predicated on a return to trend-line to slightly above trend-line yields for Brazil’s “safrinha” (second) corn crop. This crop, which represents approximately 65% of total Brazil corn production, is planted after the early season soybean harvest in January, February, and March, primarily in the states of Mato Grosso and Paraná.

In 2015/16, Conab estimated that Brazil’s safrinha corn yield fell to a drought-reduced 59.5 bpa. By comparison, for the 2016/17 crop year Conab is projecting a safrinha corn yield of 81.9 bpa, which would be similar to the USDA’s average total Brazil corn yield of 81.3 bpa for crop years 2011/12 through 2014/15. The point being that while Conab and the USDA disagree slightly on 2016/17 production prospects, both appear convinced that the previous crop year’s adverse weather cycle will prove to be an anomaly.

Why is the market sensitive to Brazil corn production? Brazil is the world’s 2nd largest corn exporter. However Brazil’s ability to export corn is not surprisingly very much a byproduct of how successful its growing season is. Brazil over the previous 5-crop years has exported on average 31% of its total corn production (low-to-high range = 25% to 41%). By comparison the United States, the world’s largest corn exporter has exported on average 12% of its total corn production over that same time period (low-to-high range = 7% to 14%). This means that Brazil’s available corn exports are much more sensitive to its production cycle versus the United States. For example, in 2015/16 Brazil’s corn exports dropped to just 650 million bushels versus 1,357 million bushels the prior crop year (-707 million bushels) due to Brazil’s total corn production decreasing 709 million bushels. Therefore, there was almost a 1 to 1 offset relative to the drop in production being met with a near equal reduction in exports. Given Brazil’s importance to world corn importers this has had an impact on world market prices.

What’s neutralized the recent impact on world corn prices? Clearly it’s been the U.S.’s record setting 2016/17 corn crop of 15,226 million bushels, which exceeded the previous record high by over 1.0 billion bushels.

That cushioned any potential deficit in available world corn exports due to Brazil’s drought reduced 2015/16 corn crop. However the critical takeaway longer-term is this, if U.S. planted corn acreage contracts 4 to 6 million acres in the spring of 2017, the U.S. supply cushion could be eliminated within a single crop year. This will invariably put more pressure on Brazil’s 2016/17 safrinha corn crop returning to form, which won’t be known or decided until May/June of 2017. This should in my opinion help put a bid in the corn market early in 2017 at current price levels…

December Corn Futures Pricing Considerations For The Week Ending 11/18/2016:

December corn futures closed on Friday (11/18) at $3.45 ½, finishing up 5 ¼-cents per bushel week-on-week. What’s semi-misleading about the higher weekly close is that most of that up move came on Friday. Therefore for the vast majority of the week December corn futures once again treaded water, moving in a very narrow trading range (low-to-high range = 11 ¼-cents per bushel). Technically both the futures price action and the major moving averages have all entered a flagging pattern (SUPPORT LEVEL 100-Day Moving Average = $3.423 with TOPSIDE RESISTANCE at 35-Day Moving Average = $3.47 ½). Therefore I wouldn’t be surprised to see a 10 to 15-cents per bushel breakout move coming in the near future, pending a definitive close above or below either major moving average.

Will it be up or down? If Friday’s Commitment of Traders Report is any indication the path of least resistance is still likely lower. Money managers turned aggressive sellers again last week selling 57,102 contracts. The Managed Money net short in corn grew to -85,156 contracts as of the market close on 11/15, the largest it has been since October 11th. Clearly the USDA’s increase to the U.S. corn yield and subsequent increase to U.S. corn ending stocks in the November WASDE report, once again turned price momentum negative or at the very least any desire by end users or specs to start accruing corn longs even at current price levels. Ultimately I still anticipate largely sideways, range bound price action into calendar year end.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service