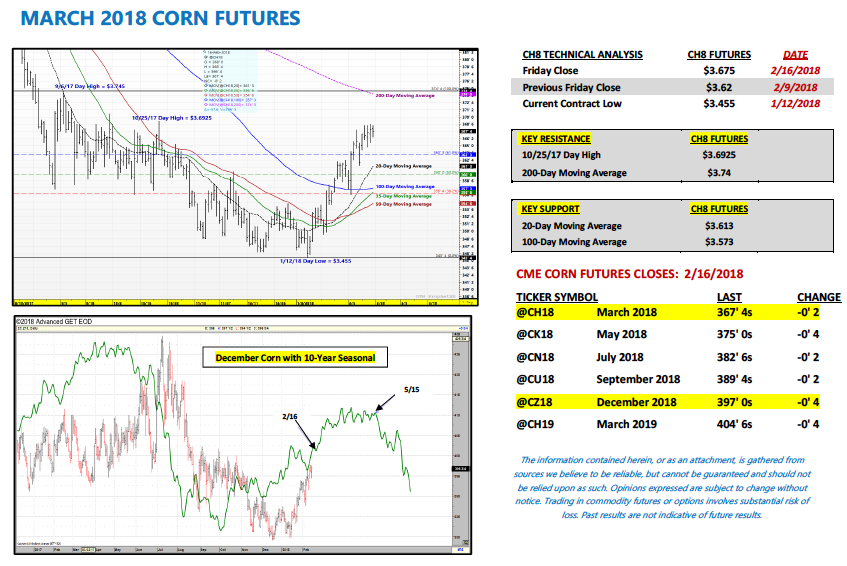

March corn futures closed up 5 1/2-cents per bushel week-on-week, finishing at $3.67 ½.

Corn bulls will look to extend the near-term rally but overhead price resistance looms (3.69 / 3.75). A strong move above 3.75 could put 4 dollar corn back on the radar.

Let’s review the latest news, data, and analysis for the week ahead.

Weekly Highlights and Takeaways for February 19, 2018

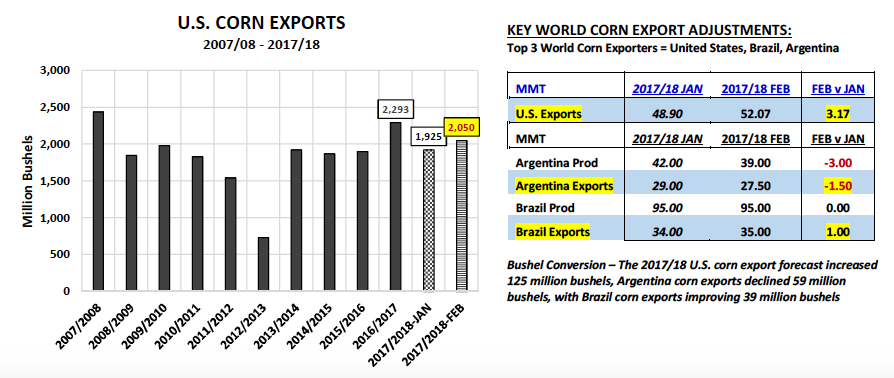

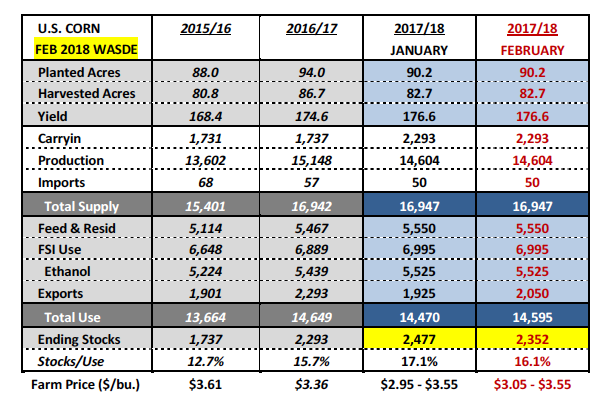

- Early in the week Corn Bulls continued to benefit from concerns centered on the expanding drought in Argentina, which has severely impacted Argentina’s corn and soybean crops. Argentina is the world’s 3rd largest corn and soybean exporter. In the USDA’s February 2018 WASDE report, Argentina’s 2017/18 corn production estimate was lowered to 39 MMT, down 3 MMT from January (-118 million bushels). The USDA also reduced Argentina’s anticipated corn exports by 1.5 MMT (-59 million bushels) to 27.5 MMT. Conversely this was undoubtedly a big reason why the USDA chose to increase 2017/18 U.S. corn exports by 3.17 MMT (+125 million bushels) in that same report. The USDA’s revised 2017/18 U.S. corn export forecast improved to 52.07 MMT or 2.050 billion bushels.

Since the release of the February WASDE report, several private analysts have gone a step further than the USDA and issued Argentina corn production estimates as low as 35.5 to 36.5 MMT. If realized, this would suggest that additional decreases to Argentina’s revised export forecast could be in the offing in either the March or April WASDE reports. Any such reductions should continue to benefit U.S. corn export sales.

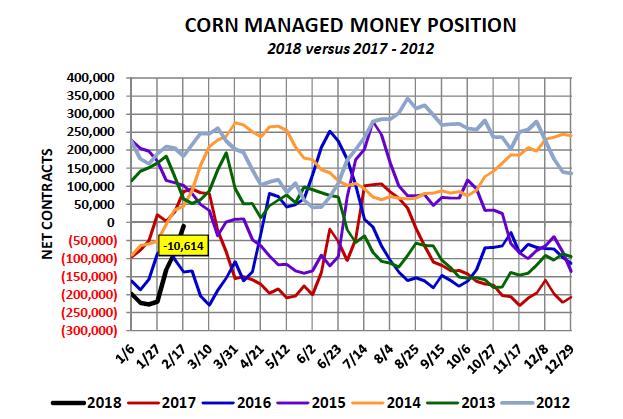

- The most recent Commitment of Traders Report showed Money Managers continuing to buy back a healthy percentage of their net short corn position. On January 10th the Managed Money short in corn was reported at -226,876 contracts. As of the market close on February 13th that short position had nearly been eliminated, reported at just -10,614 contracts. Considering prices stayed supported Feb 14th – 16th…I wouldn’t be surprised if Money Managers were now actually net LONG corn futures as of this Friday’s March corn close at $3.67 ½.

- Internal reports from Brazil continue to suggest that Brazil’s safrinha corn acreage will be down 5 to 6% versus a year ago. Last week Conab estimated Brazil’s 2017/18 corn crop at just 88 MMT, which compares to the USDA’s latest forecast of 95 MMT. I’ve seen one other private estimate as low as 86 MMT. I do believe the USDA’s current production forecast will come down in either the March or April WASDE reports. This could prove to be yet another supportive factor for U.S. corn exports longer-term. Brazil is currently the world’s second largest corn exporter at 35 MMT (1.378 billion bushels). Any production deficit relative to Brazil’s safrinha corn crop, which accounts for 65-70% of total Brazil corn production (and is harvested in June/July), should have a significant negative influence on Brazil’s available net corn exports this summer. That said with Argentina also experiencing a decrease in 2017/18 corn production, the U.S. stands to benefit considerably in the export market moving forward.

- Weekly U.S. corn export sales were very impressive for the 3rd consecutive week totaling 77.7 million bushels for the 2017/18 marketing year (week ending 2/8/2018). The prior two weeks export sales totals were 69.7 million bushels (week ending 2/1/2018) and 72.9 million bushels (week ending 1/25/2018). Crop year-to-date U.S. corn export sales have improved to 1.417 billion bushels versus 1.652 billion a year ago. Therefore the current sales pace trails 2016/17 year by 14.2%; however it’s worth nothing that at the end of December that gap used to exceed 25%. Therefore U.S. corn export business has undeniably picked up as South America’s crop problems (and potential corn production shortfalls in Argentina and Brazil) have become more and more transparent.

MARCH 2018 CORN FUTURES PRICE FORECAST

March corn futures traded up to a day high of $3.68 ¾ on Thursday, February 15th. This represented the highest tick in March corn futures since 10/25/17. On Friday…March corn closed off that high slightly; however managed to secure a 5 ½-cent higher weekly close, finishing at $3.67 ½.

Technical momentum in corn remains sideways to higher. That said I am seeing signs that March corn (as well as December corn futures) are in the final stages of possibly exhausting the current rally. March corn attempted to trade up to $3.69 on Tuesday, Wednesday, Thursday, and Friday…and failed (10/25/17 day high was $3.69 ¼ = key resistance). The same scenario played out in December corn futures at $3.98 with the market peaking at $3.97 ¾ (coincidentally the 200-day moving average in December corn is $3.977).

Given the fact that Friday’s Commitment of Traders report showed Money Managers now essentially even in corn as of 2/13 (or possibly net LONG when taking into account Managed Money buying Wednesday – Friday, which was not represented in the CFTC’s latest position summary), I’m not sure where the next round of buying is going to come from to continue propelling corn higher into next week.

The Argentina weather story is supportive to a point, however with U.S. corn exports already moving up 125 million bushels in the February WASDE report, I think the USDA has largely compensated for lower South American corn production.

I’m not bullish above $3.74 March corn futures at this time.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service