Unlike a typical life & health or property & casualty insurer that addresses human risk management needs, Trupanion (NASDAQ:TRUP) is focused on the medical needs of our cats and dogs. Investors are taking note of its business, as a Trupanion stock breakout may be under way… more below.

The $511M medical insurer provides coverage across the U.S., Canada, and Puerto Rico (currently the only pet insurer in Puerto Rico). They also have a business segment dedicated to veterinarians, providing software solutions for billing and other data.

On May 2nd, the Seattle-based company reported a Q1 loss of $0.05 per share vs Wall Street estimates of a loss of $0.06 per share. Revenue jumped more than 28% on a year over year basis to $54.73M, topping projections of $53.41M. Quarterly total enrolled pets rose 19% to 364K+ and subscription enrolled pets increased by 17% to nearly 335K over the prior year period.

Revenue growth is likely to be in the 20%-25% range over the next couple of years, going from $188M to $288M+ annually by 2018. Trupanion is expected to become profitable next year as their expansion into the United States and Puerto Rico continues. The stock currently trades at 2.80x sales and 12.43x book value.

On May 26th, Northland Securities assumed coverage on TRUP shares with an outperform rating and a $22.75 price target. Upcoming catalysts for the company include the Stifel 2017 Dental and Veterinary Conference on May 31st, Cowen and Company 2017 TMT Conference on June 1st, and Q2 earnings due out in late July/early August.

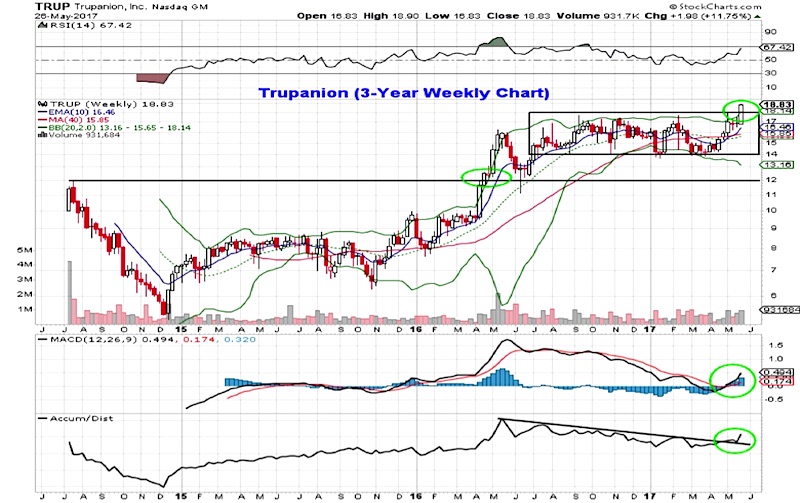

Trupanion (TRUP) “Weekly” Stock Chart

Looking at the 3-year weekly chart above, shares of Trupanion are breaking out above the $18 resistance level. This follows a prolonged base between $14 and $18 that dates back to mid-2016. A positive reversal in the moving average convergence divergence (MACD) and a breakout in the A/D line are confirming the bullish price action. On a measured move basis, the stock is likely to test $22 at a minimum ($18-$14=$4; $4+$18=$22). TRUP shares previous breakout above the IPO high near $12 also led to a quick $4+ pop before retesting the prior resistance level.

A rally up to the $22-$23 level where recent fundamental analyst research and technical analysis suggest shares could be trading at would put its valuation near 3x 2018 sales, which isn’t outrageous for the company’s growth and execution in what appears to be the early innings for the pet insurance market.

Interested investors could consider taking a starter position in Trupanion shares or deep in the money calls now, while looking to add to the position on a pullback to the $18 level. Swings of 5-10% are common in the stock, so starting small gives you upside potential while limiting risk due to the week to week volatility.

Thanks for reading and have a great week!

Twitter: @MitchellKWarren

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.