The stock market’s 2017 advance slowed last week with the blue-chip averages gaining less than 1.00% while the rally in small- and mid-cap averages stalled.

Nevertheless, the performance year-to-date continues to surprise on the upside. And the latest bump may be aided by lower treasury bond yields (INDEXCBOE:TNX).

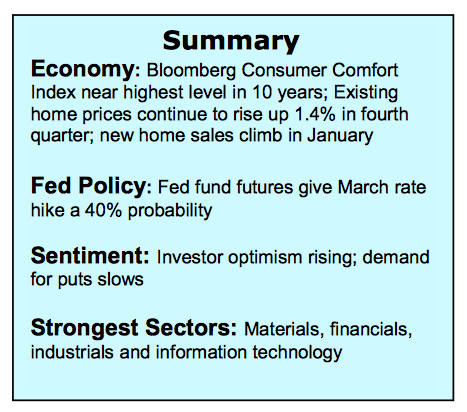

The equity markets are supported by better-than expected economic data and more recently by a drop in bond yields. The decline in interest rates is likely due to excessive bearish sentiment toward bonds since the election, the sharp break in yields in Europe where negative returns are again common, and from strong inflows ($11 billion last week) into U.S. bond mutual funds and ETFs. Rising bond yields represent a threat to the economy and stock market. The fact that the yield on the benchmark 10-year T-note has retreated in recent weeks to levels last seen in November argues that any pullback or correction in the equity markets will be limited.

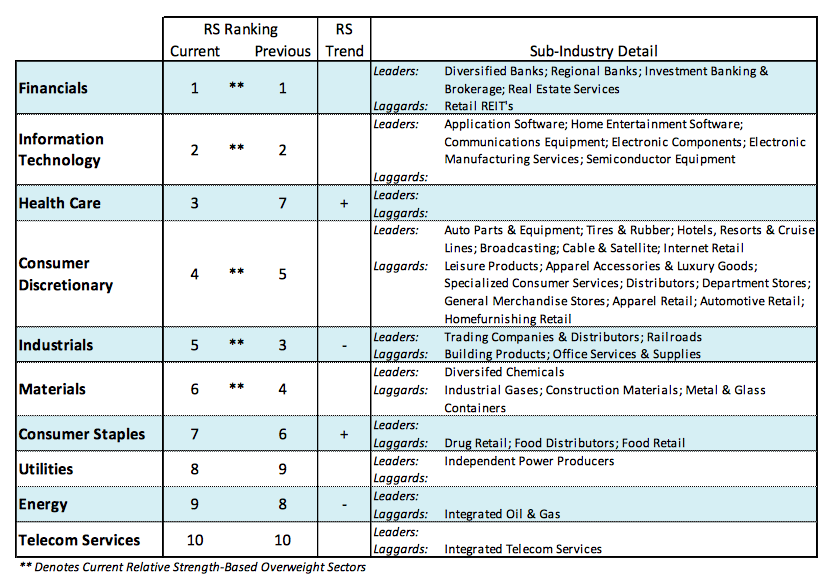

This week investors will be focused on the President’s economic policy address to Congress on Tuesday. This is not expected to remove but could reduce the level of uncertainty surrounding the implementation of tax and regulatory reforms. Last week’s stock market performance included a rotation in leadership towards defensive sectors. While one week does not make a trend, a continued shift in leadership away from cyclical sectors often precedes a market pullback.

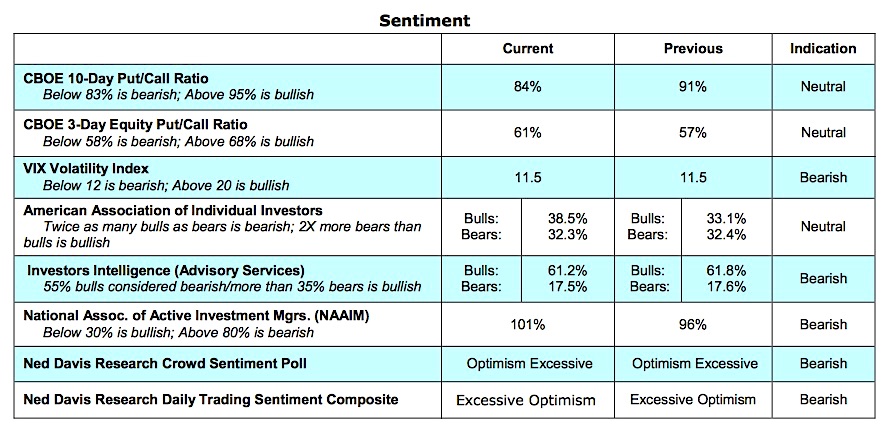

Measures of investor sentiment continue to be the soft spot in the technical condition of the stock market. Most notably last week was the pervasive drop in the demand for put options (purchasers of puts anticipate a fall in equity prices). This is in sharp contrast to most of 2017 when demand for puts was unusually strong.

Other sentiment indicators including the 61% bulls in the Investor Intelligence (II) statistics and 100% fully invested position as described in last week’s data from the American Association of Active Investment Managers (NAAIM) also indicate unusual optimism. Although this does not necessarily require that stock prices will fall, it does argue that the near-term risks are elevated.

Since December the popular averages have experienced a unique period of low volatility. The S&P 500 Index has enjoyed the longest string of consecutive gains since 2013 and the Dow Industrial’s 11 straight daily new highs is the longest in 30 years. At the pre-election lows, pessimism was easily found which is not the case as we move into the final leg of the first quarter.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.