The S&P 500 (INDEXSP:.INX) broke out to new all-time highs, finishing the week up 0.8%. But just as it appears the stock market is ready to blast off, traders would be wise to wait for follow through (a breadth thrust).

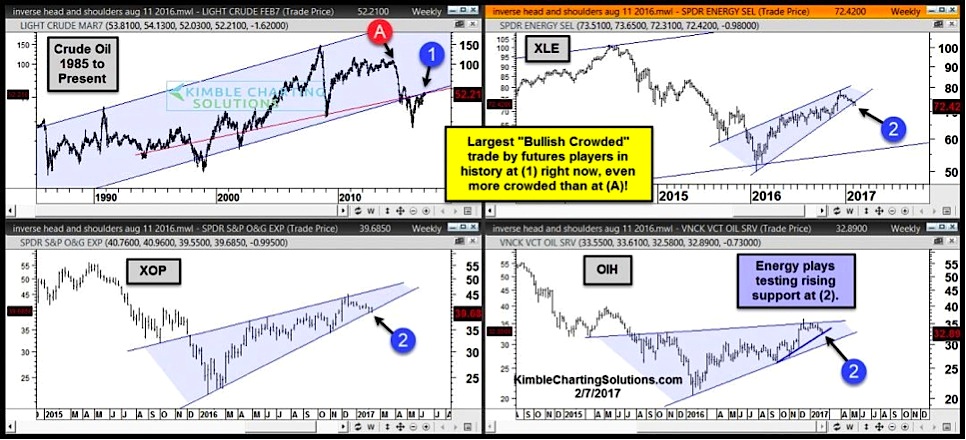

Crude oil was looking heavy early in the week but reversed course to test the upper band of its trading range. That’s one to keep an eye on. Will it ultimately break out? Or is it lacking demand?

Treasury yields also moved higher late in the week. Mark Newton’s research called this.

This week’s set of links has some solid research, highlighting market breadth, correlations, and charting observations. There’s also some solid educational posts on trading.

Lastly, be sure to check out the latest posts here on See It Market. Been some great stuff lately.

MARKET INSIGHTS

Crude Oil, the most crowded trade in history in play – Kimble Charting Solutions

3 Popular Investment Strategies that will look foolish in 40 years – Jesse Felder

A-D Line at New Highs – McClellan Financial Publications

Positive Revisions to Estimates Surge – Gavekal Capital

Stock Correlations are at 8 year lows – The Reformed Broker

Random Concerns and Observations – Calculated Risk

“If you bet too much, you’ll almost certainly be ruined” – Meb Faber Show

Breadth for the 9 S&P Sectors – Andrew Thrasher

IDEAS & RESEARCH

Habits of unproductive people – Darius Foroux

The Real Danger with ETFs – Bloomberg

Carl Sagan’s rules for bullshit busting and critical thinking – Brain Pickings

Sticking With It – North Star TA

Loneliness actually hurts us on a cellular level – Vox

The Paradox of Behavior Change – James Clear

The Most Important Component of Any Long-Term ETF Strategy – FMD Capital

The Tech Company that could lead the drone revolution – Capital Market Labs

Check back every weekend for more links to some great investing research blogs and trading ideas. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.