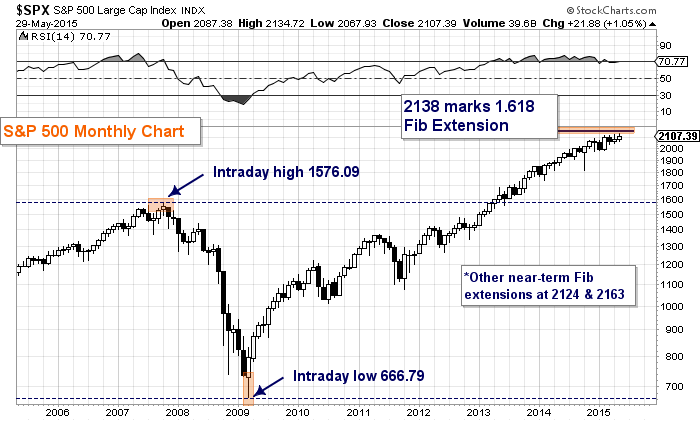

The market keeps getting tougher, particularly growth stocks, as the S&P 500 Index is still stuck under the major Fibonacci extension level. (chart via @andrewnyquist)

Economic data has evidently peaked but we know there can be a significant lag between economic peaks and market peaks. We don’t know what’s next, we just know where and when our trades are wrong. So let’s study up!

Here’s the latest and greatest via this week’s Top Trading Links.

Market Insights

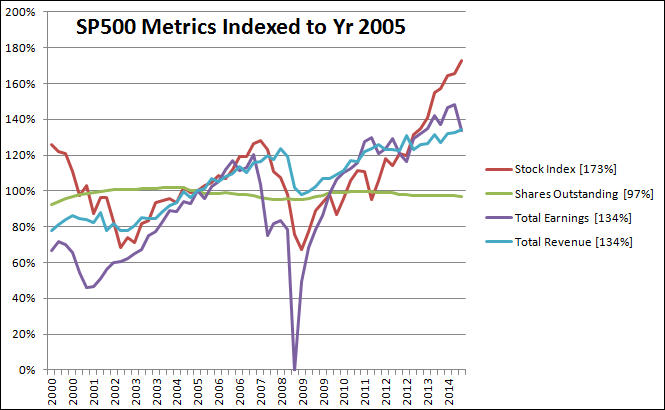

A look at S&P 500 and sector valuations via @BBtompkins:

@ivanhoff analyzes Stan Druckenmiller’s approach to being a ‘pig’.

”The years that you start off with a large gain are the times that you should go for it”

@OptiontradinIQ is tracking the Dogs of the Dow method in 2015. Here’s his latest Dogs of the Dow update.

”The biggest mistakes you will likely make also will be a lack of that courage when most needed” via @TheKirkReport

@harmongreg shares a clear way to get long term perspective in the transports.

“Maybe it is the ability to endure feeling like an idiot for a long time that distinguishes the world’s best investors.” via @millenial_inv

Linda Raschke’s 12 Trading Rules via @SJosephBurns.

@jessefelder “All of my greatest mistakes have been the result of not recognizing quickly enough the natural weakness that was at the root of the losing trade.”

@MktAnthropology shares some amazing currency analogs.

@JLyonsFundMgmt notes the long term trendline break in the NYSE Advance-Decline line.

@AndrewThrasher points out yet another divergence in stocks:

After Wednesday’s rally, @ukarlewitz noted that days with strong selling pressure often see their lows get re-tested. It’s a great study for future reference

Happenings / Research

- Robots are getting smarter via @Forbes

- Piper Jaffray anoints Virtual Reality as tech’s next megatrend

- Mary Meeker’s internet trends report slide deck

- The liquidity paradox via @valuewalk

Thanks for reading! And be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.