The Gold Miners ETF NYSE:GDX is setting up for a move higher here and has solid price support below. And I believe this rally will benefit several gold mining stocks.

The Gold Miners ETF (GDX) closed Friday at $28.45 and is setting up technically for a move higher, based on our chart analysis.

GDX recently held key price support at $26 over the last few months (between September and November), before breaking out above resistance at $28 three weeks ago.

And it has now consolidated that recent breakout, setting up the ETF (and other gold mining stocks) for its next move.

I am expecting a move higher to start over the coming days, and believe this could push the gold mining ETF to new 7-year highs, which is currently $31.06 (reached in 2013).

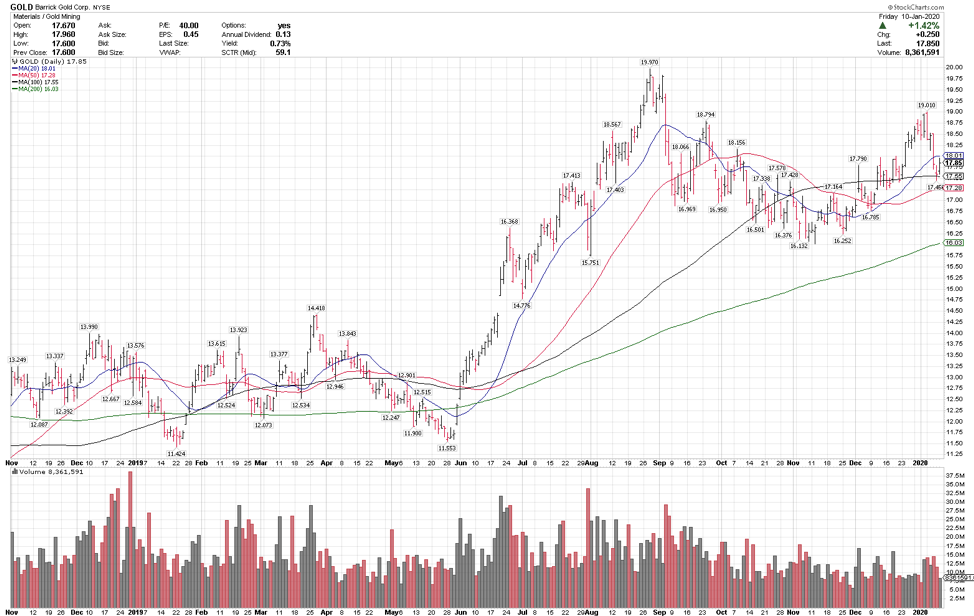

I am positioned long here in GDX (see chart below). I am also sharing my top 3 large cap gold mining stocks / ideas: Newmont Goldcorp NYSE: NEM, Barrick Gold NYSE: GOLD and Franco-Nevada Corp NYSE: FNV.

$GDX – Gold Miners ETF Stock Chart

I employ a standard 10% stop loss system, so a close under $25.60, which is below the rising 200-day moving average, would negate this position, and shorter-term, we want to see $26 hold on any pullback. As long as $26 holds, we believe there could be significant potential upside in this space.

$NEM – Newmont GoldCorp Stock Chart

$GOLD – Barrick Gold Stock Chart

$FNV – Franco-Nevada Corp Stock Chart

Larry is the publisher of the Blue Chip Daily Trend Report.

Twitter: @LMT978

The author has a long position in GDX Gold Miners ETF at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.