Janet Yellen gave testimony to Congress today which caused equity, bond and gold futures to all rally. At the end of the day, the S&P 500 (INDEXSP:.INX) was up +0.73%, with the 20+ Year Treasury Bond ETF (NASDAQ:TLT) up +0.69%, and Gold (NYSEARCA:GLD) settling back near even.

Although her comments were more dovish than many expected, it’s hard to put much faith in them longer term when her job is clearly on the line.

The main points were these: Yellen does not expect rates will have to rise by too much to reach neutral; FOMC will gradually reduce its balance sheet; Recent inflation weakness is partly due to a few unusual price categories. There is much ambiguity in many of her statements and lots of room for the FED to maneuver. What was made abundantly clear was her take on Inflation, and that it’s running below goal.

The market translated Yellen’s testimony as bullish with the belief the FED is promoting ‘lower rates, and US dollar, for longer’. But that may only be as ‘transitory’ as inflation rates.

Let’s look back before we look forward for a sign from the FED, and their coordinated central banking partners, to better help time a market top. I’m not the only one who believes Central Banks will affect policies that are equity and bond bearish. The difference may be in what confirmation I seek before having the conviction to say the market is in the late stages of a blow-off top.

Macro Notes from Federal Reserve Meeting Thursday, June 15, 2017

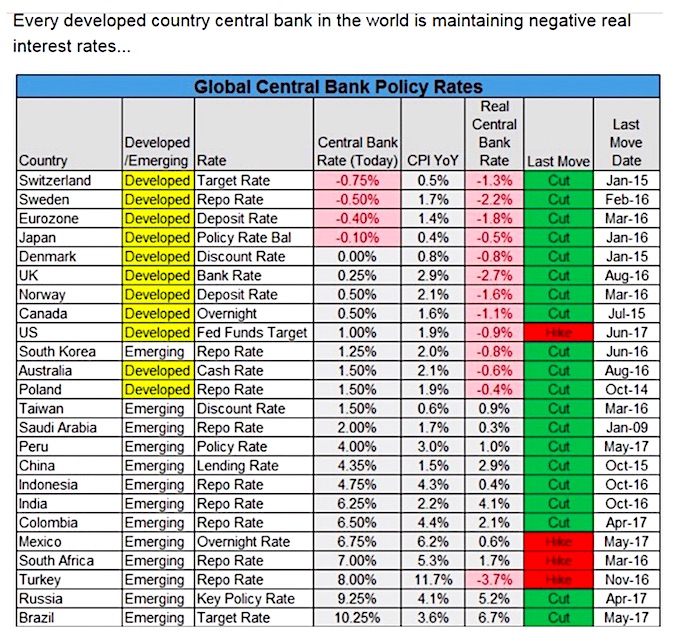

- The Fed raised its target for the federal funds rate by 0.25% (to a range of 1.00% to 1.25%). The move had largely been priced into financial markets. It was the fourth rate hike since December 2015. The market pulled back the prior three rate hikes but is trading basically flat since so the “three rates and a stumble” adage hasn’t worked out so far.

- The Federal Open Market Committee’s (FOMC) statement was more hawkish than many expected, particularly given weak inflation reading the day before, which signaled slowest growth since 2004 (a sign of disinflation).

- The median (dot plots) interest rate projections (1.4% end 2017 and 2.1% end 2018) suggests one more hike this year with possibility of three more hikes next year. The FED has a recent history of projecting higher rates than talking them back, or more noteworthy, they have a history of raising short-term rates but longer duration rates fall.

- Fed reduced its projection for core personal consumption expenditures inflation (CPCE) from 1.9% to 1.7% in 2017 but raised gross domestic product (GDP) projections from 2.1% to 2.2% for 2017 and lowered the projection for the unemployment rate from 4.5% to 4.3%. Basically that means inflation is disappointing, growth is anemic and unemployment looks great on the surface but participation rate is horrid.

Raising rates in a disinflationary period (weak inflation associated with a weak economy), and I would add, a credit contracting one (autos, cars, business loans), is unusual. Like many skeptics, maybe they see that the FED balance sheet is levered 77:1 so they should ‘do’ something, OR maybe Yellen ‘knows’ her days are limited so she is trying to ‘do’ something before she is replaced. Either way, the business of rate raising doesn’t look to slow.

Inflation is slow, however. A low employment rate has been the biggest contributor to the potential wage inflation thesis but it has not been confirmed in hard data, yet. Energy has been the biggest contributor to the actual inflation drop (although not counted in FEDs CPI benchmark). Neither of these ‘matter’ as much to traders as BOJ continuing to peg their bond yield to zero and devaluing their Yen, which is a de facto deflation export policy tool, causing commodities (energy, industrial and precious metals) to stay weak.

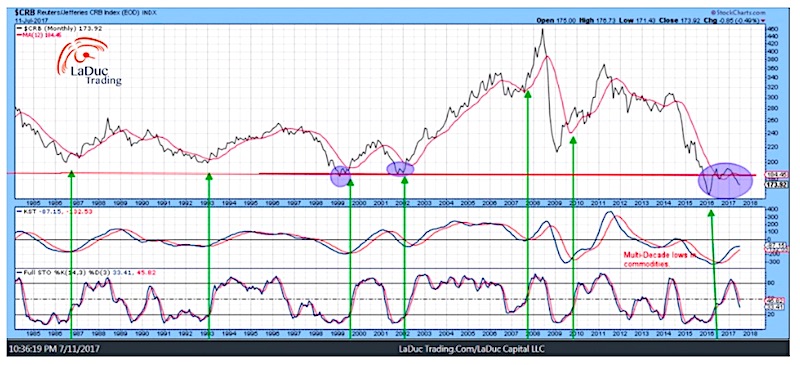

So what to do with this on-again, off-again Inflation/Reflation trade thesis many are trying to catch? Wait until we have confirmation. Or trade the chop. Yes, we are in a multi-decade low for commodities but a reversal signal for the long-term has not presented itself yet, and more to my coming point, be careful what you ask for, you might just get it (more on that below).

Even though the Federal Reserve is starting to hike short-term interest rates, quantitative easing in Europe and Japan is still keeping their bond yields from rising, and this keeps pressure on commodities. Or is it falling commodity prices put pressure on both US and global bond yields? Either way, our higher Treasury yield looks very attractive to foreign buyers. Rising foreign bond prices (supported by central bank buying) are helping keep a strong bid under US Treasuries.

So if bond yields don’t start rising despite rate hikes/expected rate hikes, it is more likely a function of Treasury yields reacting to falling foreign yields, and all of them may be reacting to falling energy/commodity prices! So when/if energy/commodity prices really start to take off, they will most likely pull foreign yields up and with it our Treasury yields.

What About That Fed Balance Sheet Move?

FED intends to gradually reduce the size of its balance sheet (currently $4.5T) by decreasing reinvestment of principal payments from maturing bonds. Fed mentions they will unwind to the tune of $60B from its balance sheet each month. NOTE: Immediately after this announcement last month, the BOE extended its bond buying to the tune of $50B per month. That’s called an orchestrated or lucky (depending on your variant perspective) “taking up the slack” move!

Further, the BOE announced last month that it would keep interest rates unchanged at 0.25% but the BOE’s vote to keep rates steady was divided, 5-3; the widest split in six years. As a result, speculation ran wild that maybe, just maybe, the BOE will raise rates in the foreseeable future.

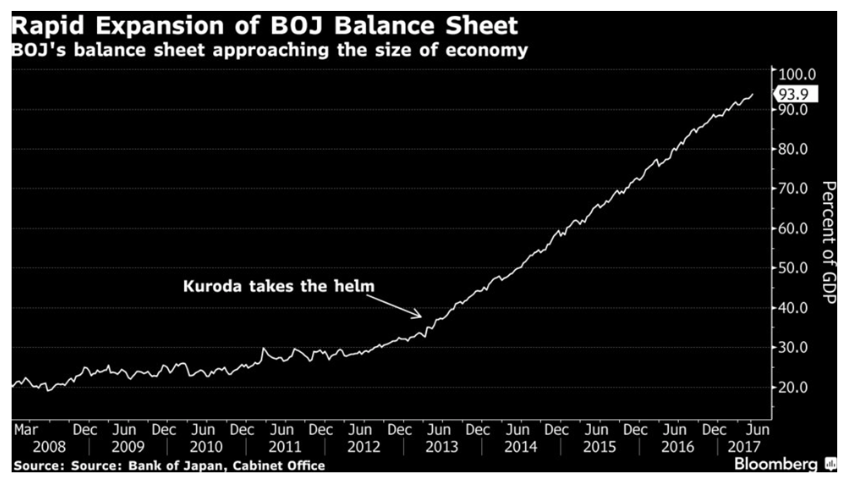

The BOJ has not moved. They have not reached consensus to remove its 80T yen ($725B) annual bond buying target nor cut its purchases of debt (for which they currently own ~40% of the market) and there is more than 10 years to maturity so the timing of this process remains unknown. All we know is they buy on dips, like magic, and as a result the SPX seemingly never really goes down (and VIX never goes up as a result). But there is that little pesky detail that the Rate of Expansion for the BOJ Balance Sheet may be nearing an end. After all, they are approaching purchases equal to 100% of their GDP. At what point do the Japanese, and rest of world, lose confidence in the grand Japanese Experiment, and most notably, of their currency.

Despite many calling for the ECB and BOE and BOJ to join the FED in starting the unwind process of exiting quantitative easing, we really don’t know when and how the market will react when they do. It appears they are ‘allowing’ the US to ‘go first’, while global Central Banks still ‘have our back’ (ECB bond buying, BOJ rate pegging). Question is for how long? And when/if the market spooks, for whatever major geo-political or credit default reason or the like, it would seem that a reversion to the mean type of market would kick in after so many years of Central Banks suppressing rates and buying bonds and equities. Until then market liquidity, and volatility, are not a problem. The opposite will also be true and Why Central Banks May Be Equity and Bond Bearish.

Timing the Market Top

I’ve been looking at a lot of macro charts and three recurring themes appear to signal a market top: 1. Full employment (check) that starts to reverse (not yet). Followed by an oil spike (or insert ‘other commodity’). 3. Fed-induced recession (higher rates which lead to economic contraction). Market leadership in Tech losing momentum is not enough. When growth tops out, it can lead to months of under-performance and volatility between growth and value plays, but we need the Credit Market to Lead the Equity Market for the market to truly roll over. There are signs of strain (flat yield curve as example), no question, but not of breaking.

So what am I looking for? Well, as you know, I like to follow money flow and money rotates around awhile before real money buyers step away. I’m watching as money rotates from tech, consumer spending stocks and industrial stocks into maybe-just-maybe inflation-hedged commodities. Why? A surge in inflation proxies might actually be the signal that the market is in the late stages of a blow-off top. So while we are all anxiously awaiting signs of inflation, be careful what you ask for, you might just get it, and with that…a market top.

Friendly Sidebar: It’s easy to subscribe to my Free Fishing Stories/Blog for more insights like these. You are also invited to Come Fish With Me on any trading day!

Thanks for reading and Happy Trading.

Twitter: @SamanthaLaDuc

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.