The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Reverse stock splits are trending once again, a sign of pessimism for corporate America

- Recent splits include: Churchill Downs, Blue Apron and Thomson Reuters

- Ahead of Q2 earnings season, traders might consider eyeing new stock split candidates, and what reverse vs. traditional splits might mean for the companies that announce them

While the Magnificent Seven remains in the limelight, international investors may be missing out on an exciting show in Japan. We touched on it earlier this month, but the Nikkei’s massive run-up has taken another leg higher lately.

The mother of all bull markets and bubbles grew in the 1970s and 80s in Japan. Its real estate sector, along with the country’s equities, surged to valuation ratios that would make today’s U.S. tech stocks blush. Alas, all good things seem to come to a harsh end when fear and greed are at play.

The Nikkei 225 peaked just shy of 39,000 shortly in advance of the go-go 90s. Right before American investors would enjoy a tech boom and bust, the land of the rising sun was on the verge of one of the most gut-wrenching bears of all time.

Closing In on a Round Trip

The Nikkei’s drawdown reached 80% by early 2003. The bear market then undercut that low at the depths of the global financial crisis in 2009. Twenty years of lower highs and lower lows is the epitome of despondency. Japanese stocks were indeed left for dead, and a meaningful rally would not begin until 2013. Amid an aging population and constant economic flirts with deflation, investors were none too interested in being overweight a nation lacking growth catalysts.

Nikkei 225 Index: From Big Bear to a Rock-Solid Brahma Bull

A New Global Market Leader

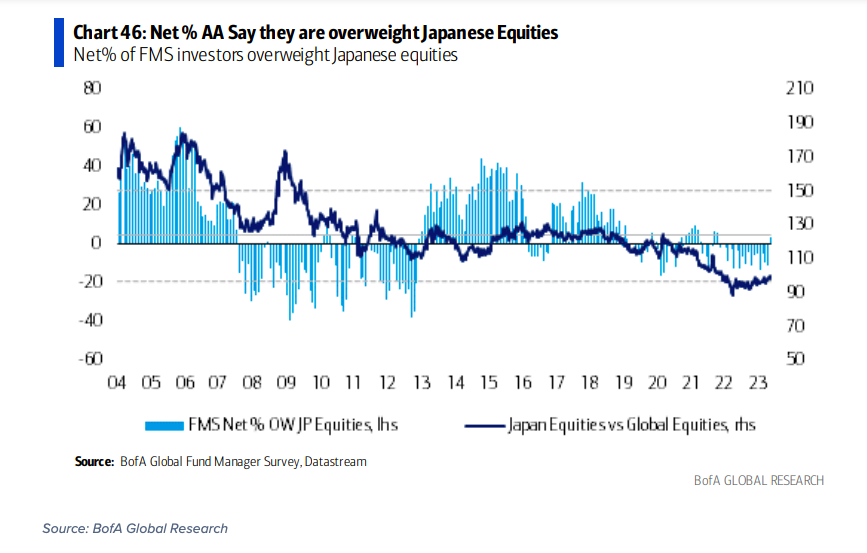

But a bull market has been raging for about a decade. Flying under the radar given the persistent alpha seen among domestic equities, Japan’s Nikkei 225 is up more than three-fold over the last 10 years. The index’s last five thousand points have finally caught the attention of big money managers. According to the latest BofA Global Fund Manager Survey, Japanese stock allocations are the highest since late 2021. Furthermore, “long Japan equities” is seen as the No. 3 most crowded trading among global portfolio managers.

Global PMs Turning Bullish on Japan

Going Micro

Fascinating macro trends, no doubt, but what can individual company events tell us about where the land of the samurai may go next? While the end of the first half is often a quiet time on Wall Street, there are key data points served up by a handful of Japanese firms over the final two weeks of June.

Auto Data Acceleration Ahead

After the Juneteenth holiday weekend, Honda Motor held its annual shareholders’ meeting on Tuesday night, June 20. The automaker then reports June monthly sales on the 30th. It’s not the only car OEM with key data on the horizon, though. Subaru paid a 38 JPY dividend on Thursday, June 22 after its shareholder gathering the day prior. Mazda and Subaru issue interim sales data on the final Friday of June while the former hosts its shareholders’ meeting on Tuesday the 27th. Maybe the biggest data point of all comes from Toyota’s June sales report which also happens on June 30th.

Other Industries Offer Cyclical Clues

Outside of the car industry, broader key sales monthly sales and production figures cross the wires over the coming days:

- June 26: NH Foods Limited (Packaged Foods and Meals)

- June 26: Japan Hotel REIT Investment Corp. (Hotel & Resort REITS)

- June 26: Invincible Investment Corp. (Hotel & Resort REITS)

- June 28: Askul Corporation (Internet Retail)

- June 29: Wacoal Holdings Corp (Apparel, Accessories, and Luxury Goods)

- June 30: Trusco Nakayama Corporation (Industrial Distribution)

The end of H1 also marks many semi-annual dividend pay dates among these companies.

The Bottom Line

Thirty-three years to recapture 33,000 on the Nikkei 225 Index is a catchy summary to grab investors’ attention. After enduring a prolonged period of decline and stagnation, Japanese stocks have experienced a significant rally over the past decade, and large money managers are increasingly allocating funds to Japanese equities, according to one recent survey. Upcoming key events, such as shareholder meetings and sales reports from prominent Japan-domiciled companies, are expected to provide further insights into the direction of the Nikkei and TOPIX as the first half of the year comes to a close.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.