By Andrew Nyquist

By Andrew Nyquist

It’s times like the past two weeks where the tension across America becomes palatable… and the growing disconnect between Wall Street and Main Street glaring. Reminds me of Soul Asylum’s “Misery:”

We could build a factory and make misery

We’ll create the cure; we made the disease

Frustrated, Incorporated

With protests around the world dominating the headlines, the markets chugged 12 percent higher in two weeks. Yes, that’s not a typo. 12 percent in two weeks. All it took was a solid dose of seller’s fatigue and a couple of positive economic data points for the big hedge funds to cover short positions and go long stocks with larger money managers. Surreal is about the only way I can describe it. Not because it was completely unpredictable, but because of how out of sync the rise feels when juxtaposed to the “Occupy” protests going on around the globe.

Welcome to the “new normal.” Dislocated, Incorporated. And for amateur investors, this disconnection between Wall Street and Main Street just adds to the uncertainty amateur investors feel when attempting to navigate the markets. But, that’s where technical analysis and experience come into play. So, let’s attempt to breakdown what’s next for the stock market?

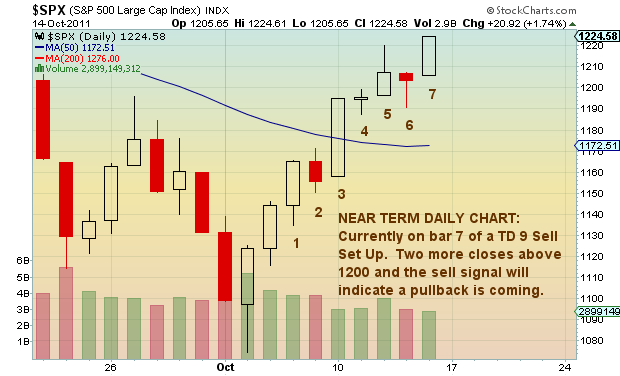

Well after the quick upside run, the S&P 500 is nearing an inflection point. Sometime in the next day or two, the market should reach upside exhaustion and slowly begin the process of retracing some of those gains (see chart 1 below). Furthermore, the market is two days away from registering a TD (Tom Demark) 9 Sell Set Up. This would produce a 1-4 day downside reaction that could spell the beginning of a pullback. Note, though, that if the S&P 500 does not exceed Friday’s high today or tomorrow, it may look to do so before a pullback of any consequence occurs.

And for those that love hypothesizing about where the stock markets may be headed or how this may play out over the near term, see chart 2 below. As long as the market (S&P 500) holds 1160 to 1180, we could see a move that pushes 1300 before year end. But this would mean that Europe offers some decent news about their debt crisis.

No doubt, the final months of the year will be interesting. And disconnected.

———————————————————

Your comments and emails are welcome. Readers can contact me directly at andrew@seeitmarket.com or follow me on Twitter on @andrewnyquist. For current news and updates, be sure to “Like” See It Market on Facebook. Thank you.

No positions in any of the securities mentioned at time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.