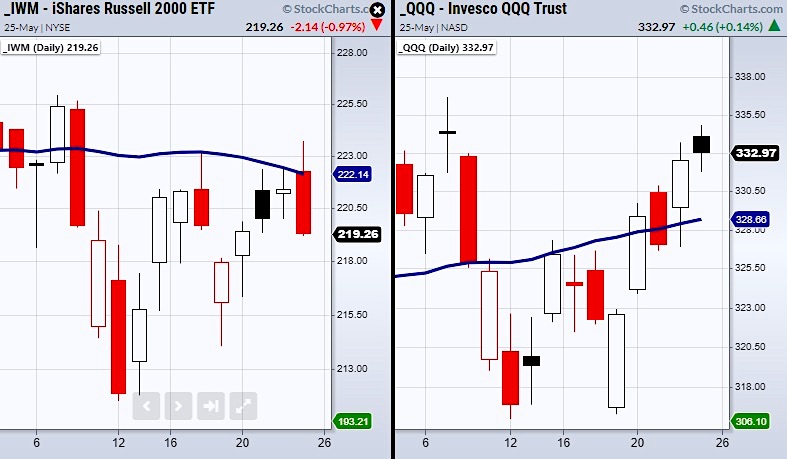

For the third time, the small-cap ETF Russell 2000 (IWM) has failed to clear its 50-Day Moving Average (DMA). And investors should take notice.

It is the last of the 4 major stock market indices to fail to clear this mark. On Monday, the Nasdaq 100 (QQQ) cleared the 50-DMA and held it on Tuesday for a second day. This confirmed its re-entrance into a bullish phase.

The other stock market indices, the S&P 500 (SPY) and the Dow Jones Industrials (DIA), are in bullish phases as well, so this only adds to the importance of IWM joining them and creating a bullish bigger picture. Of failing to do so and creating a divergence.

Representing companies between 300 million to 2 billion, the small-cap index is a vital piece of the market and holds a fair amount of weight in the markets’ price action.

Having said that, the Russell 2000 ETF (IWM) has yet to break back down to recent lows and could make a fourth attempt to clear through resistance around $222.14.

If the contrary takes place and we see a move lower other important sectors to watch include Regional Banking (KRE), Transportation (IYT) Biotech (IBB), and Retail (XRT). Each sector is starting to look heavy and could take IWMs lead.

However, Thursday the Jobless Claims, GDP, and Durable Goods Orders reports will be released at 8:30 AM ET.

If positive, this could be an uplifting event for the market and might be a catalyst for IWMs’ break over resistance at $222.

Stock Market ETFs Analysis and Summary:

S&P 500 (SPY) Resistance 422.82

Russell 2000 (IWM) Support 215. Resistance 222.14.

Dow (DIA) Needs to clear 345.

Nasdaq (QQQ) Confirmed bullish phase with close over 328.66 the 50-DMA.

KRE (Regional Banks) 68.21 support.

SMH (Semiconductors) 242.25 needs to hold as new support.

IYT (Transportation) 267.44 support.

IBB (Biotechnology) 147 support.

XRT (Retail) struggling to hold over 91.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.