The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Earnings season has been better than feared, and we highlight two firms offering differing views on the state of the economy

- There’s also one falling Pharma company that (once again) delayed its Q3 results

- Broadly, our data show solid dividend trends in the face of a possible recession

With the bulk of Q1 earnings season in the rearview mirror, investors have a better sense of where things stand at the macro and company-specific levels. It turns out that firms produced decent per-share profits last quarter despite the dismal economic outlook.

Now with the Fed likely being done with its rate-hike cycle, and lower borrowing costs on the horizon, executives can make capital allocation decisions with a bit more confidence. Still, a recession looms. Current consensus calls for two-quarters of contraction in U.S. real GDP during the back half of 2023. That uneasiness might outweigh the boon that is market interest rates which appear to be stabilizing.

Cha-Cha- (Dividend) Changes

This week, we’ll explore dividend trends seen in Q1 along with highlighting a pair of domestic large caps that have changed their payout policies in light of diverging macro trends. Spotting these micro clues helps traders and money managers get clarity on the bigger picture.

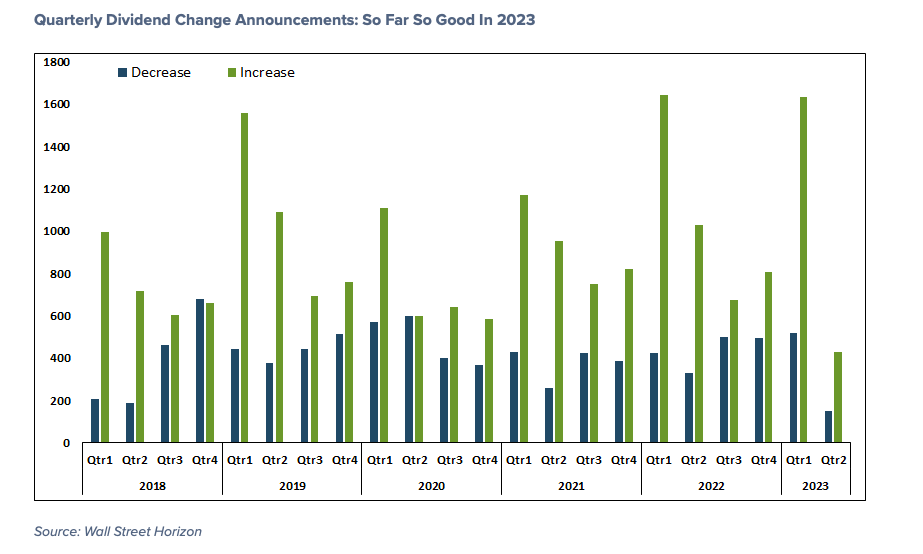

With a coverage universe spanning more than 10,000 companies worldwide, Wall Street Horizon finds that 2023 is off to a decent start from the viewpoint of the number of dividend increases compared to decreases. Illustrated below, the numbers are comparable to what was seen throughout the same period a year ago, but on the 2-year stack and versus 2020, corporate optimism today appears much better – at least according to dividend trends. This is an arrow in the bulls’ quiver amid heightened recession chatter.

Quarterly Dividend Change Announcements: So Far So Good In 2023

Two bellwethers recently had telling dividend policy news: Wynn Resorts (WYNN) and Vornado Realty Trust (VNO). Do you want the good news or the bad news first? Let’s start with the sanguine story.

A Wynn-Win Situation?

Wynn Resorts rolled the dice with its capital allocation plans by resuming a dividend. The casino company reported an operating earnings loss in its Q1 but beat on top-line estimates slightly. As expected, Las Vegas numbers were robust while Macau earnings were soft amid China’s reopening, which is taking a while to gain traction. Wynn issued decent preliminary earnings earlier this year and then backed that up with positive first-quarter results, confirming that Vegas scored record volumes in April.

What catches our eye, and perhaps yield-hungry investors, too, is that the Consumer Discretionary player reinstated its dividend this quarter with a $0.25 payout rate. It’s another clue that services spending is firm domestically. People continue to travel and spend on experiences while goods spending sags. As conference season wanes and family trips ramp up, Wynn appears optimistic about where the economy stands.

The Vornado Tornado

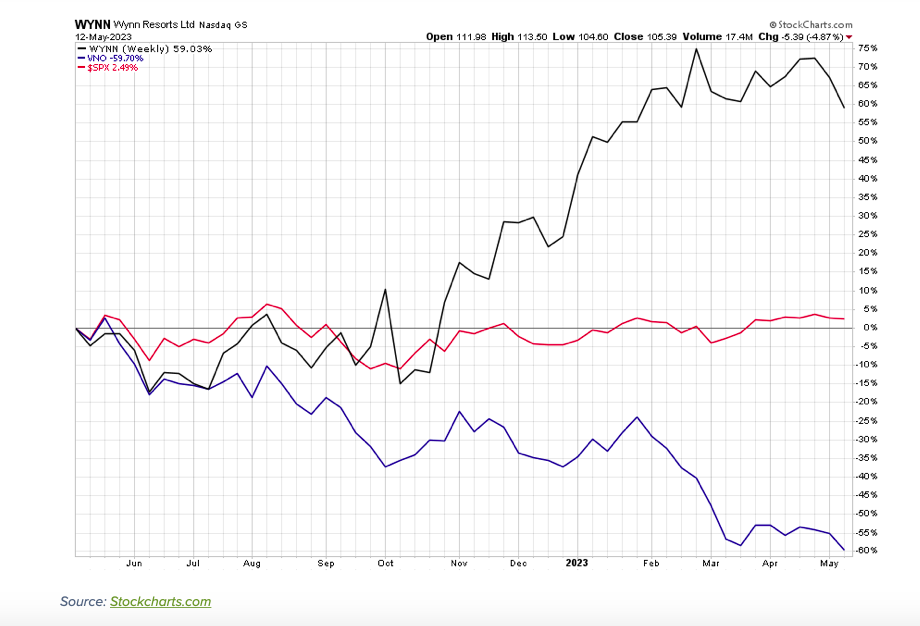

Now it’s time for the bad news. This two-faced economy is tough to figure out much of the time. Vornado Realty Trust (VNO) is a struggling Real Estate sector stock. Leasing activity is downright awful in some parts of the country, particularly in the commercial real estate arena. Still, VNO reported improved office leases in its Q1 report – the first three months of 2023 featured better activity than was seen in all of last year. Sounds like a bright message, but the lights were turned off on both Vornado’s dividend and share buyback program. That cautious move comes after a collapse in the VNO stock price; shares are down 60% from a year ago.

A Bifurcated Stock Market: WYNN Up, Vornado Down, S&P 500 About Unchanged YoY

A Pharma Fumble

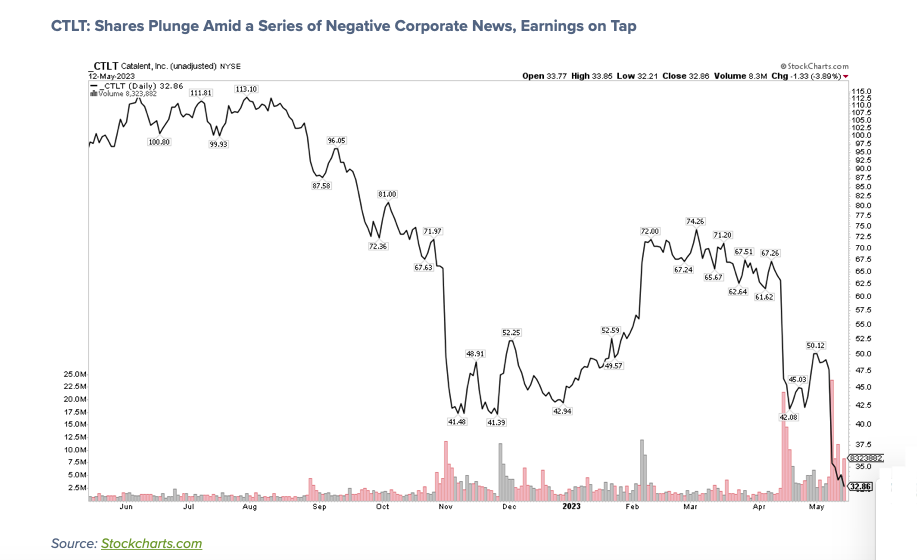

Lastly, let’s diagnose a pharmaceutical industry company within the Health Care sector. Catalent (CTLT) bulls could use some medicine considering shares settled at fresh 52-week lows last Friday. Even more troubling was an earnings delay announcement issued on Friday, too. The firm is still finalizing its financial statements, and the reporting-date pushback comes after it had already delayed the Q1 report from May 9 to May 12.

The latest word is that CTLT will report on Friday, May 19 BMO with an earnings call immediately after the numbers cross the wires. Keep CTLT on your radar for negative numbers or news to be reported Friday morning.

The stock plunged back on April 14 after it voiced cost and productivity problems along with naming a new CFO. Then came a slew of downgrades, adding insults to injury. What’s more, Danaher said it was no longer pursuing Catalent, though those talks appear ongoing according to market chatter. The hits kept on coming – CTLT canceled plans to present at a June industry conference before a very negative guidance change on May 8. It doesn’t get more bearish than this, so expect volatility as Friday’s earnings date approaches. And oh, by the way, Friday is options expiration.

CTLT: Shares Plunge Amid a Series of Negative Corporate News, Earnings on Tap

The Bottom Line

Bulls and bears have plenty of narratives from which to choose. Dividend trends are hanging in there, but it feels like a winner-take-all environment with a handful of industries thriving while many brace for a possible recession later this year. Travel spending continues to soar while REITs suggest there is no end to the commercial real estate woes any time soon.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.