The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Next week, third quarter earnings season begins, so we wanted to take an early look at who’s on the docket for October earnings.

Kick-Off: The Big Banks – October 10 – 14

As usual, the season kicks off with reports from the big banks, JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC) and Morgan Stanley (MS) report on Friday, October 14, followed by Bank of America (BAC) on Monday, October 17 and Goldman Sachs on Tuesday, October 18. These are all confirmed dates as banks tend to confirm all future earnings dates on their Q4 call from the prior year, one of the few industries to do this.

Other notable names reporting this week include PepsiCo (PEP) on October 11, and Delta (DAL), BlackRock (BLK), Walgreens (WBA) and Taiwan Semiconductor Manufacturing (TSM) on Thursday, Oct 13.

Week 2: Banks, Airlines and Netflix, Tesla and IBM – October 17 – 21

Week two we hear from more financials and get into other sectors such as industrials as a number of airlines report this week: United (UAL) on October 18 and American Airlines (AAL) and Alaska Airlines (ALK) on October 20. We’re also anticipating results from some cult favorites such as Netflix (NFLX) on October 18 and Tesla (TSLA) on October 19. This comes on the heels of Tesla’s Production & Deliveries report on October 2, which showed that while third-quarter vehicle deliveries hit a record high, they still fell short of analyst expectations, driving the stock lower during Monday’s trading.

Peak Begins: Nearly 2,000 Companies Expected to Report – October 24 – 29

Peak season begins the week of October 24 with 1,897 global companies (from our universe of 10,000 publicly traded companies) expected to release results. The focus this week will be on big tech, with Alphabet (GOOGL) and Microsoft (MSFT) reporting on October 25 and Amazon (AMZN) and Intel (INTC) out on October 27.

Other notable names reporting this week include more from the tech sector: Twilio (TWLO), Spotify (SPOT), Twitter (TWTR), eBay (EBAY), Shopify (SHOP) and Zendesk (ZEN). We’ll also hear from industrials bellwethers Caterpillar (CAT) and Boeing (BA), and start to get a read on the energy sector with Exxon Mobil (XOM) and Chevron (CVX) out on Friday, October 28.

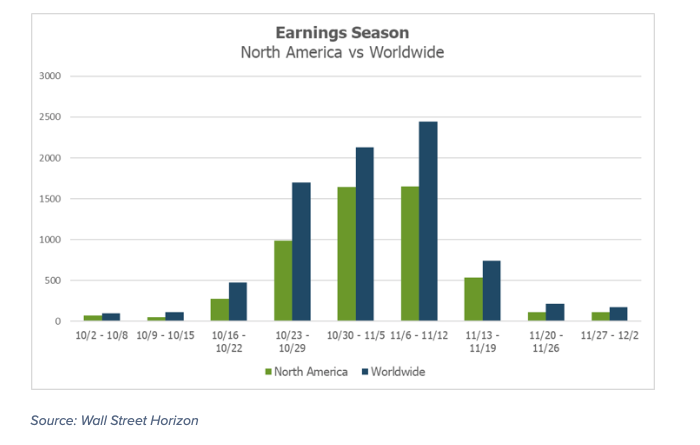

Q3 2022 Earnings Wave

This season peak weeks will fall between October 24 – November 11, with November 3 predicted to be the most active day with 1,023 companies anticipated to report. Only 28% of companies have confirmed at this point (out of our universe of 10,000 global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.