The S&P 500 Index (INDEXSP:.INX) and Dow Jone Industrial Average (INDEXDJX:.DJI) enjoyed marginal gains last week but are off to a big start this week.

Outside of the large-cap averages (small caps, mid caps, tech, transports, etc), the gains have been very impressive given that they are occurring against a difficult geopolitical and economic backdrop.

Last week’s performance (and into this week) suggests that much of the disappointing news on the economy and overseas was already baked into current prices. Moreover, the move higher may suggest that the consolidation/correction phase has run its course.

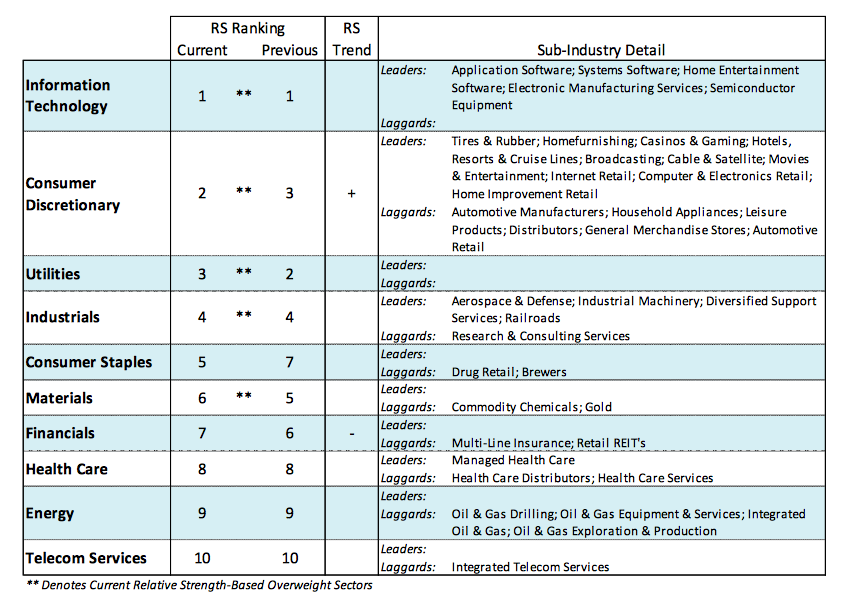

Confirmation of this would require a trading session where upside volume exceeds downside volume by a ratio of 10-to-1 or more. This would indicate that stock market momentum has shifted to the upside and likely result in a full test of the March 1 high of 2401 using the S&P 500 and Dow 21200. Entering the new week, the upside is supported by a flood of first-quarter earnings reports and the potential for some movement on tax reform. The areas of the market that are anticipated to outperform include information technology, consumer discretionary and industrials.

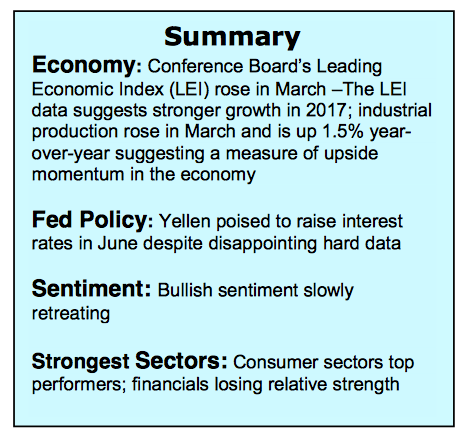

Here’s a summary of the financial markets:

Following eight weeks of sidewise movement in the stock market the technical indicators remain short of issuing a buy signal. Typically, a sustainable rally is preceded by an oversold condition with investor pessimism excessive and widespread. Even though stocks are nearly two months off the record highs, 67% of NYSE issues remain above their 10-week moving average and 70% above their 30-week average. The fact that 70% of NYSE issues remain above their 30-week moving average suggests the long-term trend remains bullish. We would need to see the percentage of stocks trading above their 10-week moving averages to fall below 40% to suggest the market is oversold.

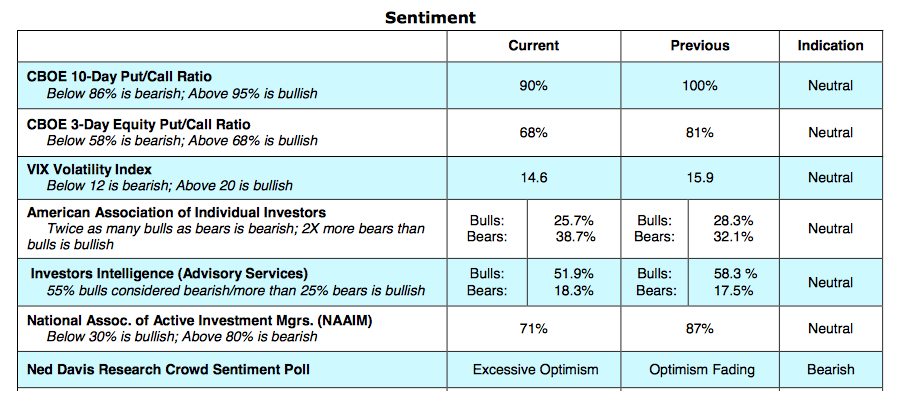

Sentiment indicators are moving in the right direction but remain a distance from offering an outright buy signal. There is an inverse relationship between sentiment and liquidity. Widespread pessimism would be an early indication that sufficient cash levels have been built to support more than a trading rally. The latest report from Investors Intelligence (II), which tracks the opinion of Wall Street letter writers, shows a drop in bulls last week to 51%. This is considered a neutral reading. This valuable indicator would shift to bullish should the percentage of bulls fall below 45%. This would complement the pessimism seen in the latest survey from the American Association of Individual Investors (AAII) which shows more bears than bulls.

Thanks for reading.