The stock market was down sharply on Thursday after Federal Reserve Chairman Powell’s press conference stating concerns over high unemployment and projecting the road to economic recovery will be long.

There was also news of isolated outbreaks of the COVID-19 in states that have re-opened their economies.

From a technical perspective, the markets were vulnerable to a pullback given the unprecedented 45% recovery from the March 23 lows and signs of excesses in the market in some areas.

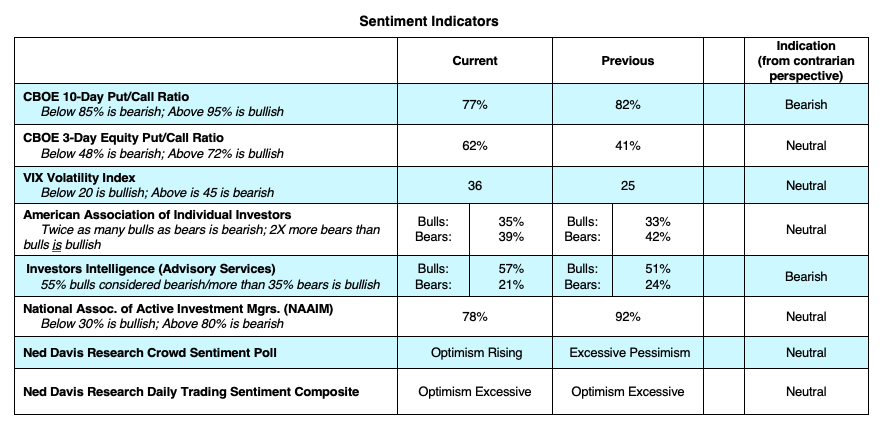

The sell-off last week helped relieve a severely overbought condition in stocks and also helped to soften investor sentiment indicators that showed extreme optimism had entered the market.

However, optimism is still evident in the Chicago Board Options Exchange data that shows a continued record number of call buyers.

The Volatility Index (VIX), the Investors Intelligence survey (II) which shows twice as many bulls as bears, the National Association of Active Investment Managers (NAAIM) and the Ned Davis Daily Sentiment Composite show a return to neutral from excessive optimism.

A surprising jobs number in May indicates the start of a recovery. The employment numbers will likely improve in June because more businesses are opening up. Next week we will have data on May retail sales, industrial production, building permits and housing starts. All are projected to show a small uptick in economic activity.

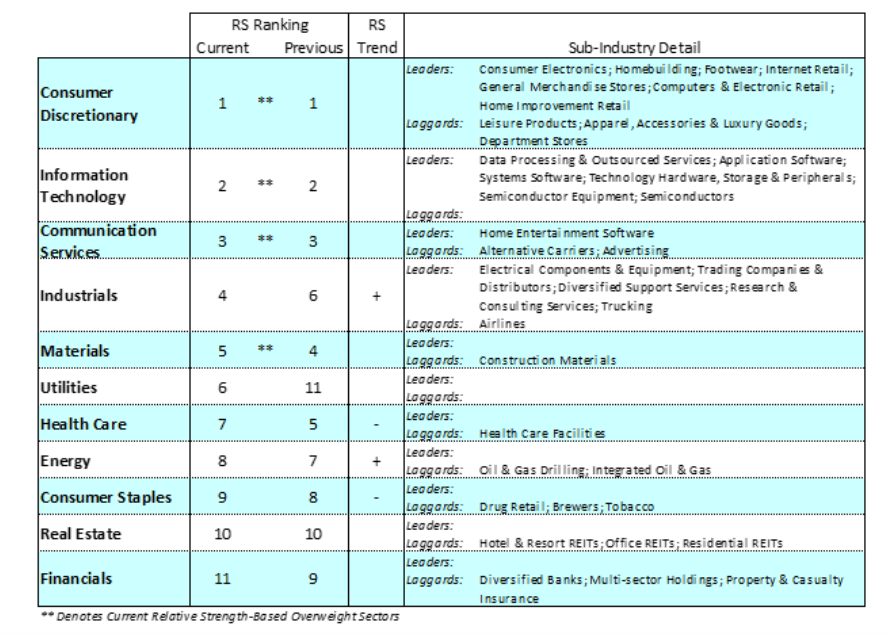

It is the expectation of an economic recovery that moves cyclical sectors such as financials, industrials and energy which are more closely tied to the economy, into positions of leadership in the market. Federal Reserve Chairman Powell said on Thursday that he plans to keep interest rates low for the next several years, into 2023. Keeping bond yields low is a very stimulative monetary policy, encourages risk appetite and is a positive for cyclicals.

Three things need to happen in order for the market to resume its upward trajectory: positive news on the economy, positive news on treatments for the virus, and continued fiscal and monetary support.

The number-one potential roadblock is whether we have an outbreak of the virus in the coming months. Should we have an outbreak, it is unlikely that we will experience the national lockdowns that we have suffered through over the past 2 l/2 months. We have a better understanding of this pandemic and are in a better position to handle the problems.

There is still uncertainty as far as the path of the virus and the economic outcome. There is a tendency to sell when the market pulls back and to buy during rallies. It’s important not to react to wide swings but to stay invested and to have a plan. We like cyclical sectors, such as industrials and materials, small- and mid-cap stocks, and suggest having a portion of investable funds in cash to be available to take advantage of corrections in the market.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.