The S&P 500 Index (INDEXSP:.INX), Dow Jones Industrial Average (INDEXDJX:.DJI) and the NASDAQ Composite (INDEXNASDAQ:.IXIC) all hit new all- time record highs last week. The gains for the week were small as the economic data and second-quarter corporate earnings offered mixed signals.

Stock Market Update – A Snapshot of the Fundamental & Technical Backdrop

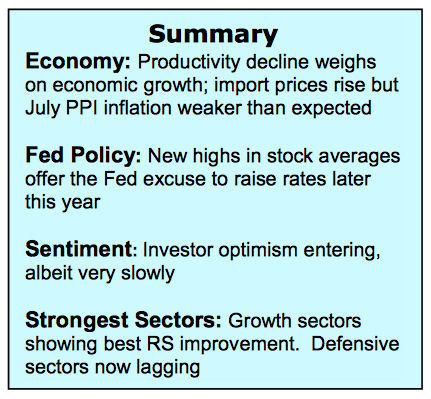

Support for the stock market continues to be from the central banks as interest rates remain at record lows for all developed economies. Expectations that the Federal Reserve would raise interest rates at the September meeting were further dampened by the latest economic reports. Retail sales were weak in July, wholesale inflation for the month was softer than expected and U.S. productivity declined for the third year in a row.

Although the stock market could continue to trade in a narrow range, the larger picture suggests higher. Concerns over the potential negative impact globally of the UK exiting the EU are receding, there is evidence that the worst for corporate profits is in the books and the global economy appears to have stabilized. The next short-term hurdle for stocks is the headwind often experienced in the September/October time frame, the odds of which are elevated by the election-year cycle which historically shows stocks hesitate the two months in front of the election. Any weakness that could develop in front of November 8 is anticipated to be followed by a post-election rally.

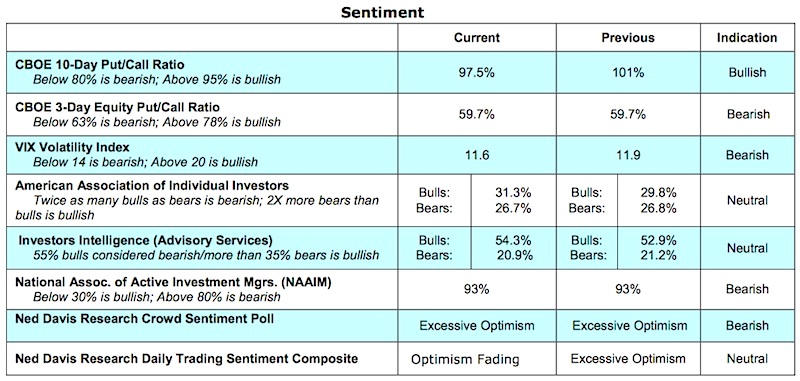

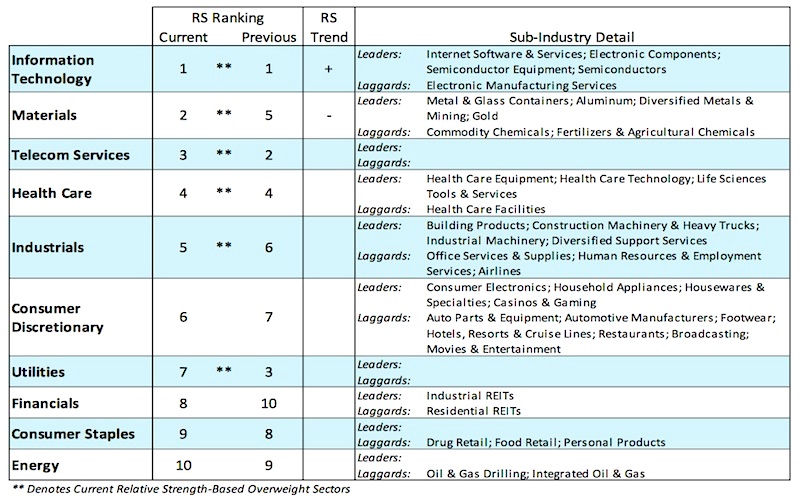

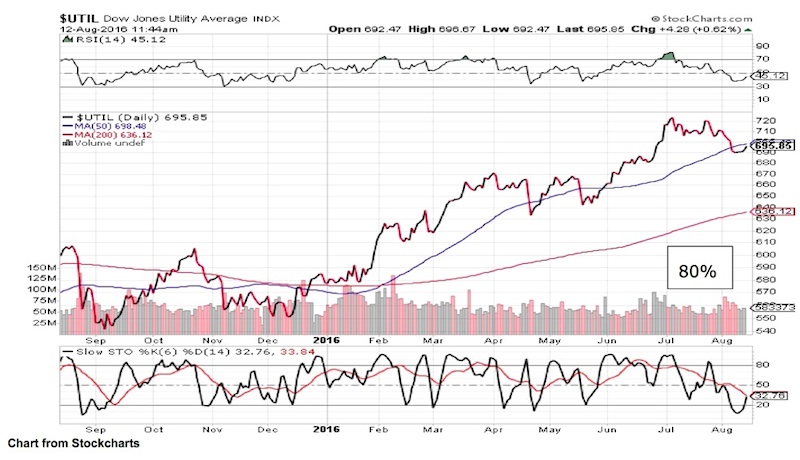

Entering the new week, stocks face the tail end of earnings season with potential market-moving reports from important technology and retail companies. The weight of the technical evidence supports the bullish case entering the second half of August. The July/August rally to new highs following a long consolidation period (18 months) has produced a new bullish uptrend. Although momentum has stalled, recent bouts of weakness have failed to dislodge the bullish trend. The most recent sentiment data show a modest drift toward more optimism but a distance from extreme readings found near market peaks and suggesting that sufficient liquidity remains to push stocks higher. Market leadership has been clearly taken over by growth sectors as defensive areas of the market lose relative strength. The transition from defensive to offensive leadership historically has been a bullish signal. The strongest sectors are information technology, materials, health care and industrials. The financials continue to lag the market in 2016. Improvement in bank earnings requires loan growth to expand and wider spreads that a rise in interest rates would provide. As a result, we continue recommend underweighting this sector.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.