The post-election stock market rally persisted last week catapulting the popular averages to new record highs. Stocks are benefiting from a new-found investor optimism. This increase in confidence is built around the idea that a business-friendly administration will allow the U.S. economy to break out from the chronic slow growth experienced the past several years.

Small cap stocks continue to outpace large caps with the Russell 2000 Index (INDEXRUSSELL:RUT) climbing 2.77% last week. Small-cap indices have soared nearly 16% since November 8. I wrote about small cap leadership early last week.

Economic Factors

The outperformance by small cap stocks is anticipated to continue as this group benefits the most from lower corporate tax rates and stronger economic growth. Although the current rally has pushed stocks into an overbought condition, any weakness that could develop is expected to be limited since investors will be reluctant to take gains in December due to tax considerations. This creates a favorable supply/demand balance that could be more pervasive this year as investors look forward to potentially lower capital gains taxes in 2017. The focus of attention this week will be on Thursday’s November ISM Manufacturing Report (PMI) that is anticipated to show a modest gain. Friday’s Employment Report is expected to show the economy generated 175,000 new jobs in November. The economic data is not expected to alter the odds of a 93.5% likelihood of a December interest rate hike, as projected by the fed funds futures market.

Stock Market Indicators & Outlook

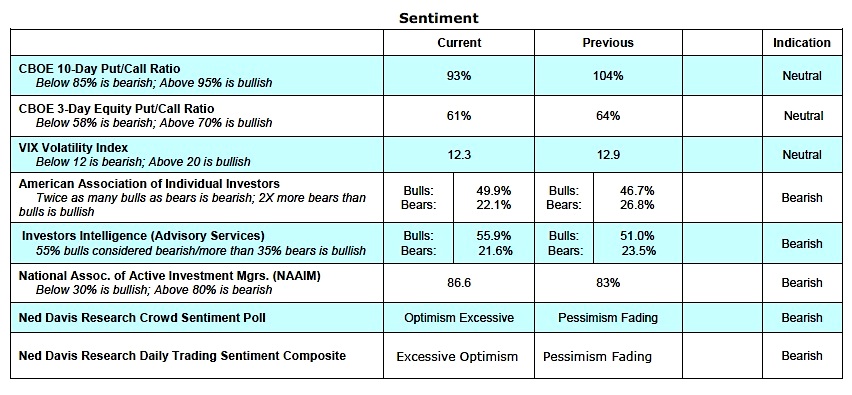

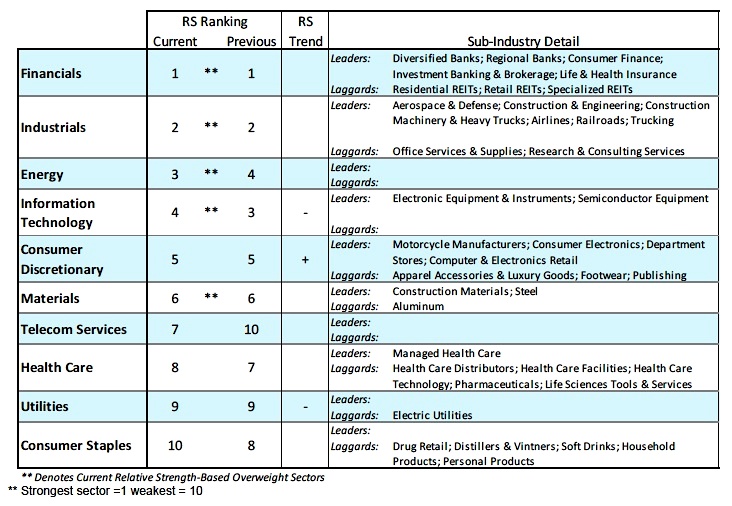

Given that stock market breadth is improving and a Fed rate hike is likely already built into current prices, the largest threat to the post-election rally is for investor optimism to become excessive. Indicators that measure investor psychology including the survey from the American Association of Individual Investors (AAII), Investors Intelligence (II) and the National Association of Active Investment Managers show sentiment has moved from pessimism prior to the election to widespread optimism. The sentiment numbers are inhibited from triggering a short-term alert by the data published by the Chicago Board of Options Exchange (CBOE) that continues to show pockets of pessimism. Additionally, adjustments should be made to factor in that investor optimism historically runs higher in December as many look forward to a new beginning in the upcoming year. Seasonally, December is the strongest month of the year for stocks but given the huge rally in November, gains could be tempered in 2016.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.