Stock Market Outlook

The Labor Department reported last week that the U.S. economy added 266,000 new jobs in November, well above the 188,000 that economists had expected and provided the markets with another boost.

The unemployment rate dipped to 3.5% and average hourly wages ticked up. The jobs data underscores the strength of the consumer and the U.S. economy.

The markets this year have been resilient in the face of trade concerns and slower global growth.

The factors that have driven and should continue to drive the markets in 2020 are the strength of the consumer, monetary policy, trade and the global economy.

Eyes will continue to be on U.S.-China trade talks…

Economy and the Strength of the Consumer

Robust job growth, rising wages, and lower interest rates should continue to support the consumer. In addition to the above-mentioned jobs numbers, the University of Michigan’s Consumer Sentiment Index edged up in December to the highest level in six months suggesting consumers are optimistic for both current and future economic conditions.

The good news, however, is offset by the Conference Board Leading Economic Index (LEI) which declined for the third month in a row indicating the economy will end on a weaker note. Additionally, the ISM Manufacturing Index fell in November to the second-lowest reading since early in 2016 and the fourth consecutive month below 50 (a reading below 50 indicates contraction).

While it is very hard to see a recession within the next 12 months with record-low unemployment and rising wages, the weak manufacturing sector and geopolitical uncertainty suggest the economy will remain in a slow-growth mode with most economists forecasting 1.80% GDP for 2020.

Monetary Policy

The Federal Reserve Open Market Committee meets this week and is widely anticipated to keep the fed funds level at 1.50% to 1.75%. Fed Chair Jerome Powell is on record indicating that monetary policy is now on hold with future moves subject to fresh incoming data. The Federal Reserve raised its fed funds target rate four times in 2018. The final increase in December last year sent stocks spiraling downward. This year the Federal Reserve has cut its fed funds target rate three times. As a result, economic prospects have improved and stocks have fully recovered from the 2018 experience.

Additionally, the global economy appears to be stabilizing. This is important as the Fed’s concern has been that the weakness in overseas economies could bleed into the U.S. The fact that global PMI data improved for the fourth consecutive month in November suggests the global economy is stabilizing. Given the strengthening PMI numbers, easy global monetary policy and improving trade prospects, evidence is building that the global economy may be bottoming, and could return to modest growth in 2020.

Trade

On Friday when the jobs numbers were announced, investors sent the stock market averages close to the record highs, largely ignoring the news from the White House that the phase one trade deal with China may be delayed until early next year. It’s apparent that the large issues between the U.S. and China, such as intellectual property theft and forced joint ventures, are not going to be resolved in the foreseeable future.

More importantly, the United States Mexico Canada Agreement (USMCA) could soon be passed by Congress. This agreement will benefit all 50 states from Wisconsin dairy farmers who will have access to Canadian markets to Detroit auto manufacturers where it will be required that 75% of auto parts be built in North America, preventing offshoring of our auto industry, and much more.

The Bottom Line

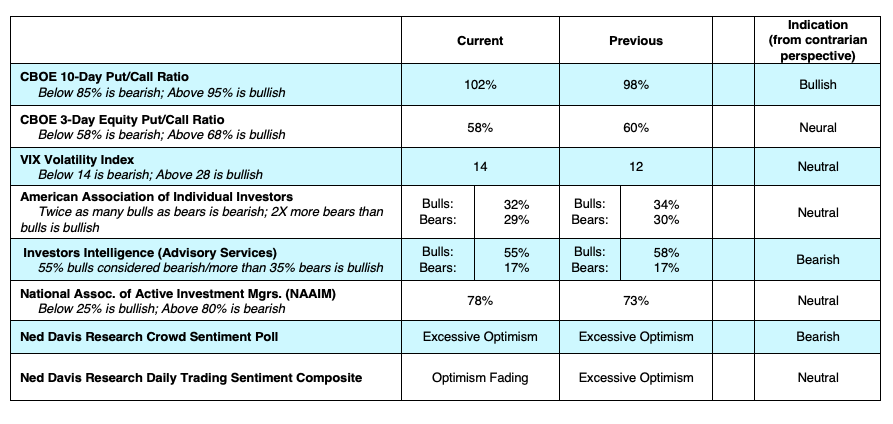

This is the 11th year of an economic cycle with slower growth expectations on the horizon and with investor sentiment optimistic (a contrarian indicator), we are advising investors to diversify and to look at the long view. But all expectations are that the consumer will remain economically healthy and the Federal Reserve will remain accommodative suggesting moderate but positive returns on the S&P 500.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.