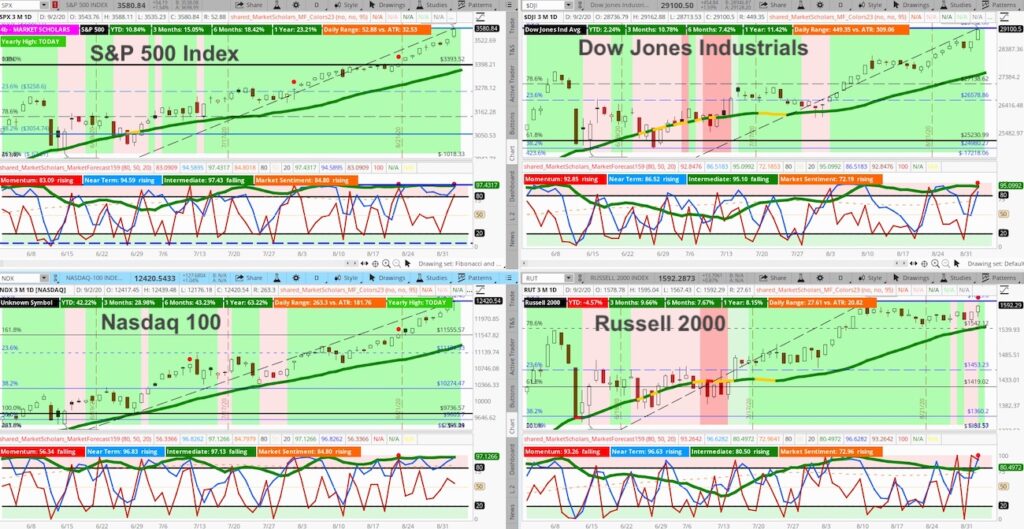

The Market Forecast indicator is showing overbought clusters on all the major stock market indexes.

In fact, the S&P 500 Index’s cluster includes the long-term Market Sentiment.

This means that oscillators that span four different timeframes – from very short term to long term – are closing above their respective 80th percentiles.

Multiple indicators are showing extreme mature trends, including the DMI and RSI.

The long-term momentum is higher on the S&P 500 Index than any other point in the past 20 years. In the past, stocks have struggled to achieve substantive returns when reaching the weekly Percent Price Oscillator reaches these levels.

Volatility has been rising on an absolute basis but not on a relative basis compared to long-term levels or historical levels. This suggests when we do get a volatility spike, the VIX Volatility Index may jump to a higher level than previously thought – especially with extreme levels on the SKEW Index.

Stock Market Outlook Video – September 2, 2020

Long-term bonds are rallying this week in addition to volatility, which is another concerning sign for the mature market. Gold and bonds remains elevated on long-term charts. This pattern suggests that while this run may end soon with an uncomfortable “exhale”-type move, there’s plenty of bullish long-term potential left.

Technology, Consumer Discretionary and Communication Services continue to mask broader weak growth in cyclical and economic-growth sensitive sectors – even as multiple sectors show overbought clusters on their own Market Forecast charts.

Get market insights, stock trading ideas, and educational instruction over at the Market Scholars website.

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.