The stock market continues to balance concerns about the sustainability of the economic rebound as COVID-19 cases surge versus more good news on treatments and vaccines for the virus.

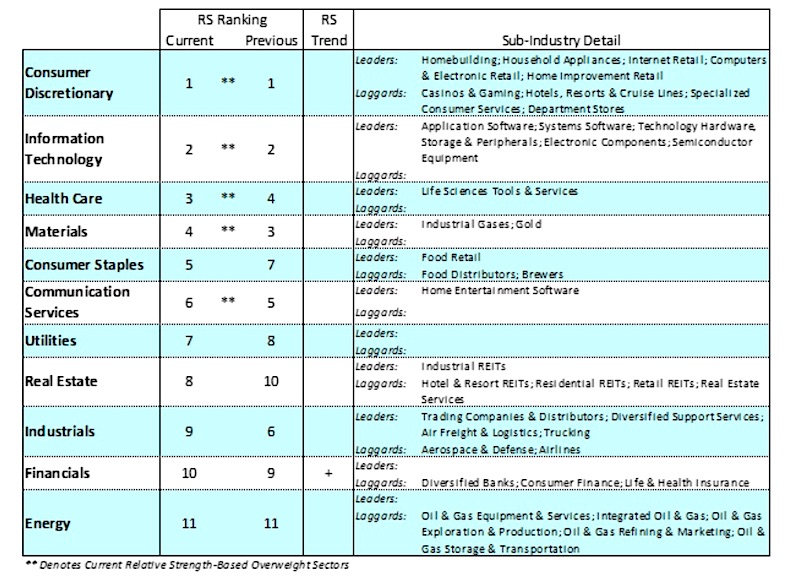

Information technology was the best performing sector of the S&P 500 increasing by 5% last week.

Gold continues to trade at all-time highs, around $2,000/ounce, due in part to economic and geopolitical concerns as well as the path of the virus and the resulting falling U.S. dollar.

Government bonds have been the traditional safe haven but with yields near zero, gold has come to the forefront as the safe haven asset of choice.

U.S. gross domestic product for the second quarter showed the largest quarterly drop on record.

This was old news, and since then we have seen a May/June rebound in economic activity in employment, payrolls, industrial production, capital goods, motor vehicles, housing and retail sales which is almost back to pre-virus levels.

However, we are seeing that the resurgence of the virus in some areas of the country is having an impact on consumer confidence and spending as evidenced by various tracking indicators of economic health like credit card spending, air travel, and restaurant reservations which point to a slowdown in the economy.

Also, the Labor Department reported that initial jobless claims filed last week were higher for the second week in a row.

We believe that based on the May and June economic data, that we are in a recovery but expect to see a slowdown due to the virus resurgence. Once the data on the virus improves, consumers will feel more confident and spending should return.

The Federal Open Market Committee has vowed to keep rates low and to use all their tools to support the markets until the U.S. economy recovers from the economic damage caused by the virus. In all likelihood, Congress will pass a fifth COVID relief plan this week with the continuation of full unemployment benefits and additional stimulus checks.

Tensions continue to escalate between the United States and the Chinese Communist Party over the coronavirus, human rights abuses in China, the closing of consulates and Hong Kong. Last week President Trump dropped the hammer on Tik Tok, the Chinese social media platform which is very popular among American teens. Tik Tok is half-owned by the Chinese Communist Party and we have seen evidence of the use of this app to spy on Americans. Efforts are in the works to ban Tik Tok from the United States.

Technical Analysis – Stock Market

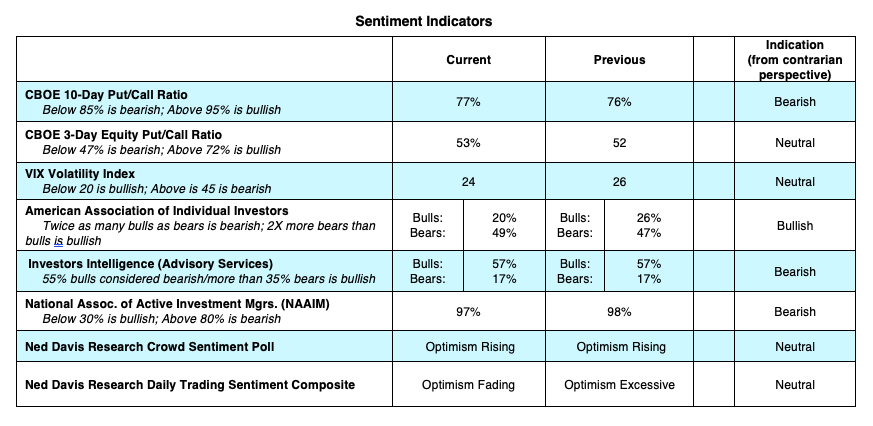

Investor sentiment argues for near-term caution. The majority of the sentiment indicators we follow point to investor optimism approaching an extreme. The Chicago Board of Options Exchange (CBOE) data shows call option buying far outpacing put buying. Investors Intelligence (II) data shows nearly four times as many bulls than bears among the advisory services.

Excessive optimism can also be found in the most recent report from the National Association of Active Investment Managers that shows a near 100% commitment to stocks. Also, NASDAQ volume relative to NYSE volume has soared to a record high. From a contrarian standpoint, the sentiment indicators suggest near-term caution.

Rallies in the market have narrowed and continue to be dominated by the five large technology companies that make up 23% of the S&P 500 Index. Should one or more of those companies stumble, the market would be impacted. Additionally, market breadth has deteriorated as the percentage of S&P 500 stocks trading above their 200-day moving average has fallen to 54% from 68% at the June peak.

Bottom Line: A near-term slowdown in the economy and stock market technical data both suggest short-term caution. However, the economy is steadily improving. We will see continuing monetary and fiscal stimulus and the Federal Reserve has pledged to keep rates low which bodes well for housing, capital spending and the stock market.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.