THE BIG PICTURE

Ok everyone…just breathe.

Between daily White House press conferences and earnings season, traders seem to have their hands full. However, between each and every one of these moments, I really cannot say that much is going on in the price action.

I can’t remember the last time I have watched a range bar not move for almost two hours. If you enjoy watching paint dry or grass grow, we are in your kind of market. That said, pretty much every day offers up some sort of micro trend for day traders like myself… but it still has us asking “where is this market headed next? And it’s hard with all the permabears consistently pointing to the sky is falling.

So what precaution can we take on the long term while still looking for opportunities to trade this week?

First, let’s expect continued news and sound bites from Washington that may send mini-ripples throughout the market on any given day. Next up, part two of our F.A.N.G. stocks may be a catalyst for the Nasdaq (INDEXNASDAQ:.IXIC). Last week’s earnings gave the Nasdaq futures (NQ) enough stamina to remain at the highs. We also close out the month with the FOMC announcement and money managers balancing their mega portfolios.

Now that the Dow Jones Industrials hit 20K (and S&P 500 hit 2300) and markets seem to be content at these levels without any sign of a serious pullback (yet), my concern is over the buildup of bearish sentiment in the market and permabear influence. All it will take is one “not so good” news bit and the cascade is initiated (keep an eye on the WH admin travel ban and China military provocations). Permabears will then inform you that they told you so. Until then, daily observations of the intraday trend are relentless in picking up off the lows and bringing back into value. Technical signs for me of a market not ready to let the “bears” out to play.

As a crumb trader you are at the whim of using your intraday technical charts to leave emotion aside and be ready for the market to move in either direction. Precautions may include moving stops up and watching internals as in the ADX or the MML levels on multiple time frames. So is this the opportune time to short the market indices?

Technical momentum probability still points to higher but “with caution” on the bigger picture (in my humble opinion). I state with caution as seen in the charts below we are at a technical momentum decision time based on my strategy that puts price action in a stall at the highs.

Note that you can also view my market outlook for ES, YM, and NQ on YouTube.

Attempting to determine which way a market will go on any given day is merely a guess in which some will get it right and some will get it wrong. Being prepared in either direction intraday for the strongest probable trend is by plotting your longer term charts and utilizing an indicator of choice on the lower time frame to identify the setup and remaining in the trade that much longer. Any chart posted here is merely a snapshot of current technical momentum and not indicative of where price may lead forward.

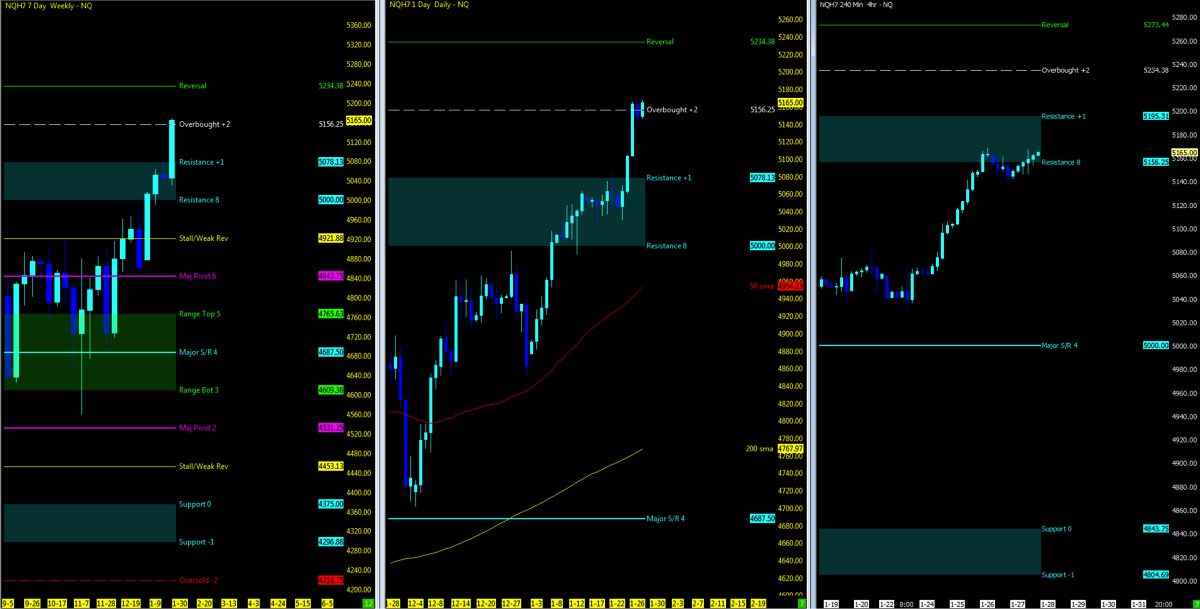

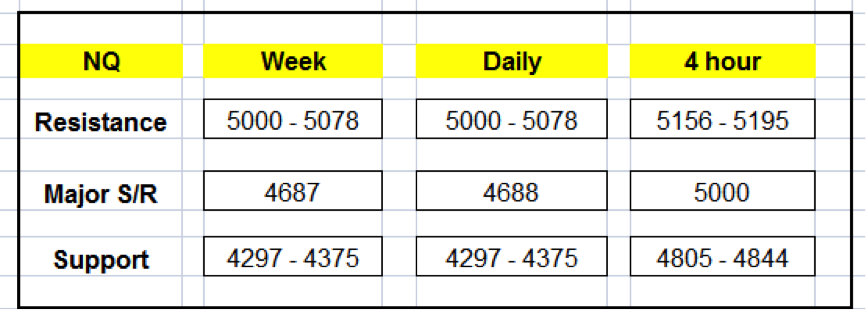

NQ – Nasdaq Futures

Technical Momentum: UPTREND

Using the Murray Math Level (MML) charts on higher time frames can be a useful market internal tool as price action moves amongst fractal levels from hourly to daily charts. Confluence of levels may be levels of support/resistance or opportunities for a breakout move.

CHARTS: Weekly, Daily; 4hour

MML Levels (NQ)

Nearest Open Daily Gap: 5104

Lowest Open Gap: 4017

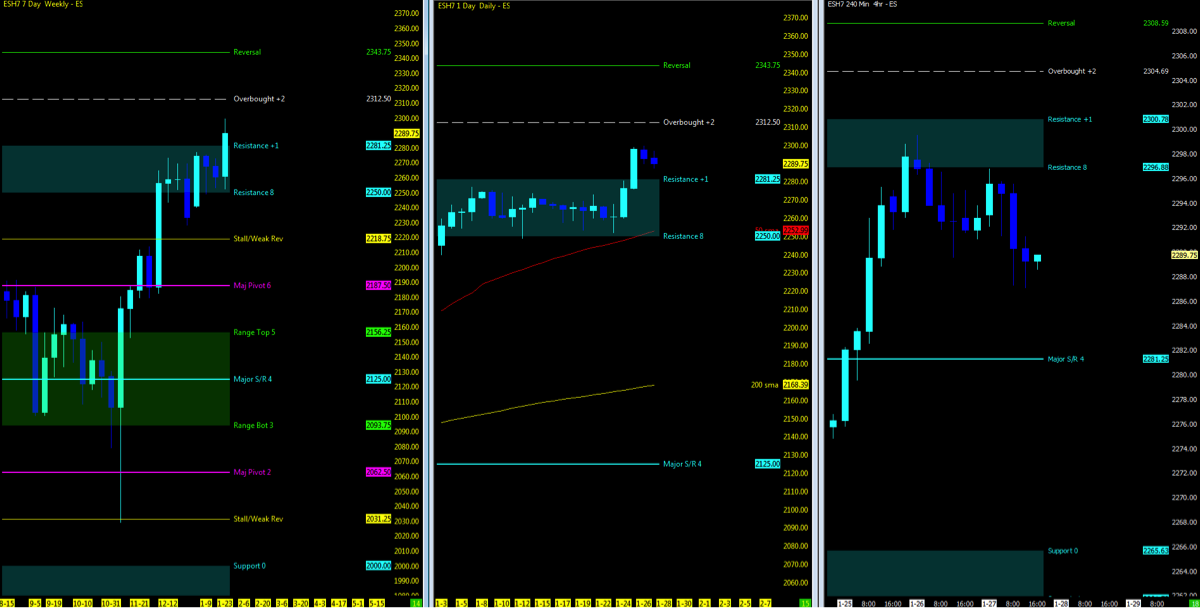

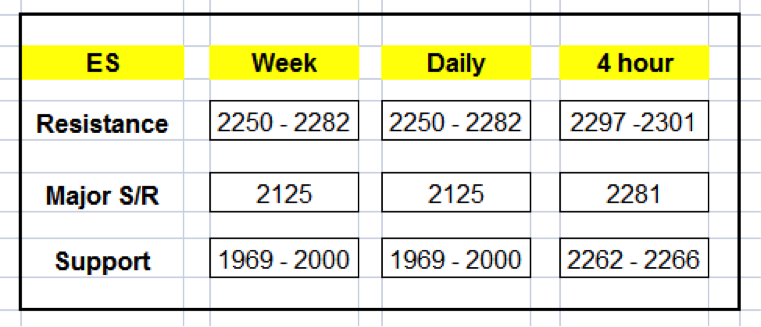

ES – S&P Futures

Technical Momentum: UPTREND

CHARTS: Weekly, Daily; 4hour

MML Levels (ES)

Nearest Open Daily Gap: 2280.5

Lowest Open Gap: 1860.75

Thanks for reading and remember to always use a stop at/around key technical trend levels.

Twitter: @TradingFibz

The author trades futures intraday and may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.