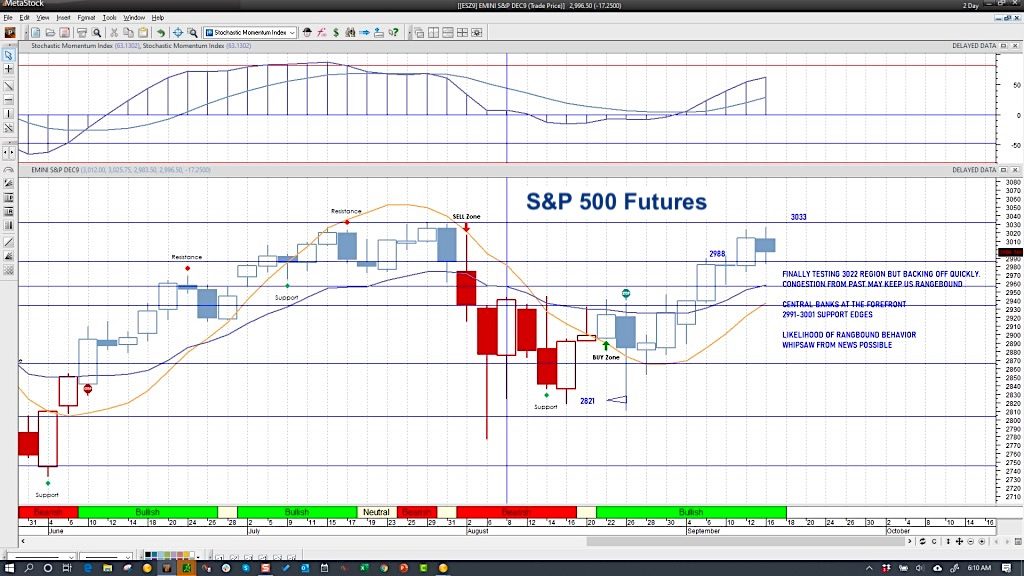

S&P 500 Futures Trading Chart Analysis – September 16

MARKET COMMENTARY

Drone attacks on Saudi Arabia’s Aramco are hitting world futures markets as the Saudis look to protect the biggest bit of business on their soil.

Other news to watch this week includes the FOMC release on the horizon tomorrow, Brexit chatter, and continued Hong Kong unrest.

We are seeing an early gap down on S&P 500 futures that has recovered from the bottom but stalled out at congestion levels. I suspect cautious traders expecting news.

WEEKLY PRICE ACTION

Support on the S&P 500 (SPX) holds near last week’s levels – 2984 -with 2991 above that. We are vulnerable to lose these levels currently but deep dips will still bring buyers.

If we look at bigger pictures, all the watched indices are still in breakout formations. Reversal zones at the upper edges near 3017 to 3025.

Weekly charts continue to show flattening momentum but we hold above major moving averages.

COMMODITY & CURRENCY WATCH

Gold prices bounces off 1500 with the drone attacks in a risk off event – but should still run into trouble above in the current negative trend near 1516 as resistance. The sweet spot still sits between 1478 to 1447 for deep support. So far, however, 1498 seems to be strong support.

Currency chatter remains in play with the dollar holding its upside above 98. WTI is in massive breakout mode with bounces right into our blog image highs of 63.3 and holding over 60 as Aramco says they will have trouble coming back online.

TRADING VIEW & ACTION PLAN

Breakout in progress and we have been given deeper pullbacks to engage- so we expect participation here. Some whipsaw action should be here as we wait on the Sept 17 meeting from the Fed. Follow the trend in the shorter time frames and watch the price action. That is POSITIVE AS LONG AS WE HOLD ABOVE 2987 today. Do what’s working and watch for weakness of trend. Please log in for the definitive levels of engagement today

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.