The equity markets continue in an extraordinary tight trading range that has the Dow Jones Industrials (INDEXDJX:.DJI) and S&P 500 Index (INDEXSP:.INX) virtually unchanged since mid-December.

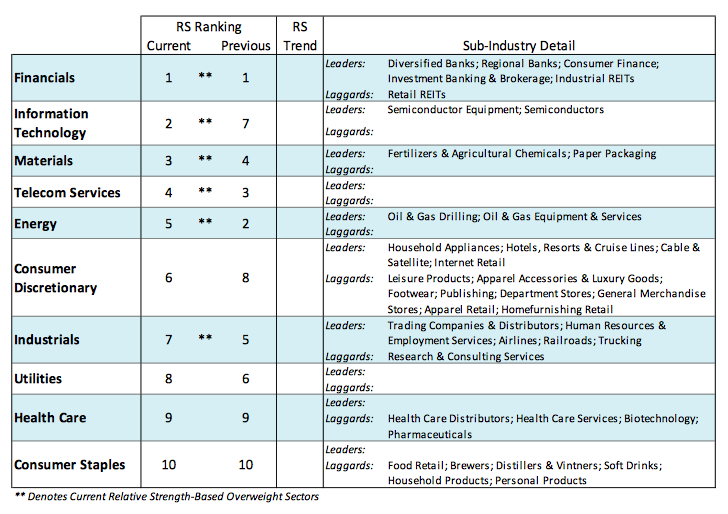

The lack of forward progress can be traced to valuations that are above historic norms during a period when support for the market is transitioning from monetary to fiscal policy. Thus, the focus is now more heavily weighted on economic and earnings growth.

Consensus estimates are that U.S. GDP will reach 2.5% in 2017 versus 1.6% last year. This appears achievable given the surge in consumer and business optimism and the prospects for tax and regulation reform. Additionally, the global economy is finding traction thereby reducing the threat of recession that could be an added stimulant that would encourage growth at home.

Fourth-quarter corporate earnings are beginning to trickle in with forecasts of 3.0% growth for S&P 500 companies. Considering the aggressive buyback programs the past five years, income statements are highly leveraged. This suggests that improving top-line growth would be magnified on the bottom line which would translate into an important assist in overcoming stock market valuation concerns. Although stocks remain vulnerable to near-term weakness (i.e. an S&P 500 pullback), the longer-term primary trend for stocks remains decidedly bullish. Technical support for the S&P 500 is near 2180 to 2220.

The technical indicators for the stock market are mixed. The overbought condition following the Trump rally has been replaced with the sidewise movement in the Dow Industrials and S&P 500 Indices.

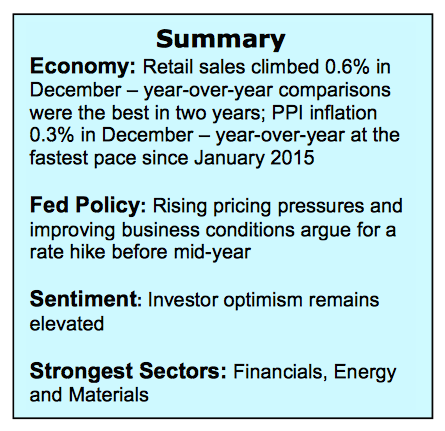

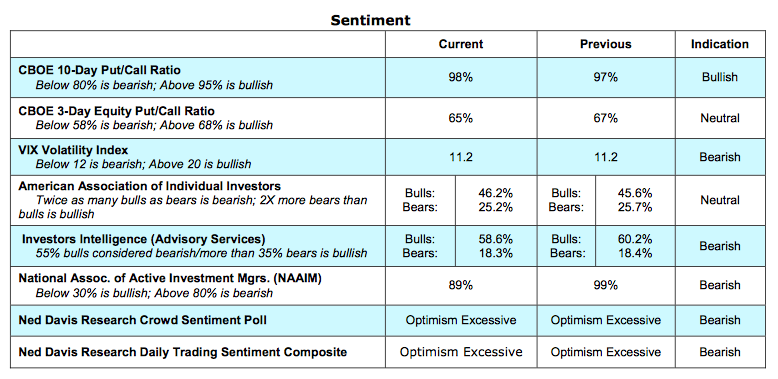

Investor sentiment has taken a step back from the exuberance seen in December but unlike previous rallies that eventually stalled, +95 bullish sentiment remains elevated. Stock market breadth has deteriorated over the short term but longer-term trends remain positive. This is particularly evident at the NASDAQ, which has made a series of new record highs but has been accompanied by a smaller number of issues reaching new high ground. Longer term, we are encouraged by the fact that more than 80% of the industry groups within the S&P 500 are in bullish uptrends. The bottom line is that the weight of the evidence from the stock market’s technicals argues for the consolidation period to continue.

The resumption of the post-election rally would likely be preceded by either the equity markets slipping into an oversold condition and or investor optimism replaced with worry, skepticism and caution. We would be encouraged should the bullish camp in the Investors Intelligence report fell below 50%, the National Association of Active Investment Mangers data show a drop-in allocation to stocks to 75% or less and a rise in the CBOE Volatility Index (VIX) above 15.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.