When a pig, in the Year of the Pig, sidles up to a bear (Pooh), you can expect action like we saw in the stock market today.

When a pig just wants to be sure of the bear, you get a downturn as the bears come out of the woodwork.

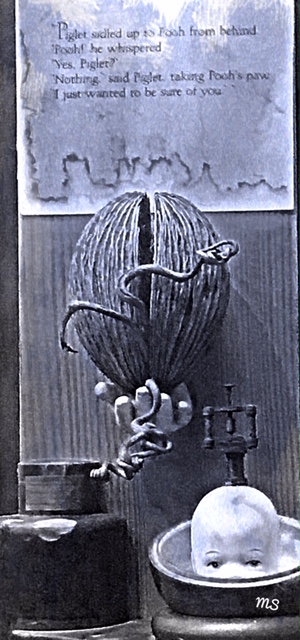

Piglet sidled up to Pooh from behind.

Pooh, he whispered, ”Yes, Piglet?”

“Nothing,” said Piglet, taking Pooh’s paw.

“I just wanted to be sure of you.”

However, since I am not really sure what the rest of Mr. Fuqua’s sculpture represents, so too, am I not sure if our market pig should be so very sure of his Pooh bear.

So many conflicting signals flying around, for instance,

Lower interest rates, a stronger dollar, the border wall and the government potentially shutting down, postponed talks with China on the tariffs and an economic slowdown in the global economy.

Yet, technically, the bears did not really do much damage.

Schneider

As we are influenced by the fundamentals, but act on the technicals, what would make Pooh braver and larger?

Coming into today, we noted that the rally off the December lows was either a monster dead-cat bounce, or the start of a foundation to melt-up from.

We also noted that as of yesterday, only the Biotechnology Sector (IBB) and Semiconductors Sector (SMH) had entered a weekly bullish phase.

And that both needed to close above their weekly 50-WMAs again this week to confirm. With SMH well below 101.06 and IBB well below 109.90, that now seems less likely.

In contrast, the Russell 2000 (IWM), Transportation IYT, and Regional Banks (KRE), are all in Caution phases on the weekly charts, while Retail XRT, is in a Distribution phase.

With that said, the four indices corrected into support on the Daily chart. The Dow in particular, is above its 200-DMA. The rest, including IWM are in Recuperation phases.

All held their fast or 10-day moving averages.

For Friday, we will be watching for today’s lows in the indices to hold.

We also be watching for the economic Modern Family, especially Semiconductors as the recent leader, to hold this week’s lows. In SMH that level is 96.99.

If all those levels hold, perhaps the market bulls will persevere over the ominous fundamentals.

Should those levels fail, that vice between the doll’s head and basin will tighten. The crack in the coconut shell will widen. And out Piglet will sidle up even closer to the Pooh bear.

S&P 500 (SPY) – A weekly close over 269 will keep the bulls in the game. Under 266.24 will embolden the bears. A close over 272.58 will excite the bulls.

Russell 2000 (IWM)– A weekly close under 147.95 not so healthy. Above 152.40 a miracle. In between, I’d use 150 as pivotal.

Dow Jones Industrials (DIA) – A weekly close over 248.96 will keep the bulls in the game. Under 246.47 will embolden the bears. A close over 254.35 will excite the bulls as we are above the 200-DMA but working a reversal topping pattern.

Nasdaq (QQQ) – A weekly close over 166.68 will keep the bulls in the game. Under 165.29 will embolden the bears. A close over 170.14 will excite the bulls.

KRE (Regional Banks) – Looking at 53.22 to hold if good and 56 the next viable resistance

SMH (Semiconductors) – 100 failed, so could be the toping candle the bears are waiting for-unless it closes back over 101

IYT (Transportation) – 180.93support to hold 185.37 weekly resistance to clear.

IBB (Biotechnology) – 109.92 the 50-WMA resistance. 107 the weekly support that needs to hold

XRT (Retail) – 44.60 pivotal for the week. 43.50 the must hold spot

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.