The stock market indices held up well given the news flow over the past week. Going through the market internals and the number of stocks that continue to screen well on our work, we believe there is still a chance for a strong rally on the S&P 500 Index from here.

Both the small and mid-caps showed outperformance versus the S&P 500 Index, and that’s a positive.

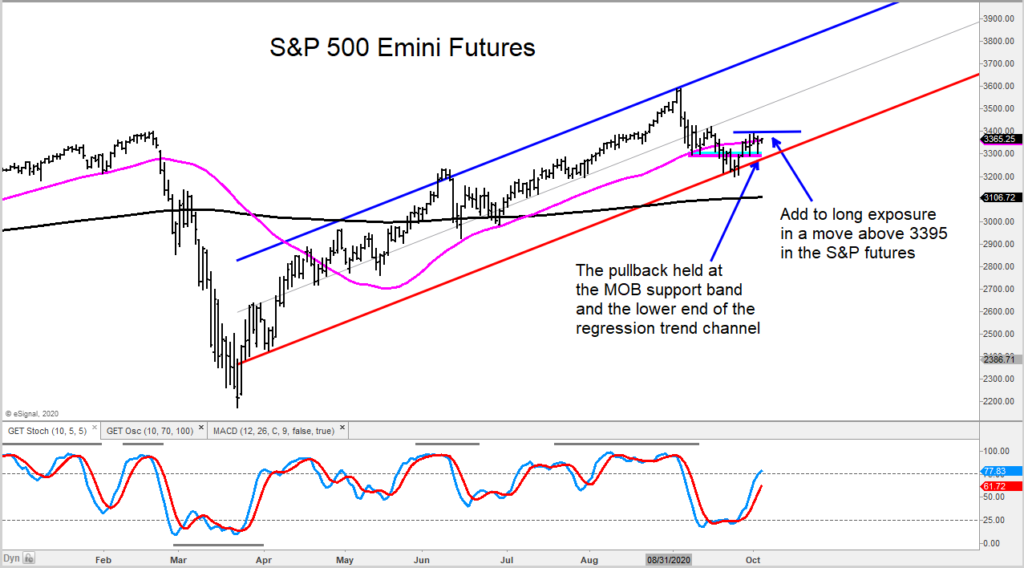

When looking at the S&P Emini futures below, we see that it held the MOB support band on the pullback and looks like it wants to take out last week’s highs. As we mentioned in a recent note on the S&P 500 cash index, “A push above 3440 would be positive and negate the downside MFU-2 target”. All eyes on these levels.

We will be looking for more long exposure this week is S&P 500 Index futures break above (and hold) 3395.

The author has a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.