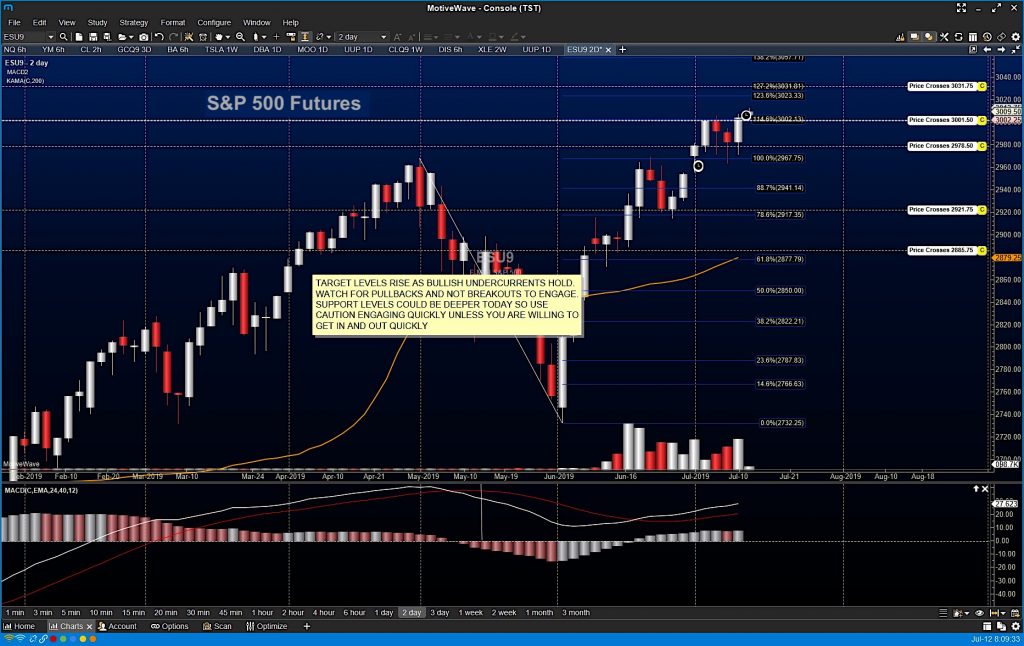

S&P 500 Futures Trading Analysis – July 12

Divergent behavior in the movement between S&P 500 futures ($ES_F), Nasdaq futures ($NQ_F), and Dow Industrials futures ($YM_F) sends warning signals under the bullish undercurrents.

I continue my work with this mindset in focus. The trend is bullish BUT traders should only engage longs at intraday support.

If I see divergence in several places, I will always take profit near old highs but leave myself partially exposed to more upside. Working this way over the last several months has been successful – particularly if I use the soft stops I use as stop hunting is a huge problem for intraday traders.

Gold broke its range resistance at 1412 but has failed and now sitting in congestion. The dollar has also faded back into support near 97.

THE BIG PICTURE – Daily momentum is positive to neutral and bouncing off daily support levels noted but with resistance nearby.

INTRADAY RECAP – Neutral to positive but broadly rangebound as traders move in to test resistance above after bouncing off support below. In crosscurrent trends, watch your size. Whipsaw is likely between these two levels. Holding 2986.5 is now the critical zone to hold through the wider support level noise.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.