S&P 500 Futures Trading Considerations for March 23, 2017

The S&P 500 (INDEXSP:.INX) held support yesterday but a test is likely to occur soon on futures. 2351 to 2355 will be the levels to watch today – buyers will become braver if they can maintain these levels. Technical price support levels sit near 2336 and 2332.25 and are still holding. I expect a bottoming formation to be tested. As the charts look, the side of the trade to be on is the short off resistance with a watchful eye on higher lows forming.

Note that the charts below are from our premium service at The Trading Book and shared exclusively with See It Market readers.

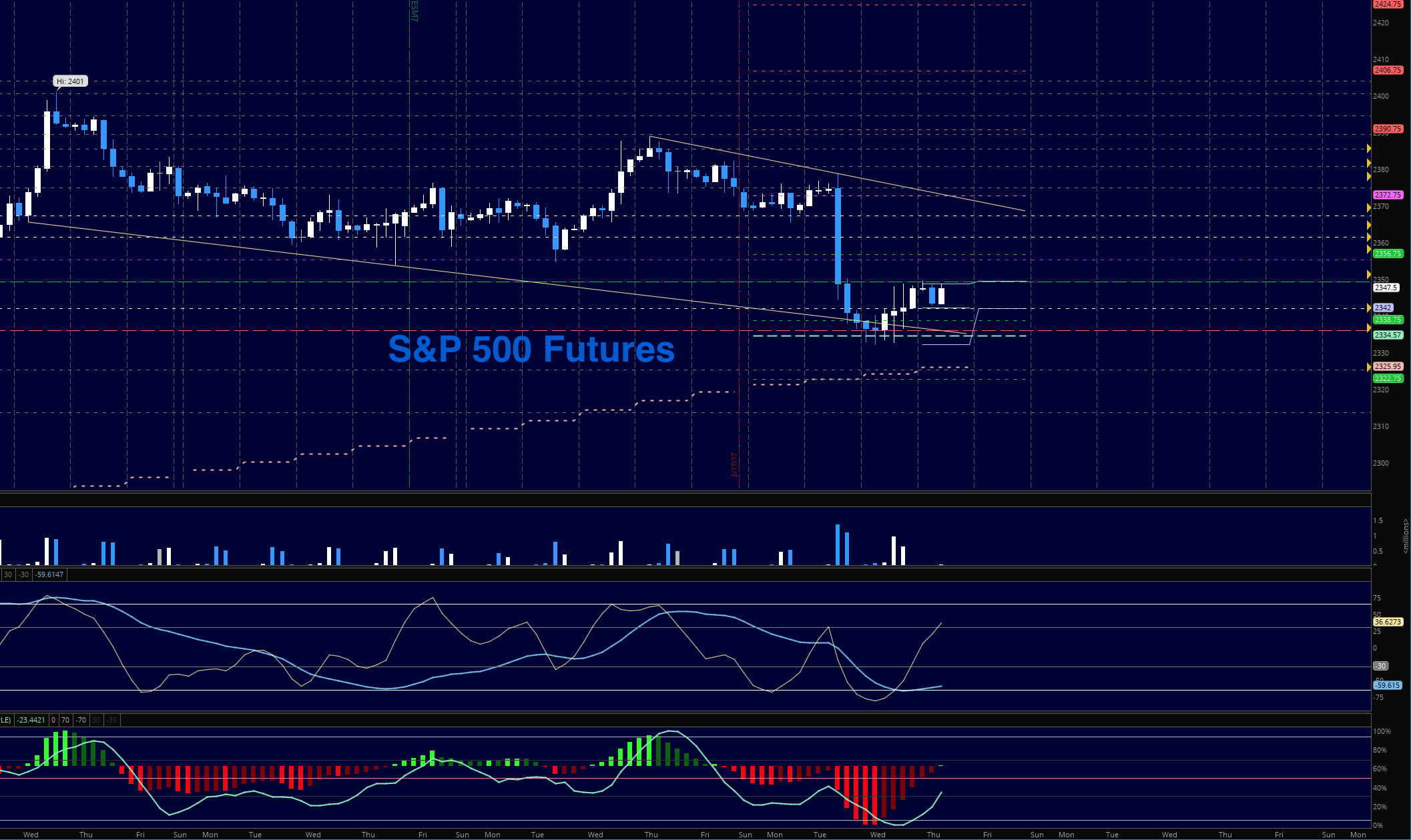

S&P 500 Futures Chart

S&P 500 Futures key trading levels & insights:

- Buying pressure will likely strengthen above a positive retest of 2351.5

- Selling pressure will likely strengthen with a failed retest of 2336

- Resistance sits near 2351.5 to 2355.5, with 2361.25 and 2367.25 above that

- Support holds between 2336 and 2332.5, with 2327.5 and 2319.5 below that

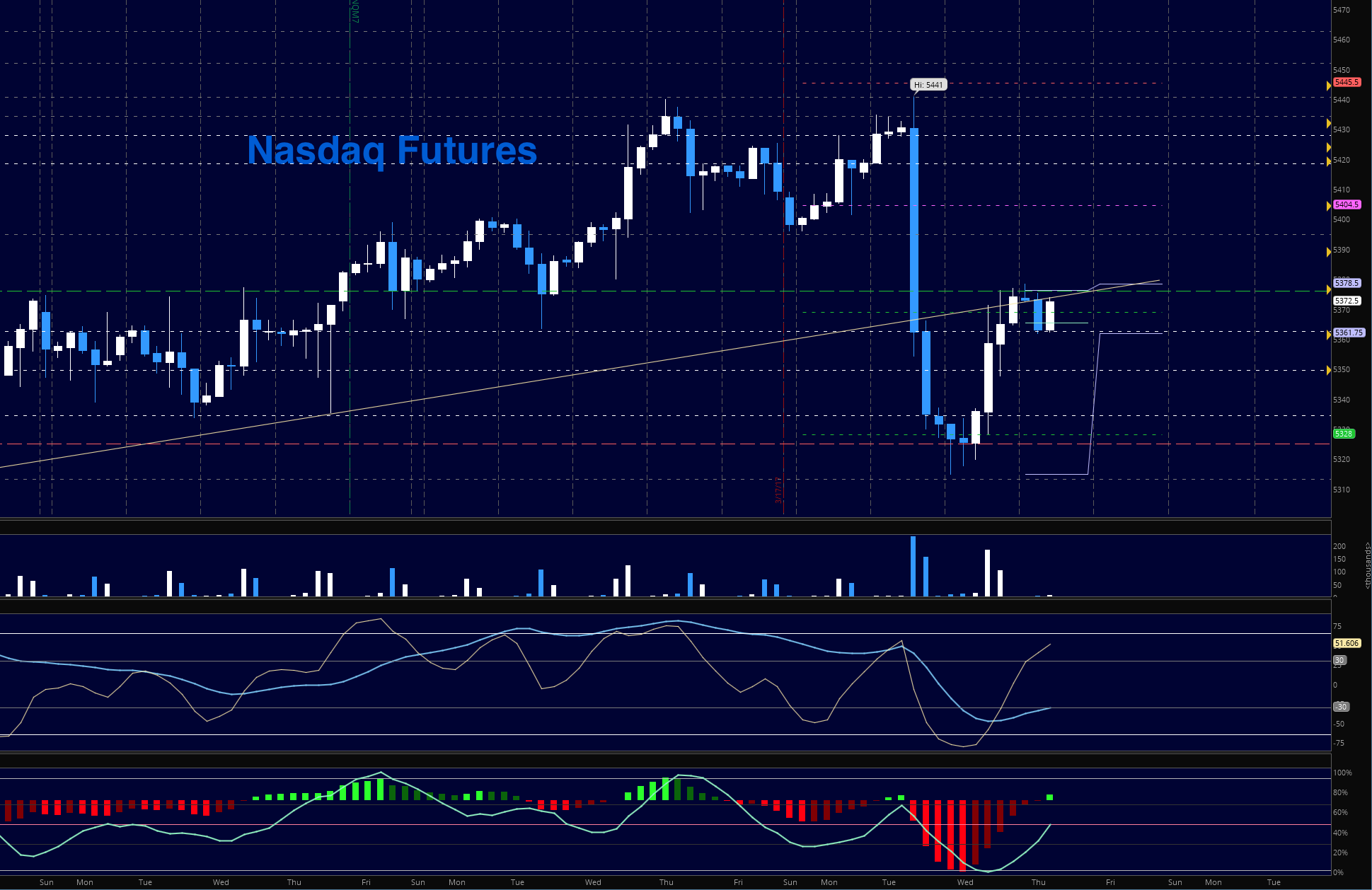

NASDAQ Futures

In the premarket this morning, we tested the first level of importance I mentioned yesterday, and rejected – so we’ll watch 5378.5 again to see if it remains resistance today and I expect it is. Higher lows should be on the horizon and a breach of 5378.5 might give us 5395. We appear to be poised to chop around the range.

Nasdaq futures key trading levels & insights:

- Buying pressure will likely strengthen with a positive retest of 5378.5 (use caution-wait for a retest)

- Selling pressure will likely strengthen with a failed retest of 5348.25

- Resistance sits near 5379.5 to 5382.5, with 5387.5 and 5395.5 above that

- Support holds between 5348.25 and 5338.75, with 5332 and 5299.25 below that

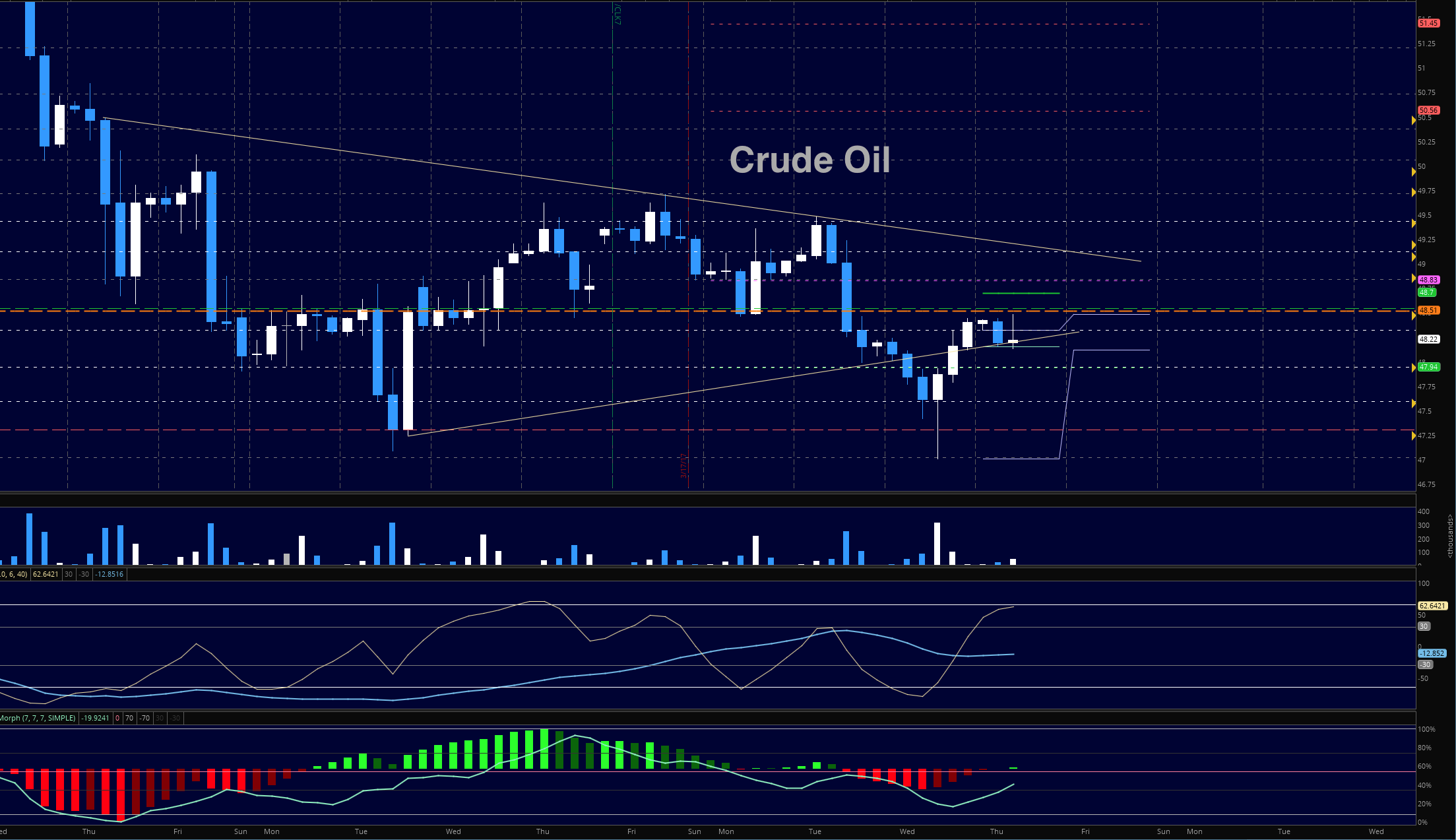

Crude Oil –WTI

With small builds in oil, and draws in distillates and gasoline, we have a mixed package of news from our reports this week. We held support yesterday, but lower highs seem likely A broken wedge is showing which potentially gives us several targets below, 46.92, and 46.2

Crude Oil key trading levels & insights:

- Buying pressure will likely strengthen with a positive retest of 48.54 (be careful here)

- Selling pressure will strengthen with a failed retest of 47.58

- Resistance sits near 48.54 to 48.84, with 49.12 and 49.72 above that.

- Support holds between 47.59 and 47.01, with 46.92 and 46.23 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.