Stock Market Futures Considerations March 27, 2017

We begin the morning testing very important support levels of support. If lost, the S&P 500 Index (INDEXSP:.INX) could make a 100% retracement into the breakout area of February 9, 2017. Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service and shared exclusively with See It Market readers.

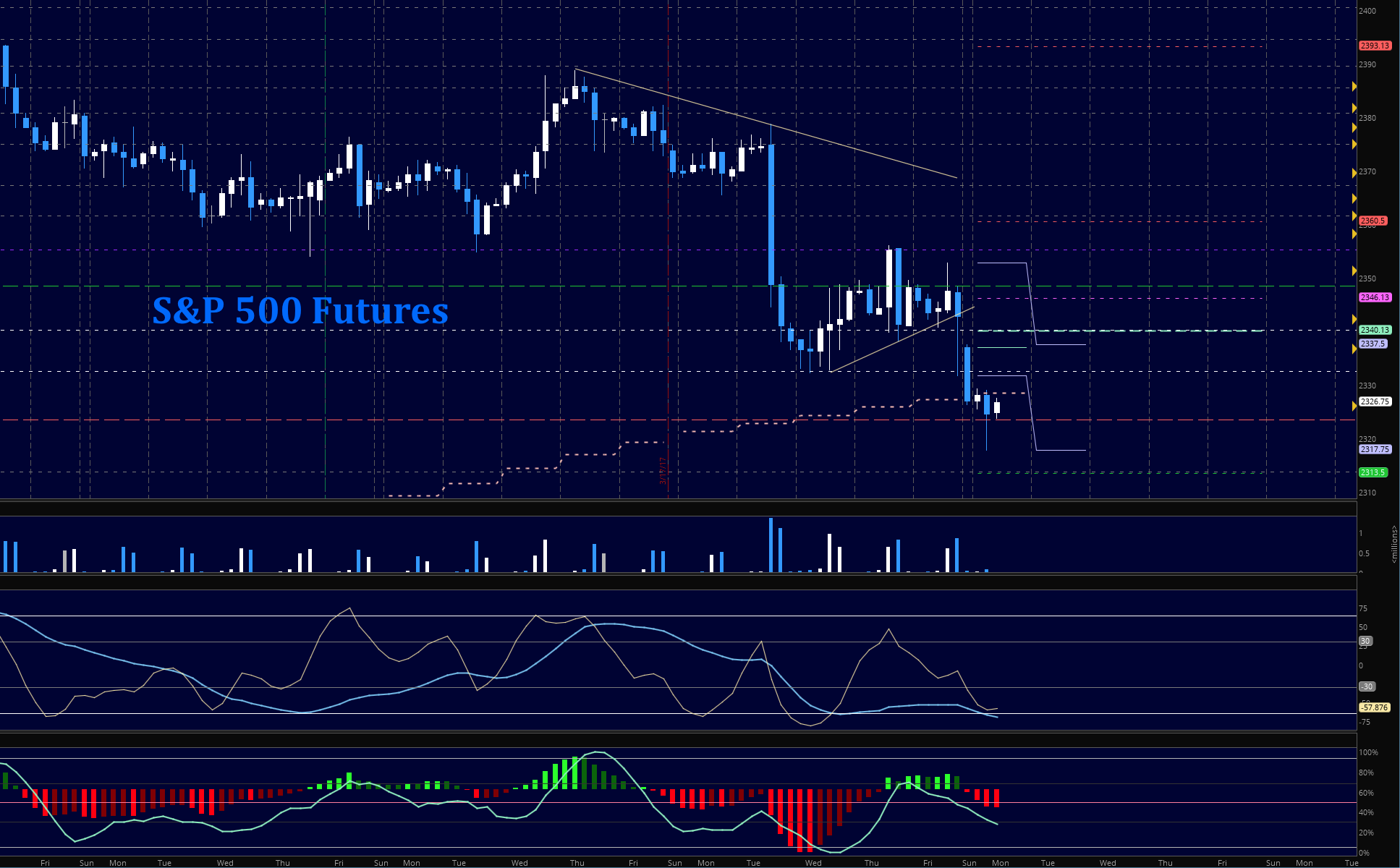

S&P 500 Futures (ES)

This still looks like a consolidation zone for now as momentum is not sharp, but selling could clearly increase with the loss and failed retest of 2323. With a watchful eye on higher lows forming, I’ll still be looking at shorting events to build as we test resistance levels, and considering the longs off support if strength of buyers shows up at baseline support areas. We will be opening (at this juncture it seems) with a gap down.

Key Trading Levels & Insights:

- Buying pressure will likely strengthen above a positive retest of 2336.5

- Selling pressure will likely strengthen with a failed retest of 2323

- Resistance sits near 2336.5 to 2342.5, with 2348.5 and 2354.25 above that

- Support holds between 2323.5 and 2317.5, with 2311.5 and 2305.5 below that

NASDAQ Futures

Though the NQ_F faded sharply as well, it is still holding stronger than the ES_F and actually holds higher lows than Friday. Premarket action has been somewhat sideways as momentum drifts negative. The watch for a failed test of old support is where I am focused. We appear to be poised to chop around the range again, but if sellers take control with the failure of 5318, we could easily see deeper tests as momentum to the downside gathers strength. The composite chart shows a daily 50 SMA near 5264.75

Key Trading Levels & Insights:

- Buying pressure will likely strengthen with a positive retest of 5362.5 (use caution-wait for a retest)

- Selling pressure will likely strengthen with a failed retest of 5330.25

- Resistance sits near 5362.5 to 5376.5, with 5382.5 and 5387.5 above that

- Support holds between 5331.25 and 5318, with 5309 and 5299.25 below that

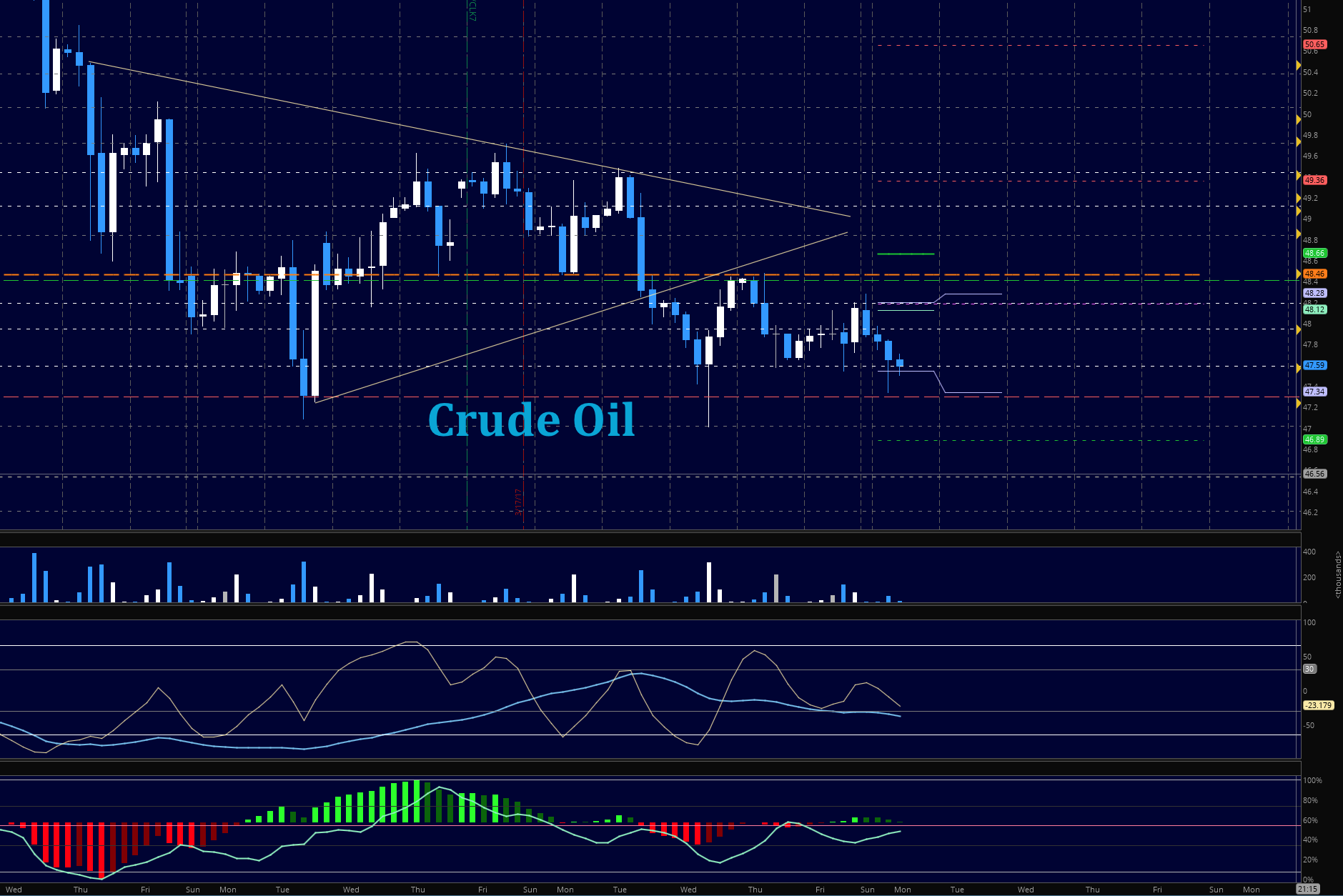

Crude Oil –WTI

Sellers drag on the price of oil and motion continues downward this morning. The low near 47 looks top be on the horizon again and a measure move shows a potential test of 46.53. Bounces should be areas to enter short with little risk. Watch for higher lows to build or for congestion to show up if momentum continues to slow to the downside. We could have sharp wicks if it fades quickly sellers remove profits at targets. We broke Friday’s prior lows, but still hold 47.2.

Key Trading Levels & Insights:

- Buying pressure will likely strengthen with a positive retest of 47.95 (be careful here)

- Selling pressure will strengthen with a failed retest of 47.74

- Resistance sits near 48.3 to 48.54, with 48.84 and 49.25 above that.

- Support holds between 47.25 and 47.01, with 46.86 and 46.53 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.