Stock Market Futures Considerations For March 15, 2017

Traders are expecting an interest rate hike today (Federal Reserve meeting), but it’s curious to see the action in gold and silver – perhaps they suspect it will be a ‘buy the rumor, sell the news’ event. Expect volatility on the S&P 500 (INDEXSP:.INX) and major indices immediately following the Fed release.

See today’s economic calendar with a full rundown of releases.

S&P 500 Futures (ES)

Buyers will very likely still hold key support levels as momentum continues to hold bullish. Retests of the breach formations will be important to note. See the image for areas of importance setting today’s trades.

- Buying pressure will likely strengthen above a positive retest of 2375.5

- Selling pressure will likely strengthen with a failed retest of 2355

- Resistance sits near 2375.5 to 2380.75, with 2389.5 and 2403.75 above that

- Support holds between 2358.5 and 2357.25, with 2355.5 and 2346.25 below that

NASDAQ Futures (NQ)

The NQ_F holds bullish formations as traders continue to view tech favorably in the environment. Breakouts seem likely to retrace if higher highs get tested. Use caution with trading the breaks – deeper support will find buyers at the ready.

- Buying pressure will likely strengthen with a positive retest of 5398.5

- Selling pressure will likely strengthen with a failed retest of 5376

- Resistance sits near 5396.5 to 5398.5, with 5400.5 and 5408.5 above that

- Support holds between 5366.25 and 5357.25, with 5348.5 and 5331.75 below that

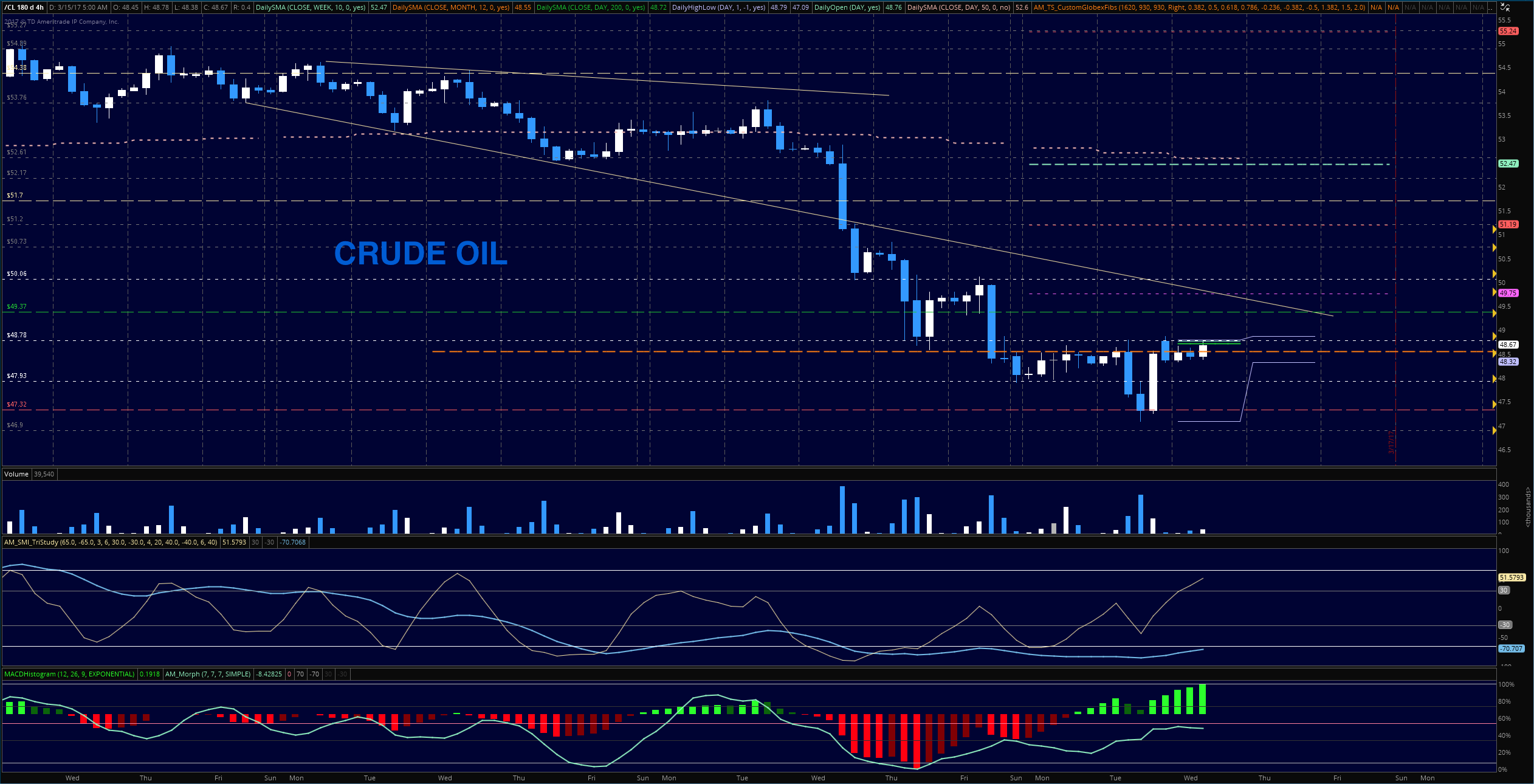

Crude Oil –WTI

The API report and tired sellers forced prices north of the lows seen yesterday and now the news on the horizon remains the EIA report coming in at 10:30 am. At this point, we see clear resistance at 48.87 but if we are bottoming, it is likely we see a dip into higher lows. Momentum remains very negative and there are still a lot of traders that are quite long in their positions. The level to watch today is 47.9 as I see it – with a shift lower if we fail to recapture the breakdown of the level, or a bounce into higher resistance if traders recover the region.

- Buying pressure will likely strengthen with a positive retest of 48.85

- Selling pressure will strengthen with a failed retest of 47.9

- Resistance sits near 48.8 to 50.04, with 50.68 and 51.04 above that.

- Support holds between 47.9 and 47.42, with 46.98 and 45.91 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.