Stock Market Futures Trading Considerations For January 25, 2017

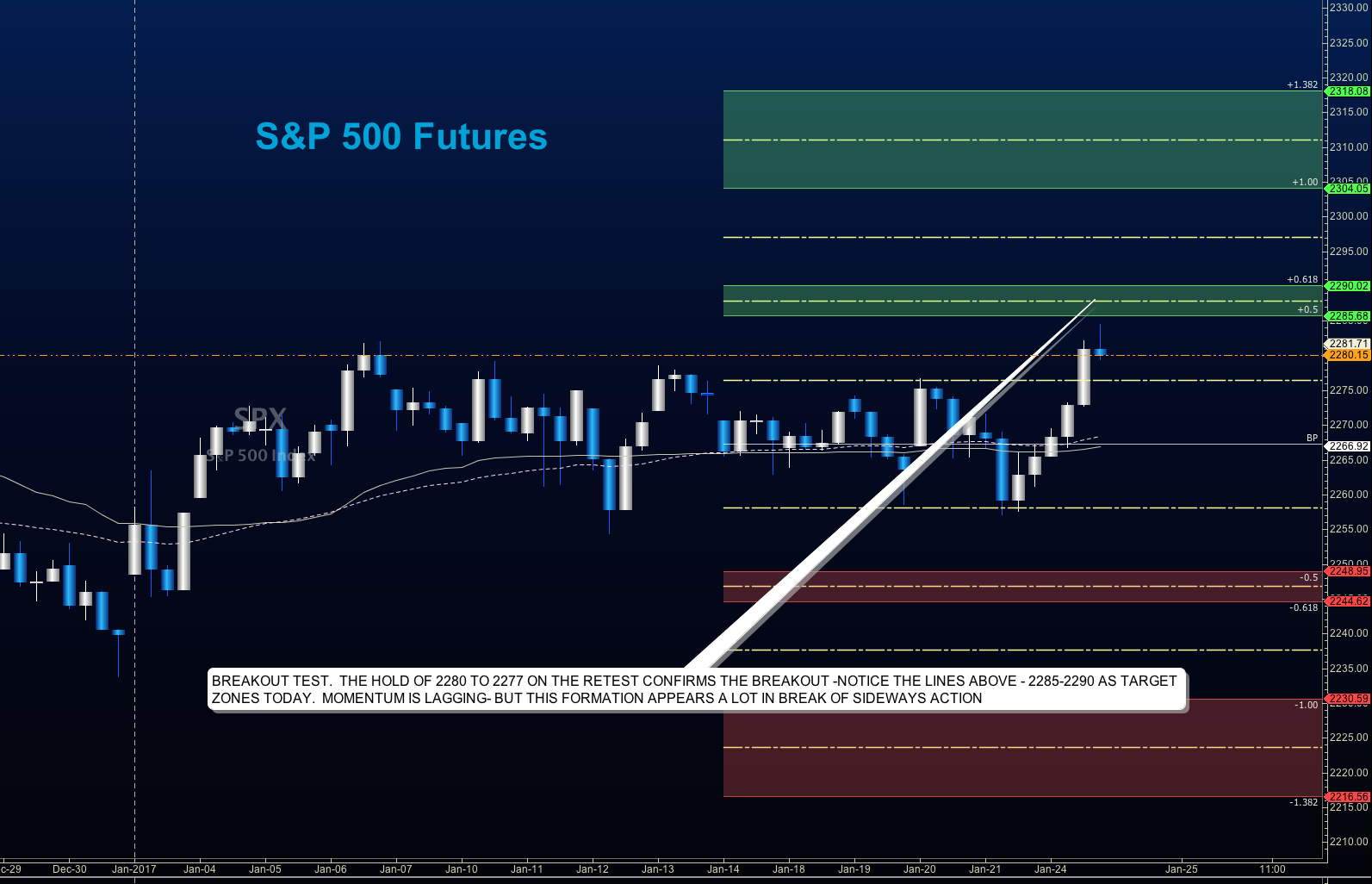

The “waiting” state broke yesterday with the confirmed test above 2269.75. And this morning the S&P 500 (INDEXSP:.INX) is in expansion. I notice that even in the state of a heavy negative media slant, the charts continue to rise. It has been the case in times past that news tends to slant the trading day, but this new pattern is interesting to observe. I will add color on this as the days continue. Market momentum is still damp, but we are clearly in breakout mode.

Buying pressure on S&P 500 futures will likely strengthen above a positive retest of 2282.5, while selling pressure will strengthen with a failed retest of 2274.75. Price resistance sits near 2287.5 to 2290.5, with 2293.5 and 2295.75 above that. Price support holds between 2271.25- 2274.25, with 2268.75 and 2264.50 below that.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

E-mini S&P 500 Futures Trading Chart For January 24

Upside trades – Two options for entry

Positive retest of continuation level -2282.75

Positive retest of support level– 2276.25

Opening targets ranges -2278.75, 2280.25, 2282.75, 2285.25, 2287.5, and 2290.5

Downside trades – Two options for entry

Failed retest of resistance level -2279.75

Failed retest of support level– 2274.5

Opening target ranges –2275.25, 2272, 2268.75, 2264.5, 2262.25, 2260.5, 2257.25, 2254, 2251.75, 2249.75, 2246.50, 2242.75, and 2239.75

Nasdaq Futures

The NQ_F resumed its upward chase and is holding a breakout pattern but momentum remains damp. Resistance is present at current levels near 5070

Buying pressure will likely strengthen with a positive retest of 5124, while selling pressure will strengthen with a failed retest of 5098.75

Price resistance sits near 5128.25 to 5136.25, with 5142.5 and 5156.25 above that. Price support holds between 5113.5 and 5109.5, with 5103.75 and 5098.75 below that.

Upside trades – Two options

Positive retest of continuation level -5117.75

Positive retest of support level– 5109.5

Opening target ranges – 5113.5, 5117.75, 5123.75, 5128.25, 5136.25, and 5144.5

Downside trades- Two options

Failed retest of resistance level -5117 ( needs confirmation – very countertrend)

Failed retest of support level– 5109

Opening target ranges – 5113.75, 5109.5, 5103.75, 5098.75, 5091.5, 5084.25, 5081.75, 5074.75, 5069, 5063.25, 5064.25, 5059.5, 5055.5, 5050.75, 5047.75, 5043.25, 5040.25, and 5036.5

Crude Oil –WTI

West Texas Intermediate remains range bound and has built a series of lower highs and higher lows – chart action is mixed and still waiting on a catalystBuying pressure will likely strengthen with a positive retest of 53.49

Selling pressure will strengthen with a failed retest of 52.09. Price resistance sits near 53.49 to 53.66, with 53.8 and 54.18 above that. Price support holds between 52.03 and 51.78, with 51.6 and 51.4 below that.

Upside trades – Two options

Positive retest of continuation level -53.11

Positive retest of support level– 52.5

Opening target ranges –52.64, 52.84, 53.27, 53.46, 53.86, 54.16, 54.28, 54.51, 54.76, 55.06, and 55.24

Downside trades- Two options

Failed retest of resistance level -52.9

Failed retest of support level– 52.5

Opening target ranges –52.63, 52.53, 52.26, 52.08, 51.78, 51.52, 51.24, 51.04, 50.82, 50.47, 50.3, and 50.16

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.