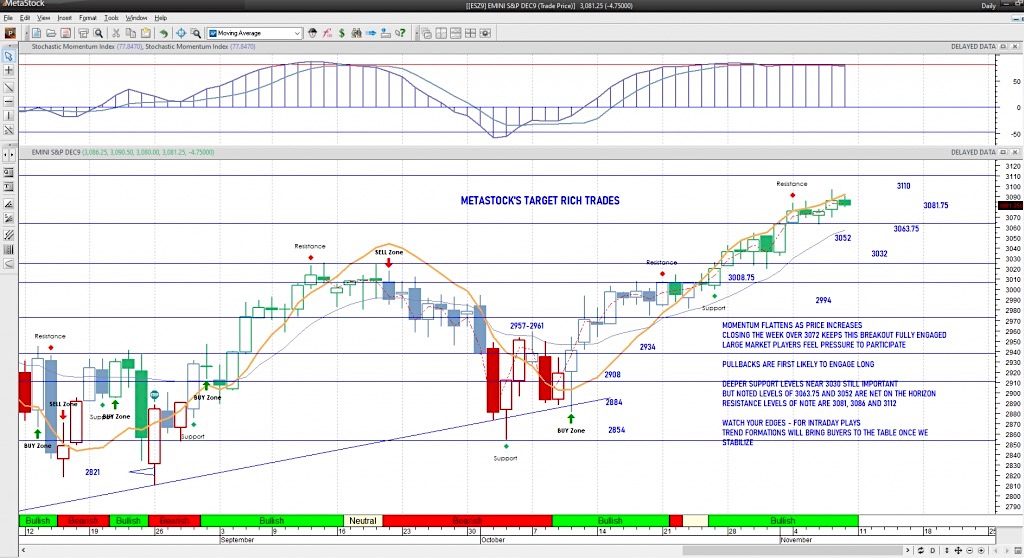

S&P 500 Index Futures Stock Market Chart – November 8

MARKET COMMENTARY

Traders continue to hold us in breakout territory as the S&P 500 Index futures have slipped into higher support and bounced once more.

Trading price ranges are compressing lightly. Early morning moves upside were not recovered for the second day in a row. Lower tests will bring buyers into support regions.

Don’t rush the trades as price action is choppy and will give you room to engage on either side. Countertrend shorts are just that – quite countertrend with a short shelf life (still).

Pullbacks, even if they jolt us by their deepness will very likely be buying areas, especially at the first pass into weekly levels.

WEEKLY PRICE ACTION

We shall keep looking for a close over 3072 to confirm a weekly breakout but dips near 3052-3063 are also presenting possibilities as a draw to a support test. Positive momentum is continuing to flatten.

Weekly patterns remain quite strong as do the monthly patterns- from a bullish perspective – so all eyes will be at the potential hold above 3072. Close of Friday’s candle below this level allow some thoughts of weakness developing. Be cautious adding to swing positions in either direction – particularly if you are considering shorts- as markets are not currently showing that short positions can gain traction at this time.

COMMODITY & CURRENCY WATCH

Finally, as we have held higher in the indices, gold has slipped below 1500 and having trouble recovering the zone. I have mentioned often since 1560 that this chart needs a significant fade as gold buyers throw in the towel at new highs.

Thursday’s test of 1461 (one of our blog targets) is a key zone but failure to hold above 1475 will deliver the possibility of a dip to 1445. We are well below breakout patterns look like tests of 1520 to 1535. Use caution with size – there is significant risk in these charts, in both directions.

The US dollar has recovered a major support region and now holding above 98, re-entering the long channel and pressing higher. Resistance so far has been strong at 98.7. WTI sits below 57 after sellers pushed the high back down into congestion. Resistance sits at 57.85. Traders are certainly trying to buy this chart up.

TRADING VIEW & ACTION PLAN

Buyers will have more strength above 3078 in the S&P 500 futures which will hold as a minor breakout region with sellers continuing to wage a battle there. Presses to the upside have been finding sellers in place. Breaching 3089 will make for another push by buyers into prior highs. Broadly speaking, buyers have the advantage as long as we hold 3063- which is where we bounced in Wednesday’s range.

The support below that is 3052ish, so the loss of 3063 opens that level below. Be patient and wait for your setups – this means we wait for key support to engage and we don’t step in front of moves. Understand what your levels mean and prepare for the potential behavior at those levels. Realize that we could bounce higher than anticipated and fade deeper than anticipated before returning to the trend and range – Follow the trend in the shorter time frames and watch the price action.

The theme of motion is:

POSITIVE AS LONG AS WE HOLD ABOVE 3078ish today (with big spikes likely fading back into congestion)

NEGATIVE AS LONG AS WE HOLD BELOW 3062ish today (with sharp bounces failing and deep pullbacks holding)– choppy inside the range.

Do what’s working (that means follow short trend and momentum signals while in the intraday spaces) and watch for weakness to develop away from your trade direction in order to leave.

Learn more about my services over at The Trading Book site.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.