Jobs numbers deliver a muted response this morning and we sit below key levels of support on the S&P 500 futures.

There is a bearish slant overtaking the market after wild swings on tweets of further tariffs.

THE PRICE ACTION

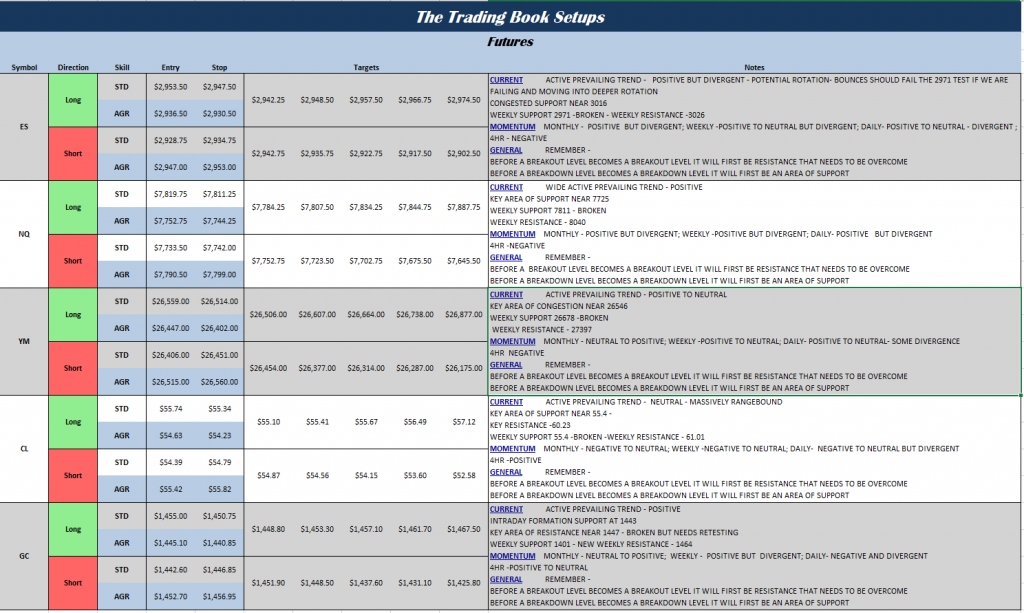

The e-mini S&P 500 index retreated to the base of deep congestion levels near 2933 where it is currently stalled. The mini Nasdaq slipped below another key support level near 7740 where it is also stalled. The mini DOW failed the deep support level near 26560 and still sits below it.

A negative slant has drifted over the market but from fast moves come failed moves – so a cautionary note about further downside that quickly recovers should be on the mind as possible.

COMMODITY WATCH

Gold is above the higher breakaway level of 1442 but is under negative divergence. Now holding support of 1422 is the bullish entry. The USD index holds above 98. and that big bounce we were estimating is in full swing as we stretched into 99 and then faded.

The ‘tit for tat’ behavior of other central banks will like push the dollar down when that begins – but before then, we will likely see more upside. WTI Oil faded sharply holding well below breakout regions near 57.16 and now setting just above key support levels near 54.4

INTRADAY RECAP

Another decision zone – but with a bearish slant as we come into deeper support. The levels and range between 2971 to 2924 is the watch data for the e-mini S&P’s. The mini Nasdaq holds the range between 7846 and 7712. Be careful here on the edges as we could accelerate out and continue if buyers or sellers get heavy on the edges.

Here’s a link to the METASTOCK software

OVERALL

Divergent action still sits below the movement of price on both sides of the trades – long and short – but traders are still looking at deep support edges to bounce.

If traders push us to close above 2976 today, we will have to consider a REVERSAL long on the upside for the short term.

IF YOU DON’T JOURNAL YOUR PROGRESS, YOU SHOULD – How about finally starting that trading journal?

Here’s an easy way to keep track of your progress

WEBINAR LINK FOR THE WEEK BEGINNING JULY 29, 2019 –

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.