The S&P 500 (SPX) rose 58 points last week to 2892, an increase of 2%.

Trade optimism returned last week, amidst improved sentiment in China, to push stocks higher.

This week we expect the declining phase of the current intermediate cycle to push the stock market to 2850 before moving higher again.

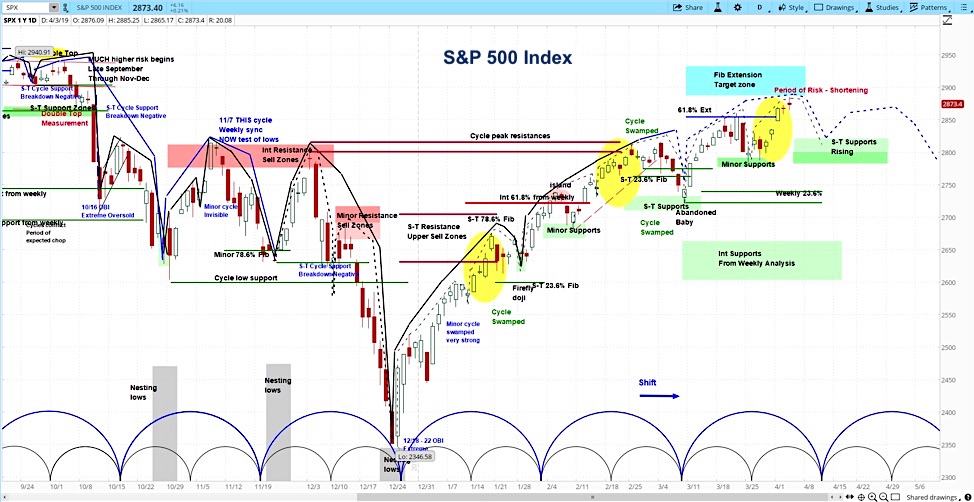

S&P 500 (SPX) Daily Chart

Our approach to technical analysis uses market cycles to project price action. As can be seen in the adjoining daily chart, we are late in the current intermediate cycle.

We thus expect a few down days as the declining phase of this cycle hits and stocks then begin to move higher again once a new cycle begins. Our target for next week is to hit a low around 2850.

Market Week Video – April 8, 2019

Stocks continued their upward climb last week as investors latched onto any tidbit of positive news and drove the markets higher, as I pointed out in the latest Market Week show.

Last week began with an uptick in Chinese business sentiment, as measured by the Caixin manufacturing PMI, which notched higher to 50.8, above the expectation of 50.1. Previously, the index had registered 49.9, which is an indication of contraction in the manufacturing sector.

Regarding the US-China trade talks, President Trump said, “We’re very well along. We’ve really negotiated probably the two hardest points very successfully for our country.” Last week Vice Premier Liu He was in Washington to meet with Steven Mnuchin and Robert Lighthizer.

Also, Trump couldn’t help but mention his forthcoming nominee for the Federal Reserve, Herman Cain. The former restaurant CEO, Kansas City Fed Chair, and Presidential candidate is now undergoing a background investigation.

Turning to the macro picture, economic sentiment was mixed as measured by purchasing managers in the US, UK, and Germany. Retail sales and durable goods orders were below expectations, while nonfarm payrolls ticked higher.

Bitcoin surged 900 points, an increase of 22%, as the media struggled to explain the move which mostly occurred on Monday. Justifications ranged from optimistic stories of Bitcoin “whales” buying again to humorous April Fool’s pranks that triggered algorithmic trading.

For the new Q1 earnings season, with 23 companies in the S&P 500 having reported, 19 beat earnings estimates, according to FactSet. However, of the 106 that have revised their earnings guidance, 74% were revised lower.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.