SolarCity (SCTY) just released earnings yesterday and reported an EPS loss of $2.41 vs. and expected $1.95 loss. The company guided EPS lower for next quarter to a range of -$2.60 to -$2.75 vs. estimates of -$2.51. Revenue came over the top of estimates at $113.9 million vs. estimates of $111.4 million.

The company’s stock price is now down nearly 55% in three-months and growth is expected to slow, but as the Motley Fool writes:

“The big reason growth is expected to slow? Management is taking its foot off the growth gas pedal, so to speak, and will invest significantly less in geographic expansion next year, versus the past few.” – Source: The Motley Fool

But neither of those are really the issue. It goes way (way) deeper than this.

Read more trading news from CMLviz.

Perhaps once in a decade do we see a company that has reached the point where it has the opportunity to radically transform the world as we know it while at the same time sits on the precipice of total and utter collapse.

Solar City is facing that reality, right now. Slate writes about SCTY’s disruptive possibility:

“Elon Musk’s Tesla and SpaceX are impressive. But the solar company he founded with his cousins could be transformational. – Source: Slate

The Good

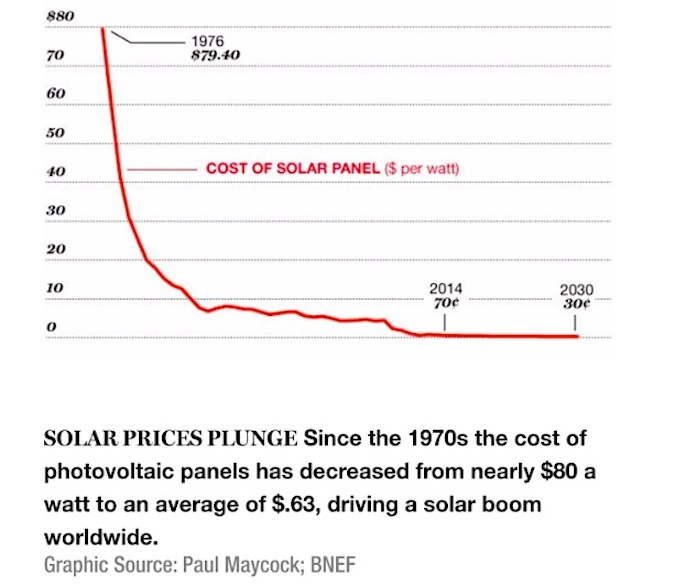

But this company did not invent the solar panel, rather it has perfected a combination of operations and disciplines-efficient assembly, economies of scale, vertical integration, and innovative financing techniques-that could make mass adoption possible. It has made the once impossible to justify expense of solar panels suddenly not only affordable, but cheaper than a normal electric bill. Here’s a history of the expense of a solar panel ($ per watt) since 1976:

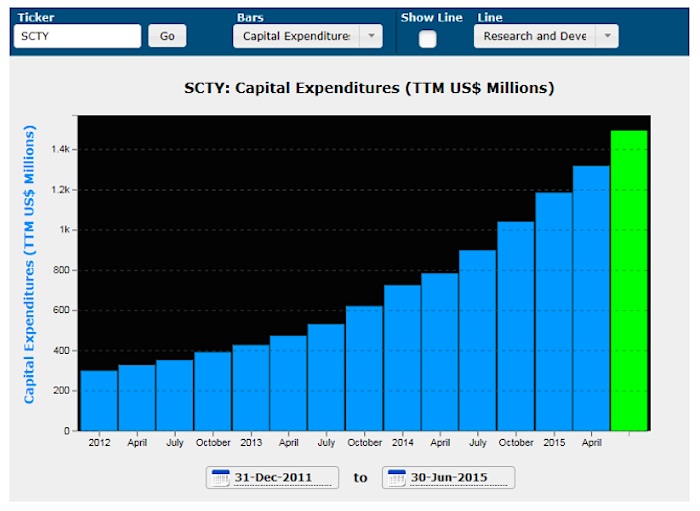

The company is investing absurd amounts into capital expenditures (CapEx) to build a customer base and then let that expense turn into two-decades of delayed revenue streams from the leased solar systems. Here’s a chart of the SolarCity’s unbelievable capital expenditure growth.

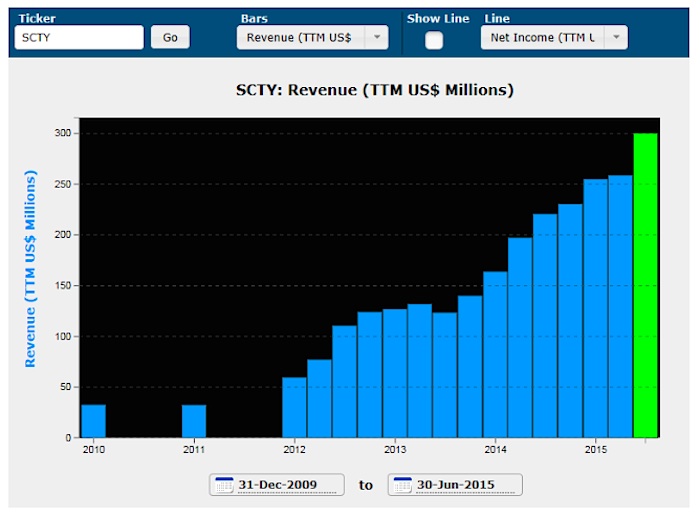

We’re looking at CapEx of nearly $1.5 billion while the company has generated just $300 million in revenue in that same trailing-twelve-months.

The company is financing itself by way of Wall Street for the construction of thousands of systems and packaged the leases into bonds that can be purchased by individual investors (Source: Slate). If that “packaged debt” sounds similar to the housing market’s boom, it kind of… should.

The genius behind SCTY is the way it worked around the reality that solar installations are really a business of “one-off” sales of a few dozen solar panels at a time for each home. So the company pivoted. First, through contracts with the Department of Defense, the company has put solar panels on large clusters of military housing. Further, SolarCity built a network of 40 warehouses in California, which serve as distribution, storage and staging areas for those single-home projects.

The Really Good

SolarCity is the largest US residential solar installer, has entered into several recent partnerships that have grown its geographic reach. The Motley Fool reported that SCTY also launched its power storage program with partner Tesla Motors (TSLA), making it available in all of SolarCity’s current markets. Moreover, to side step costs with vertical integration, SCTY purchased solar panel manufacturer Silevo. Now SolarCity is erecting an enormous plant in Buffalo, New York to supply low-cost panels for its installer.

Here’s a chart of revenue (TTM) for SCTY.

The Bad

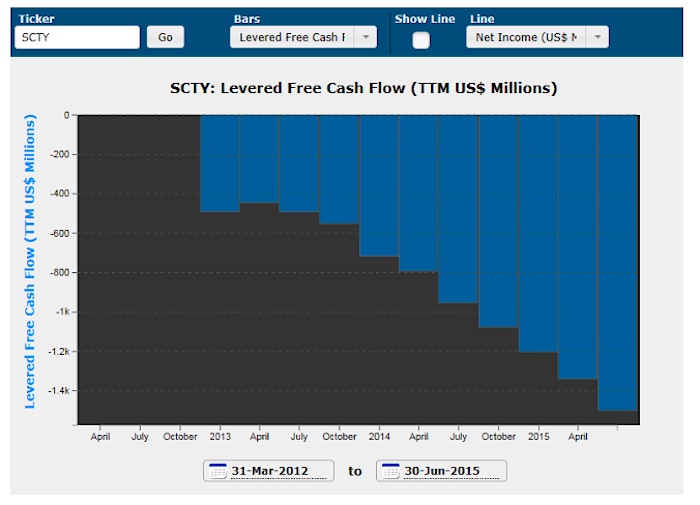

There are other facts, though. The fundamentals are atrocious and getting worse. The stock is down 52% in the last three-months. It has gotten so bad for SolarCity, that in the last quarter the company paid more than $2.25 in operating expense for every $1 in revenue it generated. That, combined with the massive CapEx, has led to this tremendously ugly levered free cash flow trend.

The company’s free cash flow in the last year is negative $1.5 billion and coupled with the already stretched line of credit and a business that today pays more than $2.25 in expense to bring in $1 of revenue, and we have come to an inflection point of true existential risk. But it’s actually worse than that.

ElonMusk always has a trick up his sleeve, and it’s the same trick every time: take money from the government. New York state is spending $750 million to build that solar panel factory in Buffalo for SolarCity. Further, in Silicon Valley, the company is leasing its plant for $1 a year and will not pay property taxes for a decade, which would otherwise total an estimated $260 million (Source: LA Times).

The federal government also provides grants or tax credits to cover 30% of the cost of solar installations. SolarCity reported receiving $497.5 million in direct grants from the Treasury Department. – Source: LA Times.

That’s right, there’s another $1.5 billion that isn’t showing up in SolarCity’s financials that look, in all fairness, like a firm that’s already bankrupt. And just one last piece to the bears’ argument, SolarCity is now borrowing money from Elon Musk’s private company SpaceX with loans now totalling $165 million.

Now, before we lose our minds, let’s digest what CEO Lyndon Rive said on the earnings call and this is the silver lining.

“taking these [slowed expansion] steps now may slow growth a little bit, but it will mean that the company is cash flow positive by the end of 2016” – Source: The Motley Fool

Now that sounds better, right?…

It’s come down to this. SolarCity is either on the verge of breaking the energy sector in half, disrupting it like never before and potentially becoming the greatest transformational force on planet Earth… or it’s a bankrupt company, with $1.5 billion in government subsidies on top of $1.5 billion in negative free cashflow and is now borrowing money from its Chairman’s other company (which is also funded by government subsidies) because credit lines are drying up.

There is yet further risk which SCTY’s CEO has called “catastrophic.” The risk is simply that the utility companies stop paying (crediting) solar users for surplus power their systems create, which gets fed back into the grid for use by other customers. This will be a state by state decision and is in fact, existential to every solar firm out there. Without the credits, unfortunately, solar makes no economic sense at all.

If you thrive on understanding what’s really going on in a company, beyond the headline noise: Then Join Us: Get Our (Free) News Alerts Once a Day.

Thanks for reading.

Read more from Ophir on CMLviz.com.

Twitter: @OphirGottlieb

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.