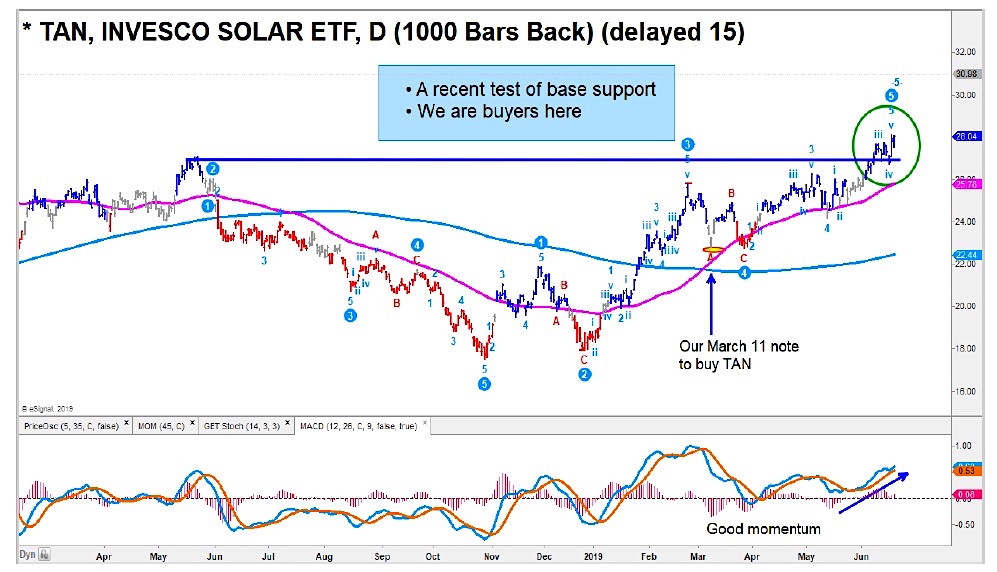

A few months ago we put a “buy” rating on the Solar Sector ETF (NYSEARCA: TAN) with a target of $28.50.

The ETF is approaching that price level, but we feel like it will extend much higher. So we are reiterating our “Buy” rating and upping our price target.

Stocks such as First Solar (NASDAQ: FSLR) and and SunPower (NASDAQ: SPWR) have been on the short squeeze list for months, and remain so. This will likely add fuel to the upside as traders get squeezed.

This should bode well for the sector.

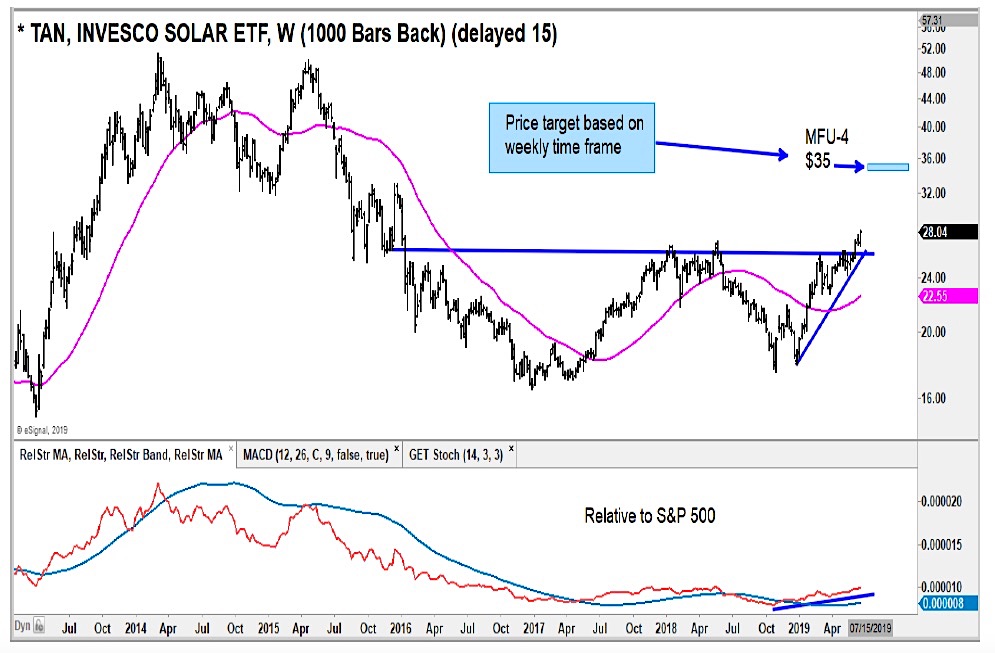

Our Money Flow Units model is indicating higher price targets based on the “weekly” time frame (intermediate), and we highlight this in the stock charts within this post.

We continue to be bullish on this sector and select stocks like First Solar and SunPower.

$TAN Solar ETF Chart – short-term

$TAN Solar ETF Chart – intermediate-term

The author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.