Given increased economic headwinds and the length of the market runup, it’s not surprising investors are flocking to what they hope will be steady-performing stocks.

Year-to-date,* an estimated $13.4 billion has poured into exchange traded funds (ETFs) focused on low-volatility equities—making this category a top destination for factor investing dollars.

What does this mean?

While stampeding toward what they hope will provide muted price movements, investors may be missing some key warning signs that could translate into painful bumps in the quarters ahead.

One of the top concerns among is weakening balance sheets.

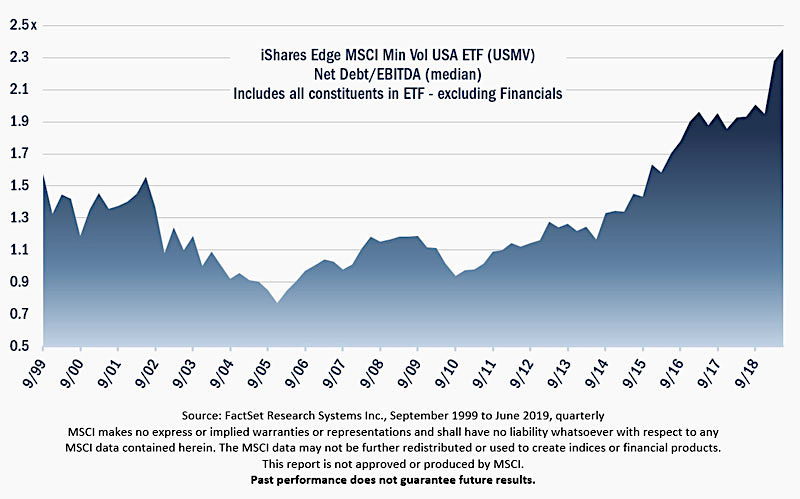

Today’s chart (above) highlights how net debt levels relative to earnings before interest, taxes, depreciation and amortization (EBITDA) for companies in the minimum volatility ETF have skyrocketed and now stand at the highest point in the last 20 years.

In the long run, we believe it’s not the volatility of share price that determines whether an investment is good, it’s valuations, the quality of the underlying business, and the strength of its balance sheet.

This article is by Will Nasgovitz, CEO and portfolio manager.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

As of 7/31/2019, Heartland Advisors, Inc. did not hold iShares Edge MSCI Min Vol USA ETF.

Definitions:

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) measures a company’s financial performance. It is used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.

Exchange Traded Fund (ETF) is a security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. ETFs experience price changes throughout the day as they are bought and sold.

Net Debt/EBITDA Ratio is calculated as a company’s interest-bearing liabilities minus cash or cash equivalents, divided by its EBITDA, and is a leverage measurement that shows how many years it would take for a company to pay back its debt if net debt and EBITDA are held constant. If a company has more cash than debt, the ratio can be negative.

Volatility is a statistical measure of the dispersion of returns for a given security or market index, which can either be measured by using the standard deviation or variance between returns from that same security or market index.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.