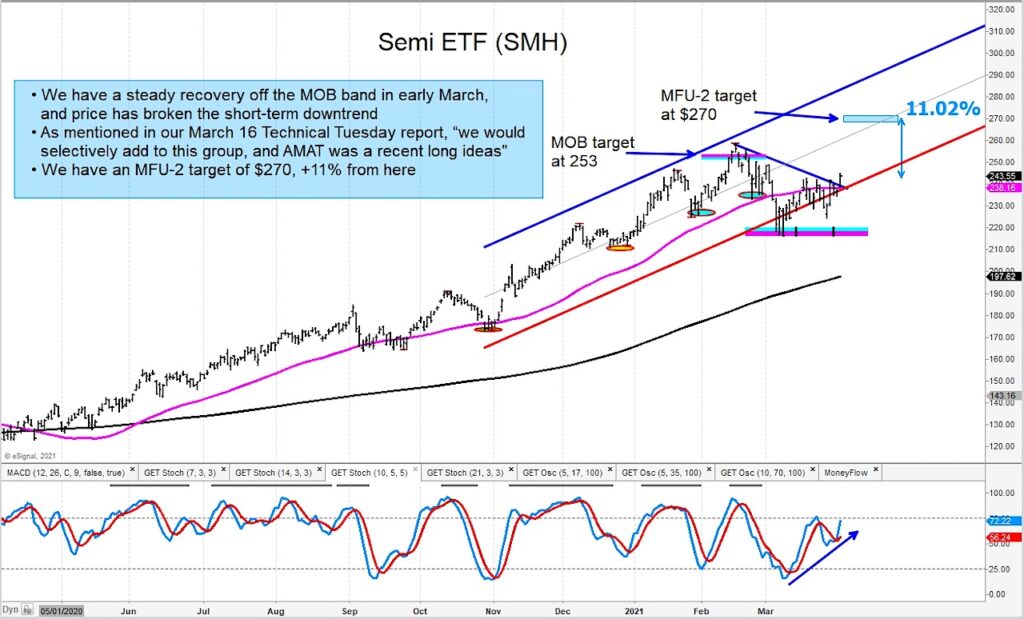

Large cap tech has pushed higher and I continue to like the improvement seen in particular in Semiconductor stocks.

Today we take a look at a trading buy signal in the Semiconductor ETF (SMH).

SMH has recovered above the lower end of the regression trend channel and has now broken above its short-term downtrend line. This should bode well for Semiconductor stocks… especially those showing relative strength.

The Semiconductor ETF (SMH) is a good way to play the call as a basket trade, but several individual stocks are looking good (like Applied Materials – $AMAT, for example). This sector is worth screening for out-performing stocks as trading ideas, in my opinion.

I have an upside price targets of $253 (MOB band) and $270 (MFU-2 target).

The author or his firm may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.