Seagate Technology (STX) reported earnings after-hours on Tuesday.

The company reported adjusted EPS of $1.20, which missed consensus estimates of $1.29. Revenue came in at $2.3B, which also fell short of consensus estimates of $2.6B.

Seagate’s CEO, Dave Mosley, said the COVID-19 pandemic disrupted demand in their key end markets and also resulted in higher logistics and labor costs.

Mosley went on to note that he expects revenue to be flat through the June 2021 FY.

Seagate Technology (STX) closed down 8.77% on the day.

Let’s review our weekly cycle analysis.

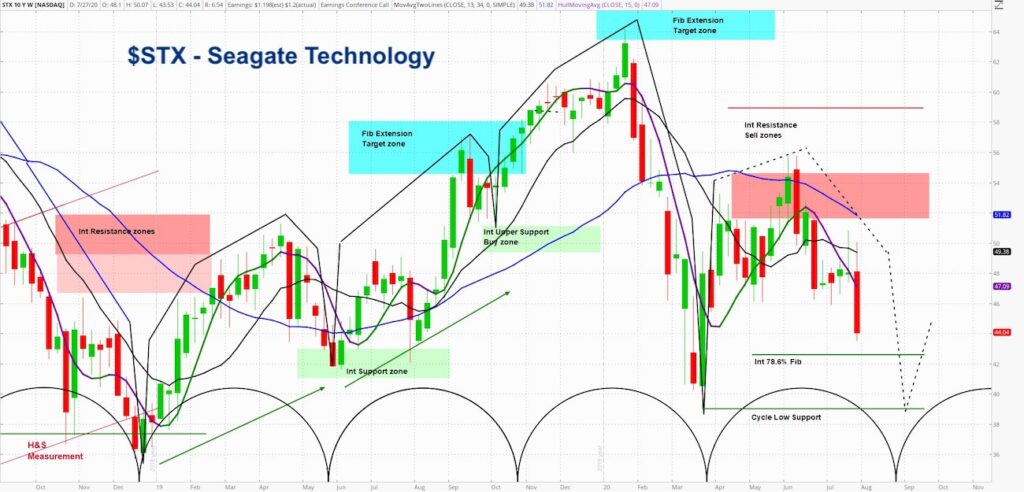

Seagate Technology (STX) Weekly Chart

At askSlim.com we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing:

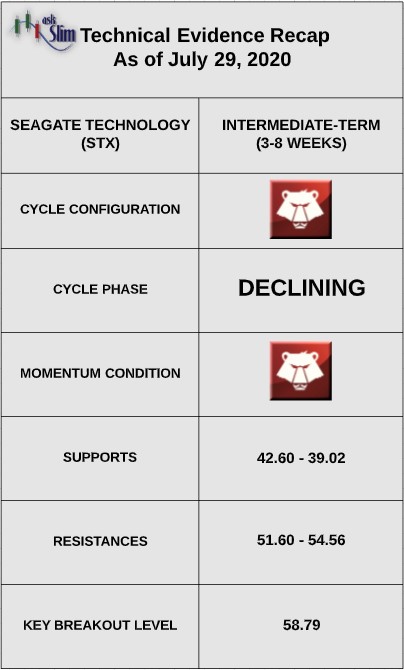

The weekly cycle analysis suggests that STX is in a declining phase. The next projected intermediate-term low is due in the end of August. Weekly momentum is negative.

On the upside, there are intermediate-term resistances from 51.60 – 54.56.

On the downside, there are intermediate-term supports from 42.60 – 39.02.

For the bulls to regain control of the intermediate-term, we would need to see a weekly close above 58.79.

askSlim Sum of the Evidence:

STX is in a declining phase with negative momentum. There is a likelihood that the stock retests the March low at 39 by the end of August.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.