I previously have profiled the M&A landscapes in Cyber Security and Consumer Foods, and two new big deals announced this week with AVG and WWAV. For those articles, visit:

For this report I want to focus on Software as a Service (SAAS) stocks, a major shift we have seen in tech as a software licensing and delivery model allowing software to be licenses on a subscription basis and is centrally hosted, also referred to as “on-demand software.” We have seen a few large Tech companies shift to a SAAS model, and the Street has rewarded them with higher earnings multiples, seeing the future benefits of higher margins, stocks like Adobe (ADBE), Autodesk (ADSK), and PTC Inc. (PTC). Moving away from the on-premise model allows companies to save on hardware costs and has pricing benefits, while the SAAS vendors benefit from the ability to cross-sell and up-sell new products.

We have already seen numerous deals in SAAS stocks over the past 12 months. Here’s a look at SAAS M&A:

- Salesforce.com (CRM) acquires Demandware (DWRE) for $2.8B (7.3X EV/Sales) on 6/1/16. DWRE’s focus is in the ecommerce space.

- Vista Equity Partners announces a $1.79B (4.3X EV/Sales) deal for Marketo (MKTO) on 5/31/16. MKTO’s focus is in marketing software.

- Vista Equity Partners announces a $1.65B (4.6X EV/Sales) deal for Cvent (CVT) on 4/18/16. CVT’s focus is in event management software.

- NICE Systems (NICE) announces a $940M (2.8X EV/Sales) deal for inContact (SAAS) on 5/18/16. SAAS’s focus is in cloud contact center software.

- Thomas Bravo announces a $3B (3X EV/Sales) deal for Qlik Tech (QLIK) on 6/2/16. QLIK’s focus is in business intelligence software with visualization and analytics.

- Accel-KKR announces a $509M (3X EV/Sales) deal for SciQuest (SQI) on 5/31/16. SQI’s focus is in streamlining and lowering cost of purchases between buyers and sellers.

- Oracle (ORCL) announces a $532M (2.7X EV/Sales) deal for Opower (OPWR) on 5/2/2016. OPWR’s focus is in software for the Utility sector.

- Oracle (ORCL) announces a $663M (4.5X EV/Sales) deal for Textura (TXTR) on 4/29/16. TXTR provides software to the construction industry.

Looking at the recent SAAS M&A activity is the best way to determine the trends and next potential targets. We can see that these deals are occurring on average around 3.5X 1 year forward EV/Sales, but some deals much higher like DWRE at 7.3X, and deals in this space from 2011 to 2014 averaged closer to 6.3X. Another reason this space is likely to remain hot for M&A is the sheer amount of buying power available to prospective buyers. The larger players expected to be active in deals are Google, Microsoft, Amazon, Cisco, Oracle, IBM, and SAP and between them have over $175B of M&A spending power, while smaller players like Adobe, Salesforce.com, Symantec, VMware, and Hewlett Packard Enterprises have more than $25B ready to spend. I find that some of the most attractive targets remaining are niche players, targeting a specific industry, and can see from Oracle’s recent deals as it bought both a Utility and a Construction software focused company, and seems to want to continue to build out its SAAS Empire. The ease of borrowing is also allowing for a very friendly deal-making environment with very strong demand in the corporate bond market. Oracle raised $14B last week in a bond sale, fueling speculation it was ready to make another deal (NetSuite (N) would fit nicely).

There are a lot of potential targets remaining, narrowing down my list of names in the $300M to $5B range left me with 33 SAAS stocks (ULTI and N were too large, but also attractive targets). We can do some comparative analysis and a brief overview of each to then determine which companies are the most attractive SAAS M&A targets. I typically utilize unusual options activity to “sniff-out” these deals, and of the names on this list, the ones that stick out from that approach are N, VEEV, GWRE, DATA, SHOP, ZEN, CSOD, BNFT, CALD and MB.

In order of market cap, largest to smallest, quick summary of the names:

Manhattan Associates (MANH) – Provides software solutions to manage supply chains and inventory control, as well as omni-channel solutions for retailers. MANH trades rich at 6.9X EV/Sales, but has posted consistently strong quarters and although growth is slowing, it remains a double digit revenue growth story.

Veeva Systems (VEEV) – Provider of cloud software and data solutions to the life sciences industry, but trades quite rich at 6.7X EV/Sales despite the 20-25% annual revenue growth expected. Its niche in a strong end-market makes it attractive, but it is pricey with it entering a slower growth phase, albeit, way above most of the market.

Guidewire Software (GWRE) – Provider of software products for the P&C insurance market, but trades very rich at 8.2X EV/Sales. I like GWRE’s niche, but its end-market is full of struggling companies which could impact growth, and it already trades at a pricey premium to peers. GWRE is only targeting 10-15% annual revenue growth.

Tableau (DATA) – Provider of business analytics and visualization software, and trades extremely cheap to peers at 2.7X EV/Sales. DATA has seen its annual revenue growth slow to the 25-30% range, but shares have been unfairly hit, and is one of the most attractive value targets in the space for M&A.

Twilio (TWLO) – Provider of cloud communication software to embed messaging, video and authentication capabilities through application interfaces. TWLO is a recent IPO, so we will have to wait and see its quarterly reports before having an opinion, but it is trading very strong.

Aspen Tech (AZPN) – Provider of mission-critical process optimization software in engineering, manufacturing and supply chain markets. AZPN trades 6.7X EV/Sales and has seen annual revenue growth slow to the single digits, not all that attractive from the valuation perspective.

Blackbaud (BLKB) – Provider of software solutions to the nonprofit, charity, and education industries, and trades 4.5X EV/Sales. BLKB is one of the few names in the industry with healthy EPS and set to grow at 28.9%, 19.9% and 16.5% clips the next three years, so its niche markets and discounted valuation make it a very interesting M&A candidate.

Paycom (PAYC) – Provider of human capital management software solutions to small and medium sized companies, areas such as talent acquisition, background checks and time and labor management solutions. PAYC trades 6.2X EV/Sales and has one of the more impressive growth profiles with annual revenue growth 2016-2018 of 43%, 29.7%, and 24.9%, and targets EPS of $1.19/share in 2018, nearly triple it’s 2015 EPS.

Shopify (SHOP) – Provider of cloud-based commerce platforms for small and medium businesses. SHOP is trading very rich at 9X EV/Sales, but is a highly likely acquisition target, and been rumored to be on Google’s shopping list. SHOP is growing revenues rapidly and set to be profitable in 2018.

Zendesk (ZEN) – Provider of software to companies for one on one interactions allowing engagement with customers as well as live chat software. ZEN trades 5.4X EV/Sales, and is seeing rapid revenue growth, 64% in 2015, 45% in 2016 and projects 25-30% the next two years out, set to hit profitability in 2018. ZEN as a niche player growing rapidly and not at an extreme valuation makes a very nice target.

Wage Works (WAGE) – Provider of employee resources such as flexible spending accounts and health reimbursement arrangements. WAGE trades 4.1X EV/Sales, cheap to many peers, but has seen growth slow with revenue growth in the 8-12% range after being above 22% the previous 3 years. WAGE is growing EPS at just under 15%, and targets $1.62/Share in 2017, which is nearly 30% growth over 2015 levels. WAGE is likely deserving of its lower multiple as its growth is much slower than peers.

Paylocity (PCTY) – Provider of cloud-based payroll and human capital management software solutions to medium-sized organizations. PCTY is trading 5.8X EV/Sales, and seeing revenue growth 2016-2018 of 49.6%, 26.9%, and 22.6%, and is already profitable. It is comparable to PAYC, though PAYC has a much better EPS growth profile.

Cornerstone OnDemand (CSOD) – Provider of talent management solutions through the entire employee lifecycle. CSOD trades cheap at 3.9X EV/Sales and has seen sizable November $45 call buying recently. CSOD is also generating 20% revenue growth annually through 2018 and targets $0.68/Share EPS in 2018 after earning just $0.04/share in 2016. CSOD is clearly one of the most attractive targets in this group.

Fleetmatics (FLTX) – Provider of solutions to medium and small businesses that utilize vehicle fleets with tools for location tracking, fuel usage, and other insights. FLTX trades just 3.7X EV/Sales with an industry-specific niche, making it an attractive target. Revenue growth expected in the 15-20% annual range through 2018 and EPS in 2018 of $2.44/Share compares to $1.76/Share in 2016.

Luxoft (LXFT) – Provider of software in architectural design, engineering, and automated testing trading 1.8X EV/Sales. LXFT is projects annual sales growth above 20% through 2019 and targets $4.50/Share EPS in 2019 which compares to $3/Share in 2017, one of the most attractive value plays in this group though recent price-action is concerning.

Ebix (EBIX) – Provider of on-demand software and e-commerce solutions to the insurance industry. EBIX trades 5.4X EV/Sales with revenue growth slowing to 9.5% in 2016 from 23.9% the prior year. Shares look cheap compared to its peer GWRE that also operates in this niche.

HubSpot (HUBS) – Provider of cloud-based marketing and sales software platform with social media, SEO, content management, and analytic features. HUBS is trading 4.1X FY17 EV/Sales and posting strong revenue growth at 42% in 2016 and targets 30% and 22.6% the next two years forward, aiming for profitability in 2018.

New Relic (NEWR) – Provider of cloud-based products to collect, store and analyze massive amounts of data in real-time, and can provide insight such as user satisfaction and app performance. NEWR trades 5.2X FY17 EV/Sales and is among the elite for revenue growth, coming off 64% growth in 2016 and 20-17-2018 annual growth rates at 39%, 27%, and 22% respectively with a goal to reach profitability in 2019.

NIC (EGOV) – Provider of digital government services allowing for Government organizations to build online portals. EGOV trades 4X FY17 EV/Sales, and is on the lower end of the growth spectrum with 7-10% annual revenue growth and EPS growth. It is an interesting niche play, but unlikely to be an attractive target due to its lower growth profile.

Ring Central (RNG) – Provider of software solutions for business communications allowing for collaboration, conferencing, and other solutions to stay connected within an organization. RNG trades 2.9X FY17 EV/Sales, one of the cheapest names, yet still a quality growth name with 34.7% revenue growth in 2015 being followed by two years of 22%+ revenue growth, and already profitable. RNG makes a very attractive target.

2U (TWOU) – Provider of SAAS solutions to nonprofit colleges and universities such as online campus, online learning platforms, and mobile applications. TWOU trades 4.5X FY17 EV/Sales, and is generating 30%+ annual revenue growth, not expected to reach profitability until 2018.

Alarm Holdings (ALRM) – Provider of solutions for the connected home such as security monitoring, light automation, and other home related services. ALRM is trading 3.8X FY17 EV/Sales and coming off a recent smart acquisition of Piper, generating 15% annual revenue growth and in a very hot industry on the verge of massive expansion, so a very attractive long term investment.

Calidus (CALD) – Provider of software to the telecom, insurance, banking and tech markets with marketing automation to generate sales leads and quoting solutions. CALD trades 4.1X FY17 EV/Sales with 20% revenue growth and EPS set to jump 41% in 2016 and 36.5% in 2017, an attractive name that is among those rumored to have interest from Google.

Benefitfocus (BNFT) – Provider of a benefits management platform for consumers, employers, and insurance carriers with online enrollment solutions as well as data analytics. BNFT trades 3.7X FY17 EV/Sales and revenue growth that was 30%+ in 2014/2015 set to be closer to 25% in 2016/2017, and not yet profitable. BNFT is an intriguing niche play at a fairly cheap valuation considering its growth.

Rubicon (RUBI) – Provider of a platform for automating the buying and selling of advertising. RUBI trades 1.5X FY17 EV/Sales, and recently underwent a valuation reset as it posted 80% revenue growth in 2015 and now closer to 30% for 2016 and 20% for 2017. RUBI also with a red flag as EPS in 2016 set to be down 16.9% Y/Y before recovering near 2015 levels in 2017.

MINDBODY (MB) – Provider of a payments and management platform with a focus on the wellness services industry. MB trades just 3.4X FY17 EV/Sales with strong revenue growth of 25-35% annually through 2017 and hitting profitability in 2018. As a niche player with strong growth and on the cheaper side of valuation as well as some unusual call buying, a favorite among these names as an M&A target.

Five9 (FIVN) – A provider of cloud software for contact centers, closely related to inContact (SAAS) which was acquired, and FIVN seen as the potential next name to be acquired. FIVN trades 3.3X EV/Sales, fairly cheap and generating 17-20% annual revenue growth with profitability targeted for 2018.

Workiva (WK) – Provider of cloud-based platform for enterprises to collect, manage, report and analyze data with solutions such as risk, compliance, audit management and accounting. WK trades just 2.4X FY17 EV/Sales with revenue growth slowing modestly since 2014, expecting 24% growth in 2017 and 20% in 2017, but far from profitability. WK trades cheap to peers, but with profitability a long way off, it may not be an attractive target at this point.

Instructure (INST) – Provider of learning management software platform for academic institutions and companies, managing face-to-face and online learning experiences with benchmarking to analytic solutions. INST trades 2.8X FY17 EV/Sales, and is growing rapidly, 65% growth in 2015 and near 50% projected for 2016 followed by 42% in 2017. Similar to the other smaller plays, INST is a long way off from profitability.

AppFolio (APPF) – Provider of cloud solutions for small and medium-sized businesses in the property management and legal industries. APPF trades 3.4X FY17 EV/Sales, and sales growth of 57% in 2015 is being followed by 36.7% and 30% projected growth for 2016/2017, and potential to reach profitability by 2018. APPF is a very intriguing niche play that makes for a great M&A target.

ChannelAdvisor (ECOM) – Provider of solutions in the retail industry with digital marketing modules. ECOM trades 2.4X FY17 EV/Sales, one of the cheapest names, though a lower growth profile with 12-15% annual revenue growth phase currently, and still not profitable.

Model-N (MODN) – Provider of revenue management cloud solutions in life sciences and tech industries with solutions such as price management, rebate management, compliance, and analytical tools. MODN trades 2.3X FY17 EV/Sales, and though a lower growth name with 14.3% 2016 revenue growth, set to accelerate to 20% and 25% in 2017/2018 if it meets projections, and also set to hit profitability in 2018. As a niche player at cheap valuation and projecting for accelerating revenue growth, a top candidate for M&A.

Apigee (APIC) – Provider of a software platform for a programmable interface allowing businesses to design and deploy APIs. APIC trades just 2.4X FY17 EV/Sales and growing revenues at 28-35% clip annually, though not set to reach profitability until 2019. APIC is a fast grower in an interesting space, worth a closer look.

With the quick overview above I was able to slim the list down to 18 of the best candidates for M&A in my view that now can be compared side by side with the acquirers metrics that will be observed.

DATA, BLKB, ZEN, PAYC, SHOP, CSOD, FLTX, HUBS, NEWR, RNG, ALRM, CALD, BNFT, MB, FIVN, APPF, MODN, APIC

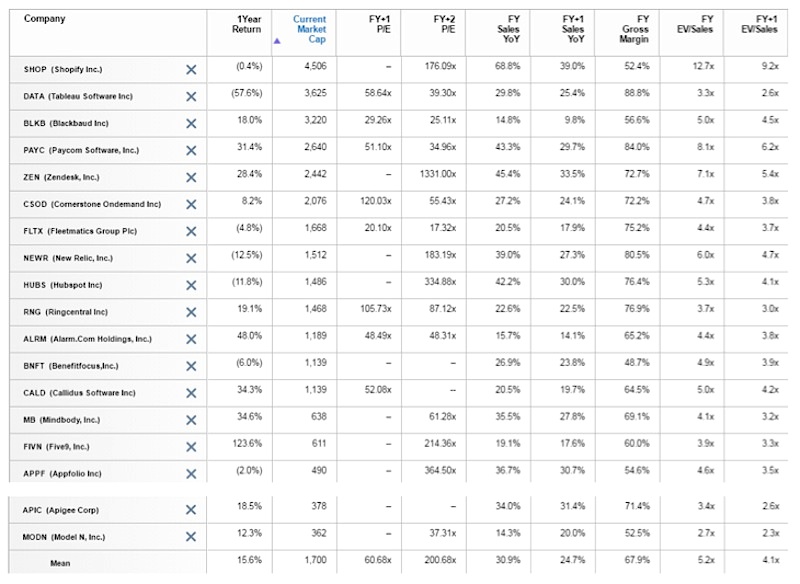

This group of 18 SAAS stocks has an average return of 15.6% over the past year, forward P/E of 60.7X, 30.9% sales growth current year and 24.7% projected for next year, 67.9% gross margins, and trades 4.1X FY17 EV/Sales. The table is shown below, and the names that trade cheaper than the average EV/Sales multiple with average or better margins, and average or better growth are HUBS, MB, DATA, and APIC. NEWR is very attractive with its growth/margin profile and trades at a slight premium multiple, and the same can be said for ZEN. CSOD and RNG look to be fairly attractive values in the group and growth is just slightly below the peer average, so they are also attractive.

In closing, after reviewing the SAAS group, the most attractive buyout targets in my opinion are DATA, NEWR, HUBS, MB, RNG, APIC and ZEN, in no particular order.

Looking at these 7 names closer with key metrics for SAAS stocks/companies like Cash, Churn Rate, and Customer Acquisition Cost you can narrow the list down further, but considering the environment, there is likely to be numerous deals in this space.

Thanks for reading.

Twitter: @OptionsHawk

Author has a position in DATA, MB, N, ZEN, and NEWR at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.